Page 18 - Q4-2024-EN

P. 18

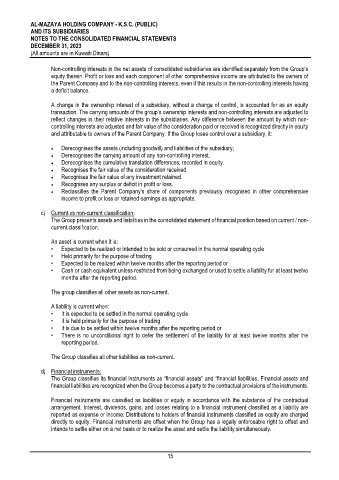

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

Non-controlling interests in the net assets of consolidated subsidiaries are identified separately from the Group’s

equity therein. Profit or loss and each component of other comprehensive income are attributed to the owners of

the Parent Company and to the non-controlling interests, even if this results in the non-controlling interests having

a deficit balance.

A change in the ownership interest of a subsidiary, without a change of control, is accounted for as an equity

transaction. The carrying amounts of the group’s ownership interests and non-controlling interests are adjusted to

reflect changes in their relative interests in the subsidiaries. Any difference between the amount by which non-

controlling interests are adjusted and fair value of the consideration paid or received is recognized directly in equity

and attributable to owners of the Parent Company. If the Group loses control over a subsidiary, it:

• Derecognises the assets (including goodwill) and liabilities of the subsidiary;

• Derecognises the carrying amount of any non-controlling interest.

• Derecognises the cumulative translation differences, recorded in equity.

• Recognises the fair value of the consideration received.

• Recognises the fair value of any investment retained.

• Recognises any surplus or deficit in profit or loss.

• Reclassifies the Parent Company’s share of components previously recognised in other comprehensive

income to profit or loss or retained earnings as appropriate.

c) Current vs non-current classification:

The Group presents assets and liabilities in the consolidated statement of financial position based on current / non-

current classification.

An asset is current when it is:

• Expected to be realized or intended to be sold or consumed in the normal operating cycle

• Held primarily for the purpose of trading

• Expected to be realized within twelve months after the reporting period or

• Cash or cash equivalent unless restricted from being exchanged or used to settle a liability for at least twelve

months after the reporting period.

The group classifies all other assets as non-current.

A liability is current when:

• It is expected to be settled in the normal operating cycle

• It is held primarily for the purpose of trading

• It is due to be settled within twelve months after the reporting period or

• There is no unconditional right to defer the settlement of the liability for at least twelve months after the

reporting period.

The Group classifies all other liabilities as non-current.

d) Financial instruments:

The Group classifies its financial instruments as “financial assets” and “financial liabilities. Financial assets and

financial liabilities are recognized when the Group becomes a party to the contractual provisions of the instruments.

Financial instruments are classified as liabilities or equity in accordance with the substance of the contractual

arrangement. Interest, dividends, gains, and losses relating to a financial instrument classified as a liability are

reported as expense or income. Distributions to holders of financial instruments classified as equity are charged

directly to equity. Financial instruments are offset when the Group has a legally enforceable right to offset and

intends to settle either on a net basis or to realize the asset and settle the liability simultaneously.

15