N

otes To The Consolidated Financial Statements

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

As At 31 December 2016

ANNUAL REPORT

2016

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

99.7%

96%

98%

90.42%

99%

98%

100%

90%

100%

100%

100%

99%

99.85%

99%

100%

99.7%

96%

98%

90.42%

99%

98%

100%

40%

100%

100%

100%

99%

99.85%

99%

100%

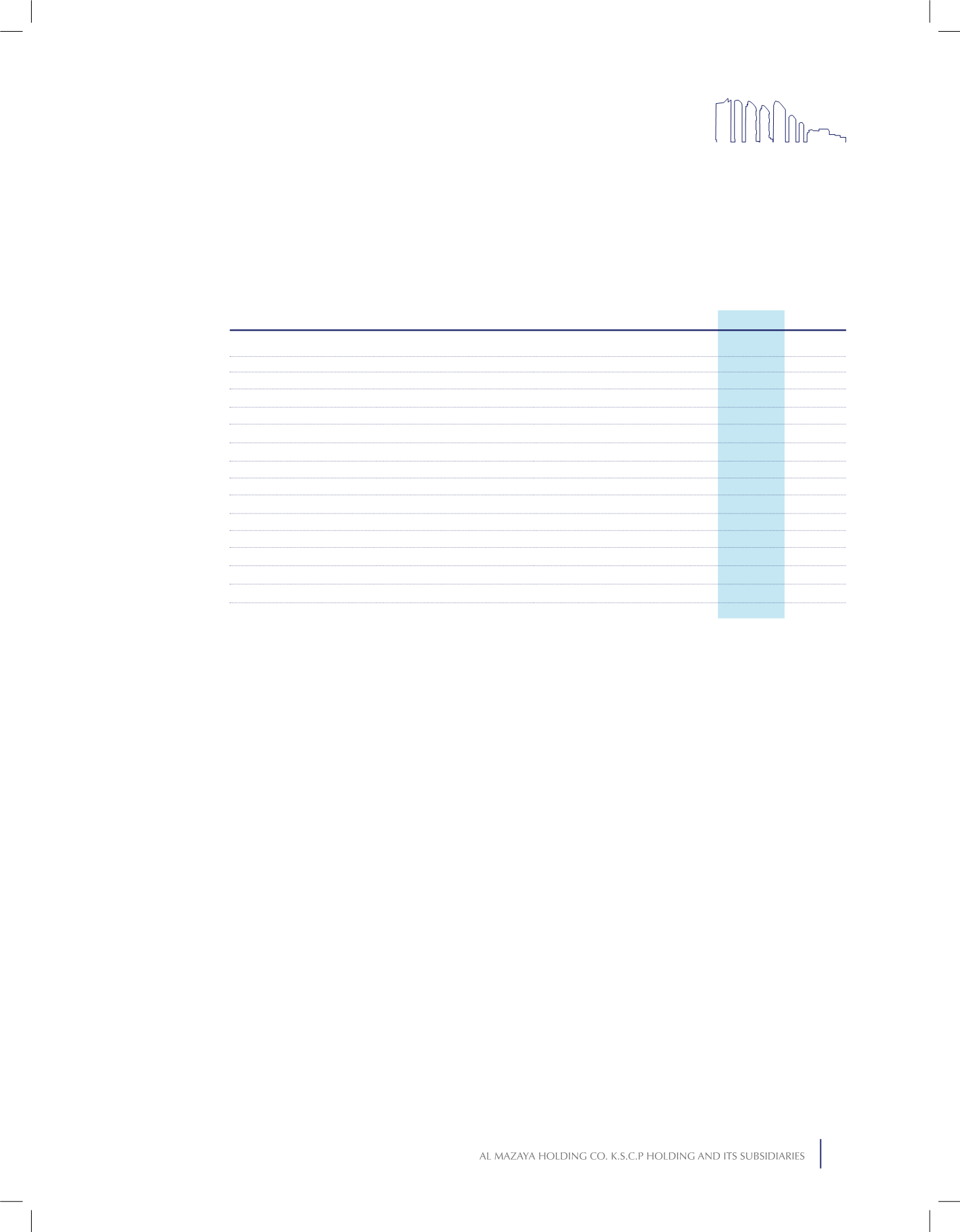

Principal activities

ownership interest %

Al Mazaya Real Estate Development Company K.S.C. (Closed)

Seven Zones Real Estate Company K.S.C. (Closed)

GulfTurkey for GeneralTrading and Contracting CompanyW.L.L.

First Dubai Real Estate Development Company - K.S.C.P.

Mezzan Combined For GeneralTrading Company -W.L.L.

First Kuwait for Projects Management CompanyW.L.L.

Al Mazaya Real Estate FZ – LLC

Ritim Istanbul Insaat Anonim Sirketi (Ritim)*

AlYammar Kuwaiti Agriculture Co. OPC

Al Mazaya Emirates Real Estate Development Company O.P.C.

Mazaya Real EstateTurkeyGayrimenkulYatirimlariAnonimSirketi

Advantage GeneralTrading Co. O.P.C.

Al Mazaya Lebanon Company - S.A.L. (Holding)

Grand Mazaya Real Estate CompanyW.L.L.

Al Mazaya Real Estate Development Company L.L.C.

2016

2015

Country of

incorporation

Entity

Kuwait

Kuwait

Kuwait

Kuwait

Kuwait

Kuwait

UAE

Turkey

Kuwait

UAE

Turkey

UAE

Lebanon

KSA

Oman

The consolidated financial statements include the financial statements of the Parent Company and the

following subsidiaries, where the Parent Company has direct investment:

* During the year ended 31 December 2016, the Parent’s acquired additional equity interest in Ritim,

accordingly its effective ownership increased from 40% to 90% and is consolidated from the date of

acquisition (Note 6).

Business combinations and goodwill

A business combination is the bringing together of separate entities or businesses into one reporting entity as

a result one entity, the acquirer, obtaining control of one or more other businesses. The acquisition method

of accounting is used to account for business combinations. The cost of an acquisition is measured as the

aggregate of the consideration transferred, measured at acquisition date fair value and the amount of any

non-controlling interests in the acquiree. Under this method, the Group recognises, separately from goodwill,

identifiable assets acquired, liabilities assumed and any non-controlling interests in the acquiree at the

acquisition date. For each business combination, the Group elects to measure the non-controlling interests

in the acquiree either at fair value or at the proportionate share of the acquiree’s identifiable net assets.

Acquisition costs incurred are expensed and included in other expenses.

When the Group acquires a business, it assesses the financial assets and liabilities assumed for appropriate

classification and designation in accordance with the contractual terms, economic circumstances and

pertinent conditions as at the acquisition date. This includes the separation of embedded derivatives in host

contracts by the acquiree.

If the business combination is achieved in stages, the acquisition date fair value of the acquirer’s previously

held equity interest in the acquiree is remeasured to fair value at the acquisition date through profit or loss.

89