Notes to The Consolidated Financial Statements

AL MAZAYA HOLDING K.S.C. (HOLDING) AND ITS SUBSIDIARIES

For the year ended 31 December 2011

40

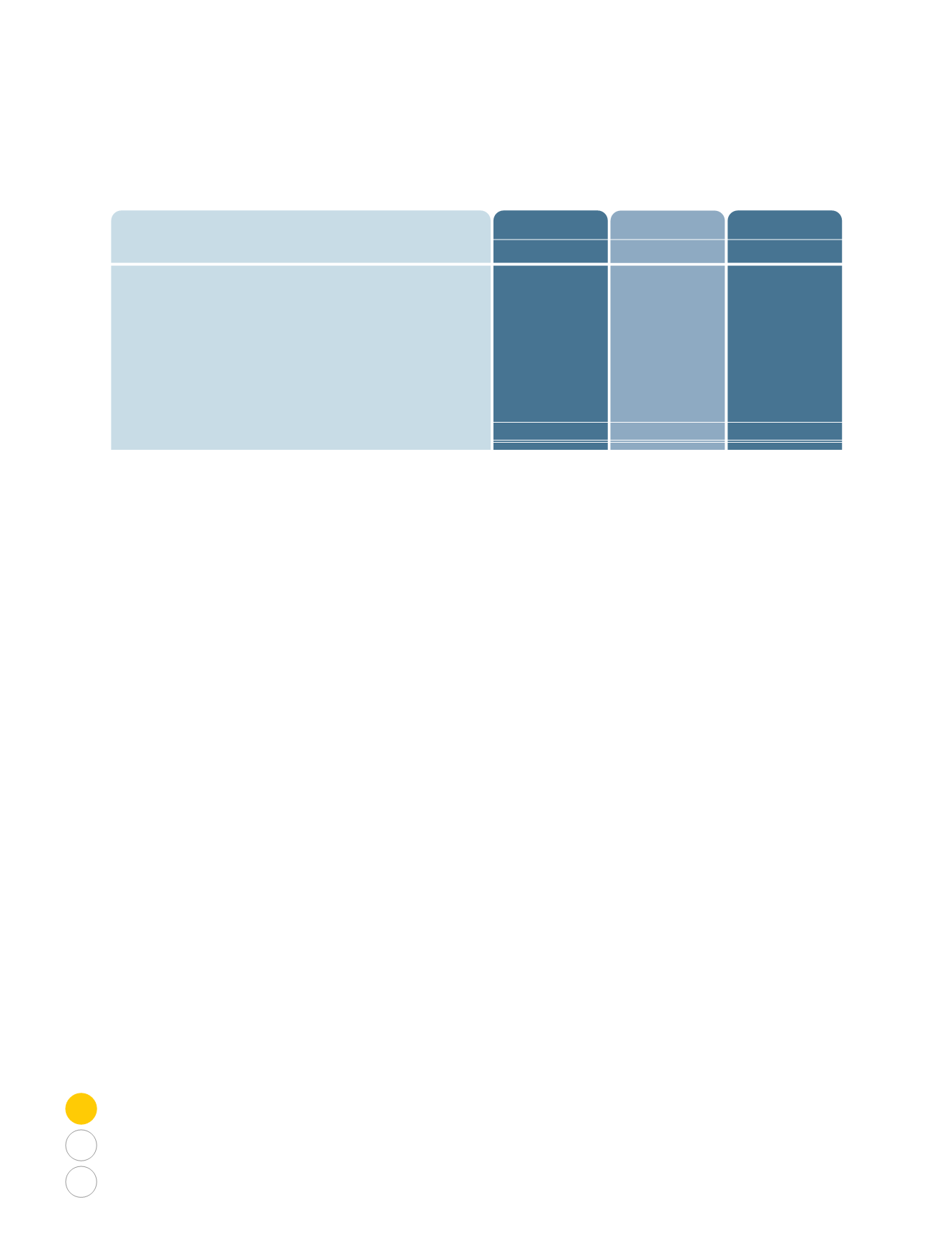

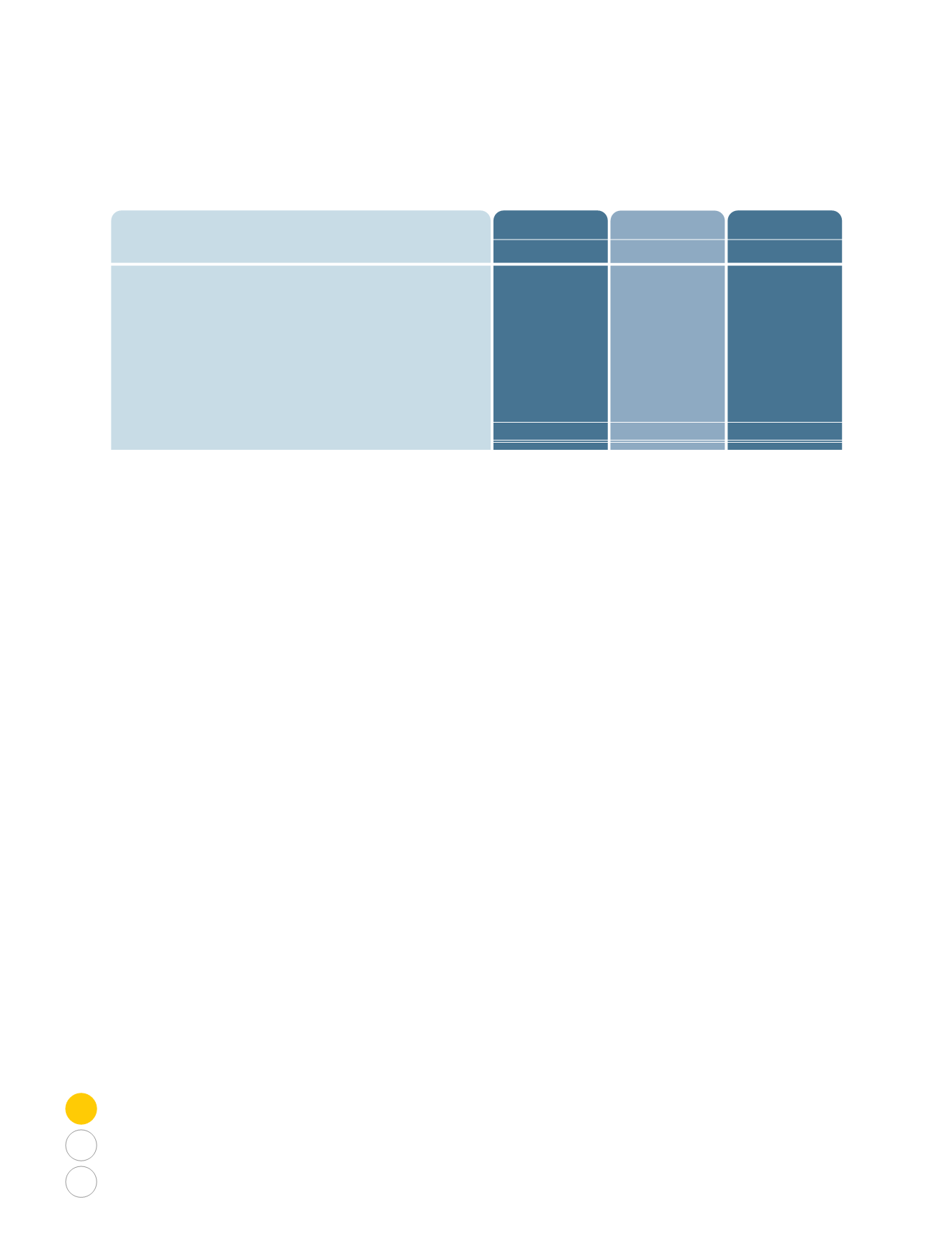

12. INVESTMENT PROPERTIES

116,921,489

-

801,770

(32,538,709)

-

-

(11,239,341)

(88,537)

73,856,672

101,852,535

1,089,036

3,174,783

-

20,816,119

(519,366)

(8,935,807)

(555,811)

116,921,489

19,906,643

11,620,362

86,648,299

-

-

-

(16,028,799)

(293,970)

101,852,535

Balance at the beginning of the year

Additions

Transferred from properties held for trading (note 8)

Adjustments

Transferred from fixed assets

Reversal of revaluation surplus

Changes in fair value

Foreign currency translation adjustments

Balance at the end of the year

2011

KD

2010 (Restated)

KD

2009 (Restated)

KD

The fair value of the Group’s investment properties at 31 December 2011 has been arrived at on the basis of a valuation

carried out at that date by independent evaluators.

Investment properties amounting to KD 9,708,334 (2010: KD 9,647,000) are pledged against a term loan disclosed in

note 14.

Adjustments represent the following:

One of the Group’s subsidiaries Al Mazaya Real Estate Company FZ LLC (“MREC FZ”) on 4 December 2007 signed a

sale and purchase agreement with Limitless Company LLC (Limitless) for purchasing 9 plots in Down Town Jebel Ali,

Dubai (DTJA) for KD 34.712 Million of which KD 19.6 Million was paid in cash and the remaining consideration of

KD 15.166 Million was deferred. MREC FZ has sought to terminate the agreement and submitted a claim before the

Dubai International Arbitration Tribunal claiming an amount of KD 15.8 Million plus interest besides claiming alternative

reliefs in accordance with the prevailing UAE laws and the Real Estate rules and regulations applicable in Dubai. Based

on the opinion of the Group’s internal legal advisory, MREC FZ claim is supported based on the fact that Limitless has

not done the necessary infrastructure like electricity, water plumbing, drainage, approach roads etc that was required

for delivery of the plots to FZ under the agreement. As on the date of issue of the consolidated financial statements the

arbitration proceeding is ongoing and the Group’s management is of the view that based on the legal opinion, the Group’s

liability to Limitless towards this deferred consideration is remote. Limitless has also submitted their plea to the arbitration

committee for forfeiture of the advance amount paid by the Group. Accordingly, the Group has offset the related deferred

consideration of KD 15.166 Million (see note 16) against the carrying value of the investment property of KD 34.712

Million and the resultant amount of KD 19.546 Million has been recorded as fair value decline of investment properties.

In a separate transaction, the Group had entered into a Sale Purchase Agreement (SPA) with an investor to acquire

Waterfront land (WF) in Dubai at a cost of KD 42 Million by paying KD 31.5 Million in advance. A consideration of KD

10.5 Million was deferred and recorded as a payable. A cumulative provision reflecting a fair value decline of KD 24.7

Million had been recorded against the Waterfront assets in prior years.

Due to certain delays in the development of the project from the master developer, the Group has withdrawn its right to

the acquired properties and demanded the settlement of advance paid. Accordingly, the Group has offset the outstanding

deferred consideration payable to the investor of KD 9 Million (see note 16) against the carrying value of the land amounting

to KD 17.3 Million. The net amount of KD 8.3 Million was transferred to trade and other receivables and an equal amount

of allowance for doubtful debts has been recorded.