Page 21 - FS-EN-Q2-30-06-2022

P. 21

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

JUNE 30, 2022

(All amounts are in Kuwaiti Dinars)

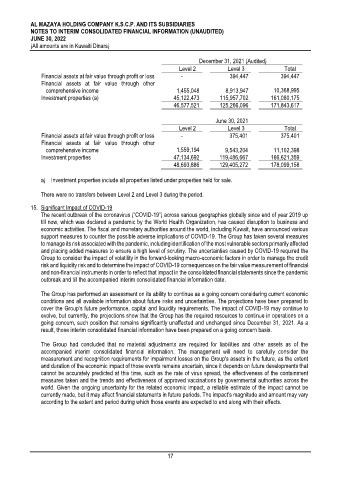

December 31, 2021 (Audited)

Level 2 Level 3 Total

Financial assets at fair value through profit or loss - 394,447 394,447

Financial assets at fair value through other

comprehensive income 1,455,048 8,913,947 10,368,995

Investment properties (a) 45,122,473 115,957,702 161,080,175

46,577,521 125,266,096 171,843,617

June 30, 2021

Level 2 Level 3 Total

Financial assets at fair value through profit or loss - 375,401 375,401

Financial assets at fair value through other

comprehensive income 1,559,194 9,543,204 11,102,398

Investment properties 47,134,692 119,486,667 166,621,359

48,693,886 129,405,272 178,099,158

a) Investment properties include all properties listed under properties held for sale.

There were no transfers between Level 2 and Level 3 during the period.

15. Significant Impact of COVID-19

The recent outbreak of the coronavirus (“COVID-19”) across various geographies globally since end of year 2019 up

till now, which was declared a pandemic by the World Health Organization, has caused disruption to business and

economic activities. The fiscal and monetary authorities around the world, including Kuwait, have announced various

support measures to counter the possible adverse implications of COVID-19. The Group has taken several measures

to manage its risk associated with the pandemic, including identification of the most vulnerable sectors primarily affected

and placing added measures to ensure a high level of scrutiny. The uncertainties caused by COVID-19 required the

Group to consider the impact of volatility in the forward-looking macro-economic factors in order to manage the credit

risk and liquidity risk and to determine the impact of COVID-19 consequences on the fair value measurement of financial

and non-financial instruments in order to reflect that impact in the consolidated financial statements since the pandemic

outbreak and till the accompanied interim consolidated financial information date.

The Group has performed an assessment on its ability to continue as a going concern considering current economic

conditions and all available information about future risks and uncertainties. The projections have been prepared to

cover the Group’s future performance, capital and liquidity requirements. The impact of COVID-19 may continue to

evolve, but currently, the projections show that the Group has the required resources to continue in operations on a

going concern, such position that remains significantly unaffected and unchanged since December 31, 2021. As a

result, those interim consolidated financial information have been prepared on a going concern basis.

The Group had concluded that no material adjustments are required for liabilities and other assets as of the

accompanied interim consolidated financial information. The management will need to carefully consider the

measurement and recognition requirements for impairment losses on the Group's assets in the future, as the extent

and duration of the economic impact of those events remains uncertain, since it depends on future developments that

cannot be accurately predicted at this time, such as the rate of virus spread, the effectiveness of the containment

measures taken and the trends and effectiveness of approved vaccinations by governmental authorities across the

world. Given the ongoing uncertainty for the related economic impact, a reliable estimate of the impact cannot be

currently made, but it may affect financial statements in future periods. The impact’s magnitude and amount may vary

according to the extent and period during which those events are expected to end along with their effects.

17