Page 17 - Q3 2024 EN

P. 17

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

SEPTEMBER 30, 2024

(All amounts are in Kuwaiti Dinars)

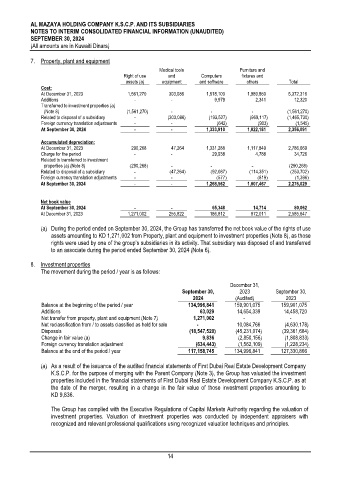

7. Property, plant and equipment

Medical tools Furniture and

Right of use and Computers fixtures and

assets (a) equipment and software others Total

Cost:

At December 31, 2023 1,561,270 303,086 1,518,100 1,989,860 5,372,316

Additions - - 9,979 2,341 12,320

Transferred to investment properties (a)

(Note 8) (1,561,270) - - - (1,561,270)

Related to disposal of a subsidiary - (303,086) (193,527) (969,117) (1,465,730)

Foreign currency translation adjustments - - (642) (903) (1,545)

At September 30, 2024 - - 1,333,910 1,022,181 2,356,091

Accumulated depreciation:

At December 31, 2023 290,268 47,264 1,331,288 1,117,849 2,786,669

Charge for the period - - 29,938 4,788 34,726

Related to transferred to investment

properties (a) (Note 8) ) 290,268 ( - - - ) 290,268 (

Related to disposal of a subsidiary - ) 47,264 ( ) 92,087 ( ) 114,351 ( ) 253,702 (

Foreign currency translation adjustments - - ) 577 ( ) 819 ( ) 1,396 (

At September 30, 2024 - - 1,268,562 1,007,467 2,276,029

Net book value

At September 30, 2024 - - 65,348 14,714 80,062

At December 31, 2023 1,271,002 255,822 186,812 872,011 2,585,647

(a) During the period ended on September 30, 2024, the Group has transferred the net book value of the rights of use

assets amounting to KD 1,271,002 from Property, plant and equipment to investment properties (Note 8), as those

rights were used by one of the group’s subsidiaries in its activity. That subsidiary was disposed of and transferred

to an associate during the period ended September 30, 2024 (Note 6).

8. Investment properties

The movement during the period / year is as follows:

December 31,

September 30, 2023 September 30,

2024 (Audited) 2023

Balance at the beginning of the period / year 134,996,841 159,901,075 159,901,075

Additions 63,029 14,654,339 14,458,720

Net transfer from property, plant and equipment (Note 7) 1,271,002 - -

Net reclassification from / to assets classified as held for sale - 10,084,766 (4,630,178)

Disposals (18,547,520) (45,231,074) (39,361,684)

Change in fair value (a) 9,836 (2,850,156) (1,808,833)

Foreign currency translation adjustment (634,443) (1,562,109) (1,228,234)

Balance at the end of the period / year 117,158,745 134,996,841 127,330,866

(a) As a result of the issuance of the audited financial statements of First Dubai Real Estate Development Company

K.S.C.P. for the purpose of merging with the Parent Company (Note 3), the Group has valuated the investment

properties included in the financial statements of First Dubai Real Estate Development Company K.S.C.P. as at

the date of the merger, resulting in a change in the fair value of those investment properties amounting to

KD 9,836.

The Group has complied with the Executive Regulations of Capital Markets Authority regarding the valuation of

investment properties. Valuation of investment properties was conducted by independent appraisers with

recognized and relevant professional qualifications using recognized valuation techniques and principles.

14