Page 25 - Q3 2024 EN

P. 25

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

SEPTEMBER 30, 2024

(All amounts are in Kuwaiti Dinars)

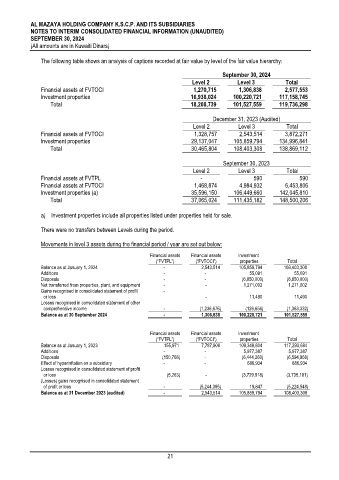

The following table shows an analysis of captions recorded at fair value by level of the fair value hierarchy:

September 30, 2024

Level 2 Level 3 Total

Financial assets at FVTOCI 1,270,715 1,306,838 2,577,553

Investment properties 16,938,024 100,220,721 117,158,745

Total 18,208,739 101,527,559 119,736,298

December 31, 2023 (Audited)

Level 2 Level 3 Total

Financial assets at FVTOCI 1,328,757 2,543,514 3,872,271

Investment properties 29,137,047 105,859,794 134,996,841

Total 30,465,804 108,403,308 138,869,112

September 30, 2023

Level 2 Level 3 Total

Financial assets at FVTPL - 590 590

Financial assets at FVTOCI 1,468,874 4,984,932 6,453,806

Investment properties (a) 35,596,150 106,449,660 142,045,810

Total 37,065,024 111,435,182 148,500,206

a) Investment properties include all properties listed under properties held for sale.

There were no transfers between Levels during the period.

Movements in level 3 assets during the financial period / year are set out below:

Financial assets Financial assets Investment

(“FVTPL”) (“FVTOCI”) properties Total

Balance as at January 1, 2024 - 2,543,514 105,859,794 108,403,308

Additions - - 55,091 55,091

Disposals - - (6,850,000) (6,850,000)

Net transferred from properties, plant, and equipment - - 1,271,002 1,271,002

Gains recognised in consolidated statement of profit -

or loss - 11,490 11,490

Losses recognised in consolidated statement of other

comprehensive income - (1,236,676) (126,656) (1,363,332)

Balance as at 30 September 2024 - 1,306,838 100,220,721 101,527,559

Financial assets Financial assets Investment

(“FVTPL”) (“FVTOCI”) properties Total

Balance as at January 1, 2023 155,971 7,787,909 109,349,804 117,293,684

Additions - - 5,977,387 5,977,387

Disposals (150,708) - (6,444,260) (6,594,968)

Effect of hyperinflation on a subsidiary - - 686,934 686,934

Losses recognised in consolidated statement of profit

or loss (5,263) - (3,729,918) (3,735,181)

(Losses) gains recognised in consolidated statement

of profit or loss - (5,244,395) 19,847 (5,224,548)

Balance as at 31 December 2023 (audited) - 2,543,514 105,859,794 108,403,308

21