Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

31 December 2013

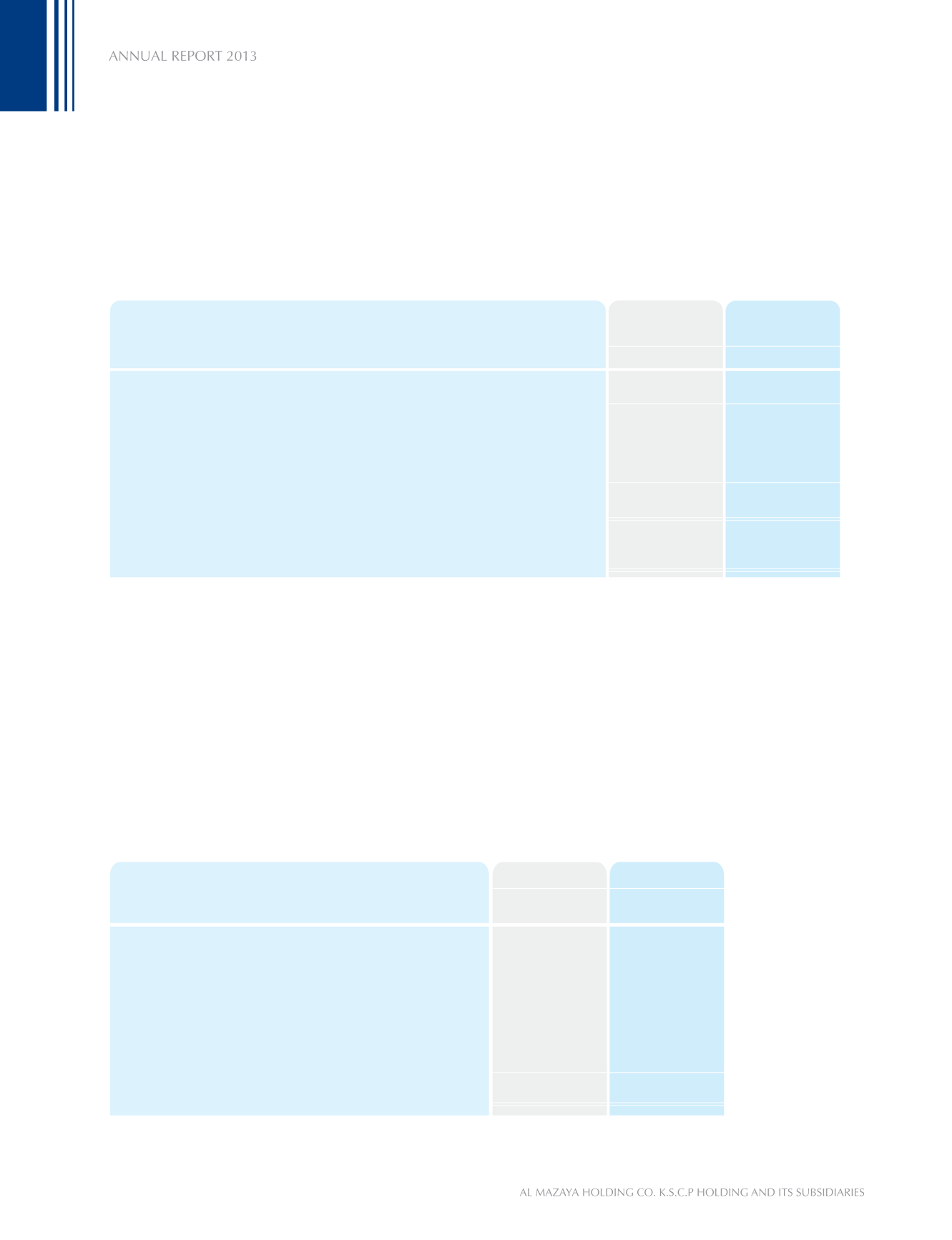

6,001,051

Shares

649,319,770

(64,802,134)

584,517,636

10.27 fils

290,553

Shares

649,319,770

(64,802,134)

584,517,636

0.50 fils

Profit for the year attributable to equity holders of the Parent Company

Weighted average number of ordinary shares

Less: weighted average number of treasury shares

Weighted average number of shares outstanding

Basic and diluted earnings per share attributable to the equity holders

of the parent company- (fils)

2013

KD

2012

KD

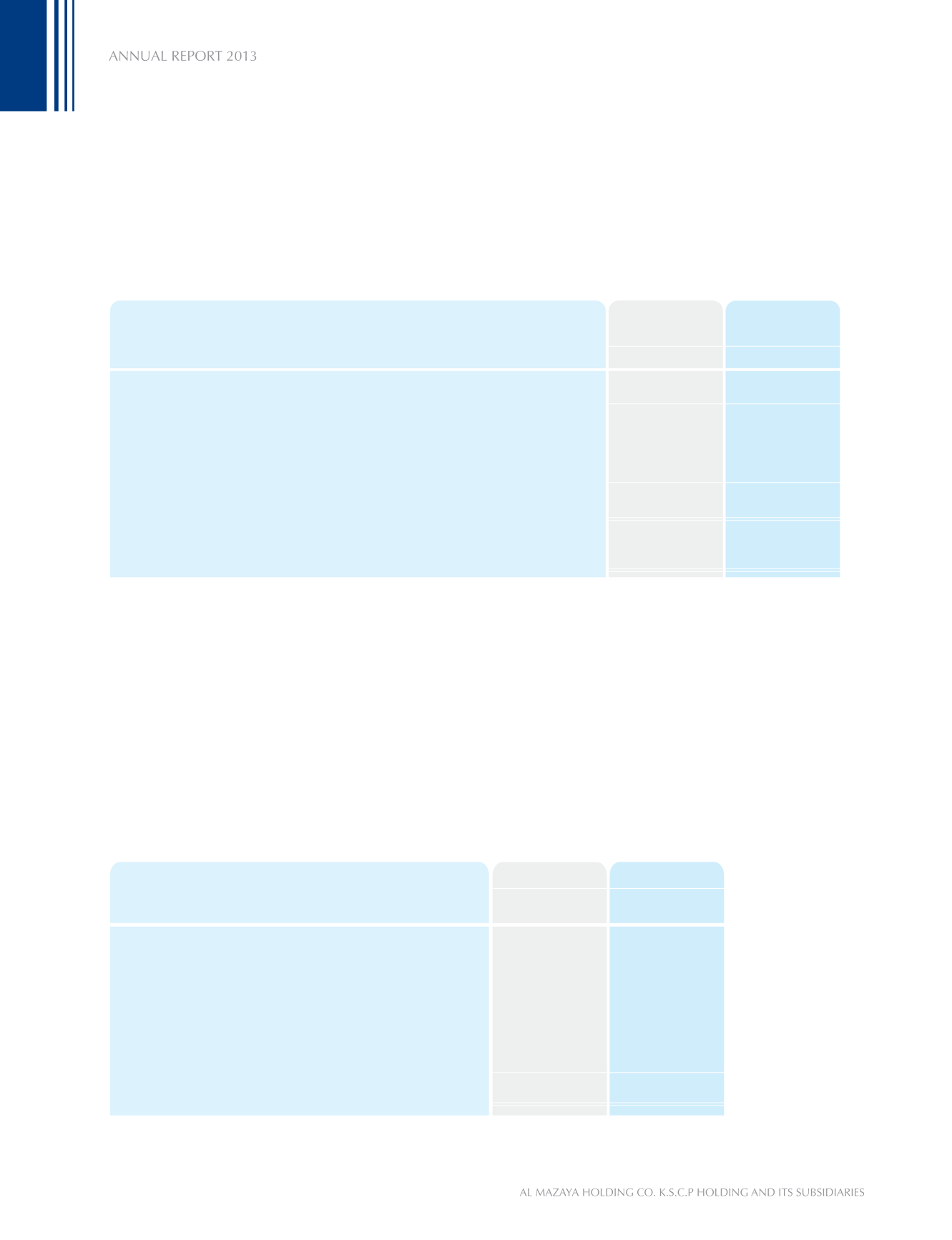

Investment properties mainly comprise of the following;

39

74,474,146

10,149,170

)700,089(

-

5,083,148

88,496

89,094,871

73,856,672

2,198,232

-

345,710

)1,965,753(

39,285

74,474,146

Balance at the beginning of the year

Additions (refer note (i) below)

Disposals

Transferred from properties held for trading (Note 12)

Net gain (loss) from fair value adjustment (refer note

(ii) below)

Foreign currency translation adjustments

Balance at the end of the year

2013

KD

2012

KD

7. GOODWILL

Goodwill represents excess of consideration paid for acquisition of First Dubai Real Estate Development Company K.S.C.P.

(FDDRE) shares over and above the fair value of the identifiable assets and liabilities. During the year management has

tested the carrying value of goodwill for impairment based on fair value of FDDRE shares quoted on the Kuwait Stock

Exchange and has noted no impairment.

During the previous year management tested the carrying value of goodwill based on cash flows from the underlying real

estate projects of FDDRE. The management used cash flow projection for 1 to 2 years, applying 15% discount rate and

recorded an impairment loss of KD 825,000. For projecting cash flows, management used assumptions of market rate per

sq. ft. derived from the valuation performed for properties held for trading in the books of FDDRE.

8. INVESTMENT PROPERTIES

6. BASIC AND DILUTED EARNING PER SHARE

Basic and diluted earnings per share is computed by dividing the profit for the year attributable to the equity holders of the

Parent Company by the weighted average number of shares outstanding during the year less treasury shares.

The following reflects the profit and share data used in the basic and diluted profit per share computations:

58