Page 24 - Q1 2024 EN

P. 24

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

MARCH 31, 2024

(All amounts are in Kuwaiti Dinars)

The Parent Company’s Shareholders’ Extraordinary General Assembly, held on January 4, 2024, had approved the

merger contract as well as the merger through amalgamation between Al Mazaya Holding Company K.S.C.P and First

Dubai Real Estate Development Company K.S.C.P, after completing all approvals of the relevant regulatory authorities.

Also, it approved the capital increase of Al Mazaya Holding Company from KD 48,474,817 to KD 52,556,117 distributed

over 525,561,174 ordinary shares via an in-kind increase amounting to KD 4,081,300, distributed over 40,813,008

shares (Notes 3 and 9) which is assigned to the non-controlling shareholders of First Dubai Real Estate Development

Company that are registered in First Dubai Real Estate Development Company shareholders’ registry as on the record

date, In addition, it approved approving the amendment of the Company’s Memorandum of Incorporation and Articles

of Association regarding the increase of the Company’s capital as a result of that merger (Note 1), which was notarized

in the commercial register No. 75203 on February 27, 2024.

The Parent Company’s Shareholders’ Ordinary and Extraordinary General Assembly meeting, held on October 5, 2023,

approved the reduction of the Parent Company’s authorized, issued and paid up capital from KD 62,955,982 to

KD 48,474,817, with total reduction of KD 14,481,165 to set-off the full balance of the accumulated losses amounting to

KD 24,245,118 as per the audited consolidated financial statements for the period ended June 30, 2023, as follows:

• Reducing the balance of statutory reserve by KD 937,755.

• Reducing the full balance of share premium by KD 8,826,198.

• Reducing the share capital by KD 14,481,165 through cancelling 144,811,650 shares with a par value of 100 fils

per share to set-off the remaining portion of the accumulated losses balance.

The Annual General Meeting of the Shareholders held on March 16, 2023, has approved the consolidated financial

statements of the Group for the year ended December 31, 2022 and approved the following items:

• Not to distribute cash dividends or bonus shares for the year ended December 31, 2022.

• Not to pay Board of Directors remuneration for the year ended December 31, 2022.

• To offset the entire accumulated loss balance amounted to KD 9,095,362 as at December 31, 2022 against reducing

the balance of the share premium from KD 17,921,560 to KD 8,826,198.

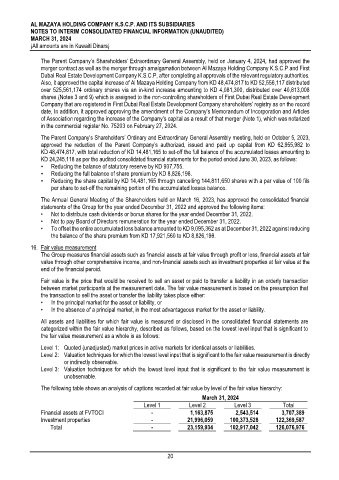

16. Fair value measurement

The Group measures financial assets such as financial assets at fair value through profit or loss, financial assets at fair

value through other comprehensive income, and non-financial assets such as investment properties at fair value at the

end of the financial peroid.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date. The fair value measurement is based on the presumption that

the transaction to sell the asset or transfer the liability takes place either:

• In the principal market for the asset or liability, or

• In the absence of a principal market, in the most advantageous market for the asset or liability.

All assets and liabilities for which fair value is measured or disclosed in the consolidated financial statements are

categorized within the fair value hierarchy, described as follows, based on the lowest level input that is significant to

the fair value measurement as a whole is as follows:

Level 1: Quoted (unadjusted) market prices in active markets for identical assets or liabilities.

Level 2: Valuation techniques for which the lowest level input that is significant to the fair value measurement is directly

or indirectly observable.

Level 3: Valuation techniques for which the lowest level input that is significant to the fair value measurement is

unobservable.

The following table shows an analysis of captions recorded at fair value by level of the fair value hierarchy:

March 31, 2024

Level 1 Level 2 Level 3 Total

Financial assets at FVTOCI - 1,163,875 2,543,514 3,707,389

Investment properties - 21,996,059 100,373,528 122,369,587

Total - 23,159,934 102,917,042 126,076,976

20