Page 65 - FS-Q2-2023-EN

P. 65

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC) AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

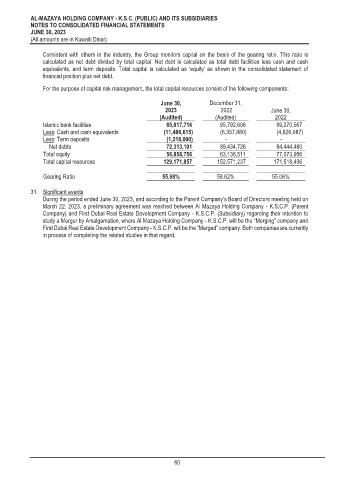

Consistent with others in the industry, the Group monitors capital on the basis of the gearing ratio. This ratio is

calculated as net debt divided by total capital. Net debt is calculated as total debt facilities less cash and cash

equivalents, and term deposits. Total capital is calculated as ‘equity’ as shown in the consolidated statement of

financial position plus net debt.

For the purpose of capital risk management, the total capital resources consist of the following components:

June 30, December 31,

2023 2022 June 30,

(Audited) (Audited) 2022

Islamic bank facilities 85,017,716 95,792,606 99,270,567

Less: Cash and cash equivalents (11,486,615) (6,357,880) (4,826,087)

Less: Term deposits (1,218,000) - -

Net debts 72,313,101 89,434,726 94,444,480

Total equity 56,858,756 63,136,511 77,073,956

Total capital resources 129,171,857 152,571,237 171,518,436

Gearing Ratio 55.98% 58.62% 55.06%

31. Significant events

During the period ended June 30, 2023, and according to the Parent Company’s Board of Directors meeting held on

March 22, 2023, a preliminary agreement was reached between Al Mazaya Holding Company - K.S.C.P. (Parent

Company) and First Dubai Real Estate Development Company - K.S.C.P. (Subsidiary) regarding their intention to

study a Merger by Amalgamation, where Al Mazaya Holding Company - K.S.C.P. will be the “Merging” company and

First Dubai Real Estate Development Company - K.S.C.P. will be the “Merged” company. Both companies are currently

in process of completing the related studies in that regard.

60