ANNUAL REPORT

2016

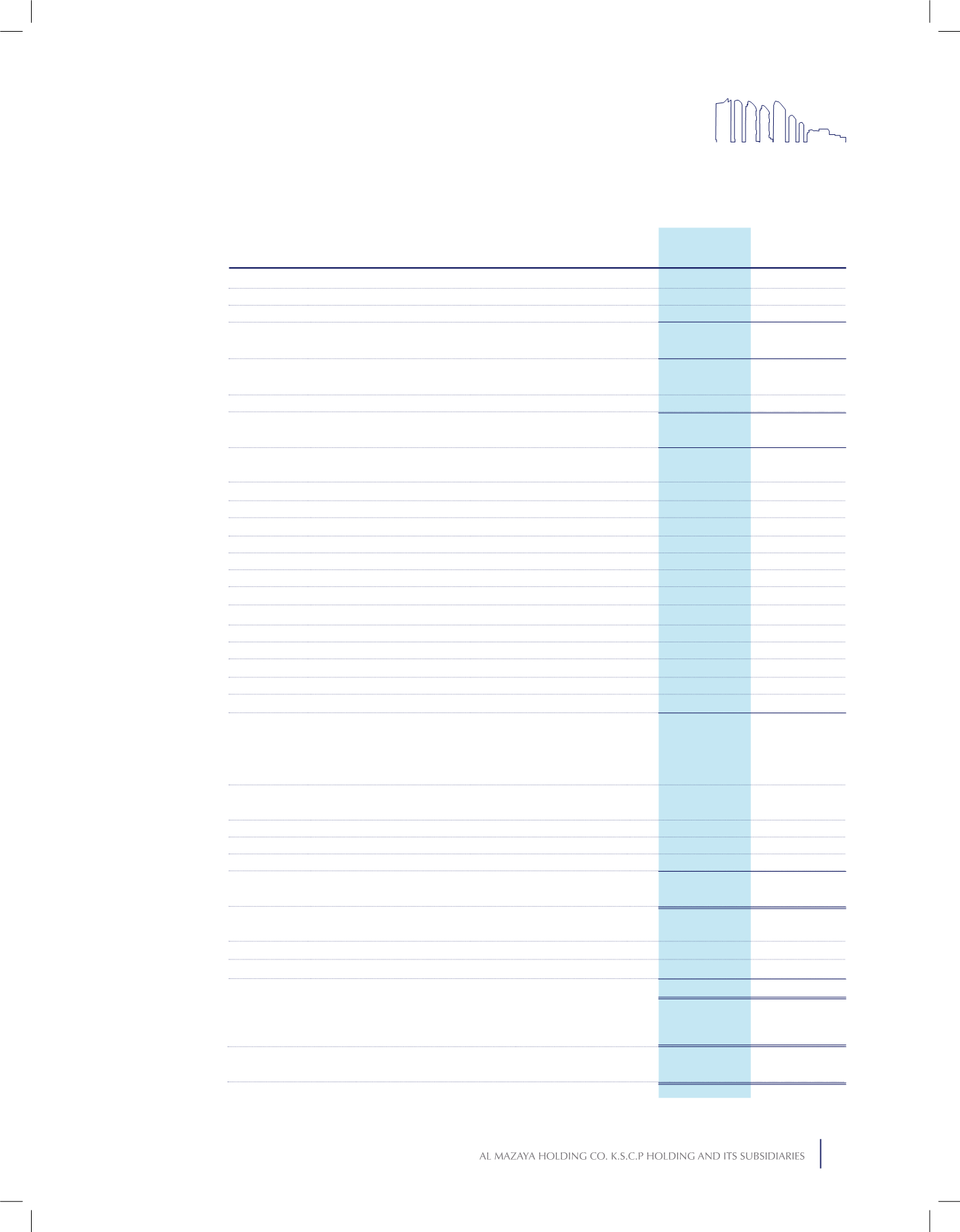

Revenue from sale of properties held for trading

Rental income

Net management fees and commission income

REVENUE

Cost of sale of properties held for trading

Cost of rental

COST OF REVENUE

GROSS PROFIT

Net change in fair value of investment properties

Loss on disposal of investment properties

Net gain from business combination

Share of results from joint venture and associate

Net gain on sale of a subsidiary

Gain on disposal of joint venture and an associate

(Provision for) write back of impairment loss on properties held for trading

General and administrative expenses

Net investment income

Other income (expenses)

Finance costs

Foreign exchange gain

Profit for the year before contribution for Board of Directors’

remuneration, Kuwait Foundation for Advancement of Sciences (“KFAS”),

National Labour Support Tax (“NLST”) and Zakat

Board of Directors’ remuneration

KFAS

Zakat

NLST

PROFIT FOR THE YEAR

Attributable to:

Equity holders of the Parent Company

Non- controlling interests

BASIC EARNING PER SHARE ATTRIBUTABLE TO EQUITY HOLDERS OF

THE PARENT COMPANY

DILUTED EARNING PER SHARE ATTRIBUTABLE TO EQUITY HOLDERS

OF THE PARENT COMPANY

2016

KD

2015

KD

Notes

22

9

6

10,11

32

13

23

25

16

7

7

The attached notes 1 to 32 form part of these consolidated financial statements.

47,814,320

7,112,362

245,543

55,172,225

(39,741,345)

(1,444,129)

(41,185,474)

13,986,751

(965,641)

(303,633)

2,425,221

1,055,072

1,184,979

-

(296,282)

(4,634,002)

741,826

2,422,863

(4,062,517)

230,680

11,785,317

(185,000)

(70,713)

(48,192)

(159,507)

11,321,905

10,253,235

1,068,670

11,321,905

16.51 fils

16.39 fils

53,265,302

6,174,227

378,830

59,818,359

(42,375,649)

(1,300,616)

(43,676,265)

16,142,094

817,386

(12,293)

-

128,125

-

883,165

1,411,010

(4,274,123)

11,413

(1,641,567)

(3,450,440)

6,540

10,021,310

(160,000)

(88,583)

(63,326)

(241,518)

9,467,883

9,319,104

148,779

9,467,883

15.04 fils

15.04 fils

C

onsolidated Statement of Income

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

For the year ended 31 December 2016

79