N

otes To The Consolidated Financial Statements

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

As At 31 December 2016

ANNUAL REPORT

2016

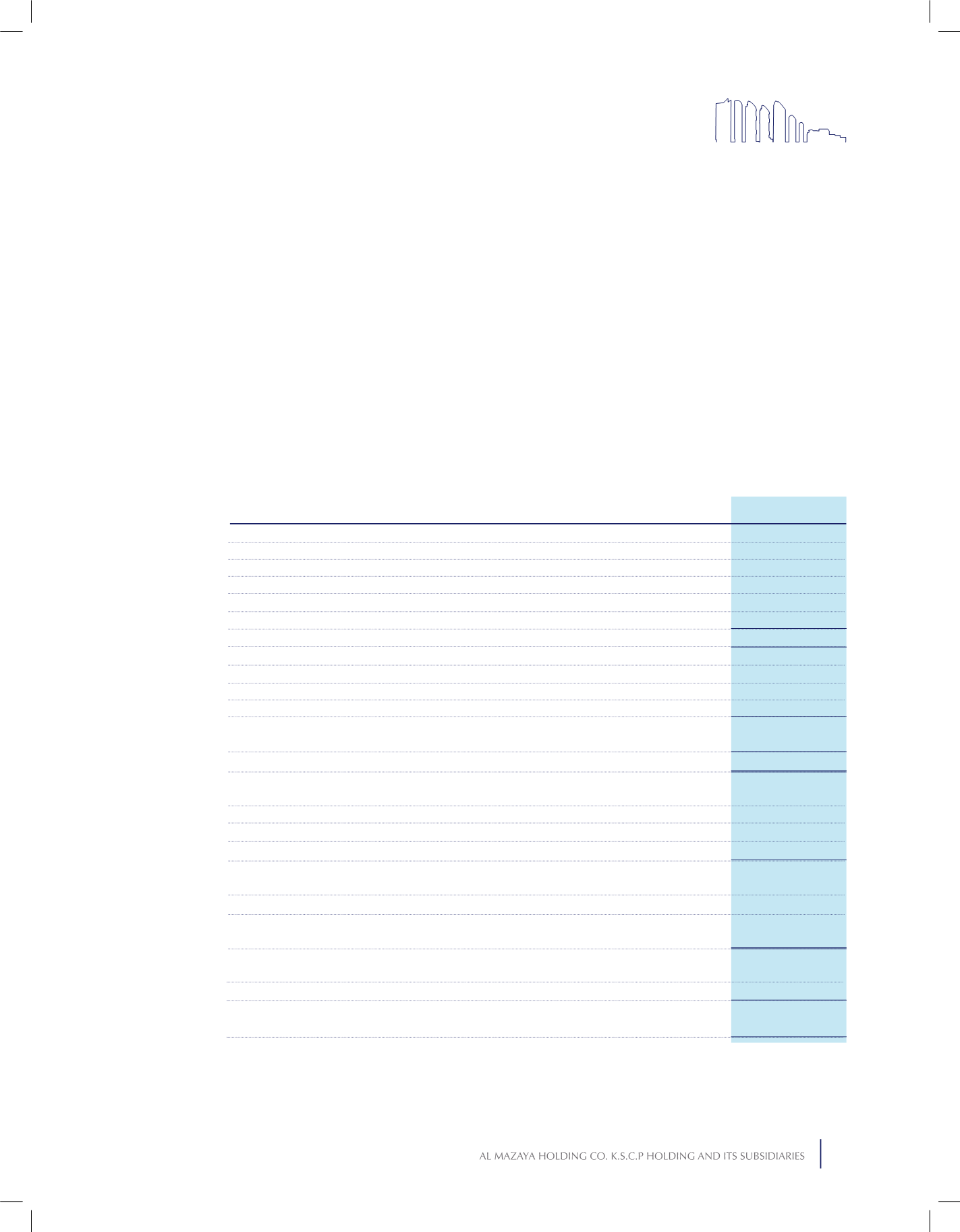

KD

13,825,998

12,309,657

7,095,308

3,582,920

418,183

37,232,066

10,023,718

1,041,594

13,570,939

24,636,251

12,595,815

)1,502,303(

)1,547,333(

)6,189,334(

)3,000,000(

356,845

2,068,376

2,425,221

)1,502,303(

418,183

)1,084,120(

ASSETS

Investment properties (Note 9)

Properties held for trading (Note 13)

Deferred tax assets (included in accounts receivables and other debit balances)

Accounts receivable and other debit balances

Cash and bank balances

LIABILITIES

Term loans

Advances from customers

Accounts payable and other credit balances

Total identifiable net assets at provisional fair value

Cash consideration for the acquisition

Non-controlling interests share in the acquiree’s identifiable net assets

Fair value of acquirer›s previously held equity interests

Settlement of pre-existing relationship *

Gain on bargain purchase on acquisition

Gain on remeasurement of previously held equity interest **

Net gain arising on business combination

Consideration paid

Cash and cash equivalents in subsidiary acquired

Cash outflow on acquisition

6. BUSINESS COMBINATION

The Parent Company owned 40% equity interest in Ritim Istanbul Insaat Anonim Sirketi (“Ritim”) which was

classified as a joint venture with carrying value of KD 3,904,559. During the current year, the Parent Company

acquired additional 50% equity interest in Ritim from the other shareholders of the company. As a result, the

Parent’s Company effective equity interest in Ritim increased from 40% to 90%. As this transaction meets the

criteria of IFRS 3 – Business Combination for the business combination achieved in stages, the Group reclassified

its investment in Ritim from investment in joint venture to investment in subsidiary and consolidated Ritim from

the effective date of control.

The acquisitions have been accounted based on the fair values assigned to the identifiable assets and liabilities

assumed of the acquiree Company as on the reporting date.

The consideration paid and the values of assets acquired and liabilities assumed, as well as the non-controlling

interests at the proportionate share of the acquiree’s identifiable net assets, are summarized as follows:

* Settlement of pre-existing relationship represents certain properties owned by the seller before the business

combination and considered part of the consideration.

105