Page 11 - Q4-2024-EN

P. 11

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

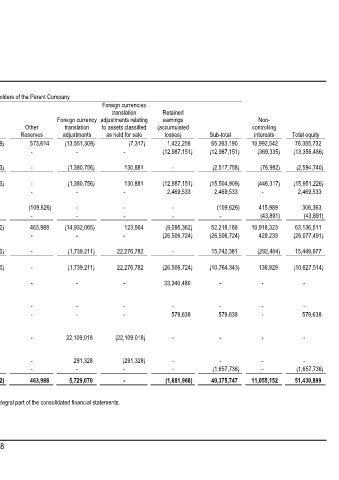

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

Attributable to shareholders of the Parent Company

Foreign currencies

translation Retained

Foreign currency adjustments relating earnings Non-

Share Share Treasury Statutory Fair value Other translation to assets classified (accumulated controlling

Capital Premium Shares reserve reserve Reserves adjustments as held for sale losses) Sub-total interests Total equity

Balance as at January 1, 2022 62,955,982 17,921,560 (1,777) 1,632,430 (5,582,249) 573,614 (13,551,309) (7,317) 1,422,256 65,363,190 10,992,542 76,355,732

Loss for the year - - - - - - - - (12,987,151) (12,987,151) (369,335) (13,356,486)

Other comprehensive (loss) income for

the year - - - - (1,267,883) - (1,380,756) 130,881 - (2,517,758) (76,982) (2,594,740)

Total comprehensive (loss) income for

the year - - - - (1,267,883) - (1,380,756) 130,881 (12,987,151) (15,504,909) (446,317) (15,951,226)

Effect of hyperinflation on a subsidiary - - - - - - - - 2,469,533 2,469,533 - 2,469,533

Effect of partial disposal of a

subsidiary - - - - - (109,626) - - - (109,626) 415,989 306,363

Effect of disposal of a subsidiary - - - - - - - - - - (43,891) (43,891)

Balance as at December 31, 2022 62,955,982 17,921,560 (1,777) 1,632,430 (6,850,132) 463,988 (14,932,065) 123,564 (9,095,362) 52,218,188 10,918,323 63,136,511

(Loss) profit for the year - - - - - - - - (26,506,724) (26,506,724) 429,233 (26,077,491)

Other comprehensive (loss) income for

the year - - - - (4,795,190) - (1,739,211) 22,276,782 - 15,742,381 (292,404) 15,449,977

Total comprehensive (loss) income for

the year - - - - (4,795,190) - (1,739,211) 22,276,782 (26,506,724) (10,764,343) 136,829 (10,627,514)

Setting off accumulated losses (Note

25) (14,481,165) (17,921,560) - (937,755) - - - - 33,340,480 - - -

Distribution of dividends as free bonus

shares from treasury shares (Note

25) - - 508,405 (508,405) - - - - - - - -

Effect of hyperinflation on a subsidiary - - - - - - - - 579,638 579,638 - 579,638

Transferred to foreign currency

translation adjustments relating to

assets classified as held for sale - - - - - - 22,109,018 (22,109,018) - - - -

Transferred from foreign currency

translation adjustments relating to

assets classified as held for sale - - - - - - 291,328 (291,328) - - - -

Purchase of treasury shares - - (1,657,736) - - - - - - (1,657,736) - (1,657,736)

Balance as at December 31, 2023 48,474,817 - (1,151,108) 186,270 (11,645,322) 463,988 5,729,070 - (1,681,968) 40,375,747 11,055,152 51,430,899

The accompanying notes from (1) to (32) form an integral part of the consolidated financial statements.

8