ANNUAL REPORT

2015

Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

31 December 2015

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

Real estate development

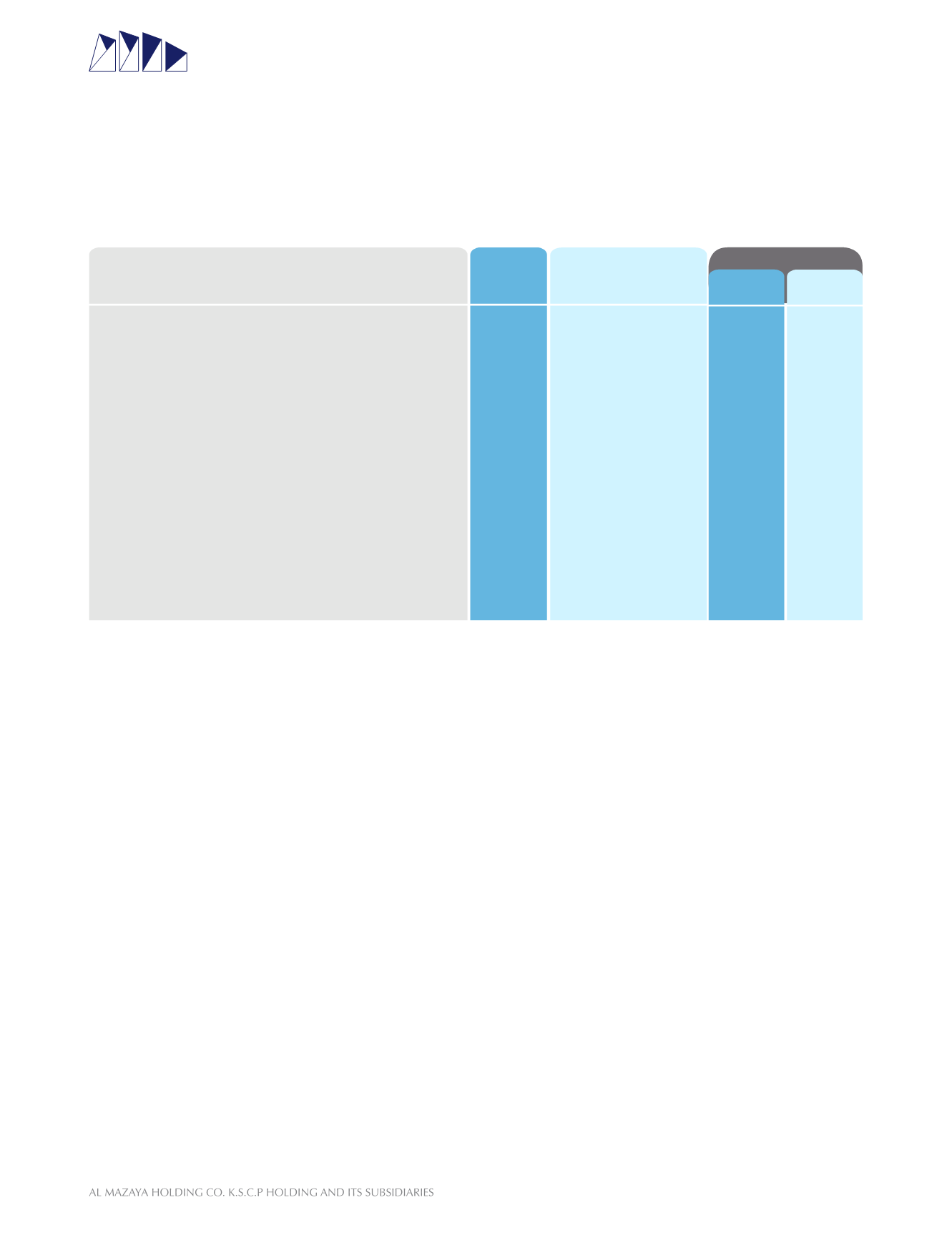

99.7%

96%

90.42%

99%

98%

98%

100%

80%

80%

99%

99%

99.85 %

99.9%

99.7%

96%

90.42%

99%

98%

98%

100%

80%

80%

99%

99%

99.85 %

99.9%

Principal activities

ownership interest %

Al Mazaya Real Estate Development Company K.S.C. (Closed)

Seven Zones Real Estate Company K.S.C. (Closed)

First Dubai Real Estate Development Company – K.S.C.P.

Mezzan Combined For General Trading Company - W.L.L.

Gulf Turkey for General Trading Co. W.L.L.

First Kuwait for projects management Co. W.L.L.

Al Mazaya Real Estate Free Zone( FZ)/ LLC

Al Dana Real Estate Limited

Al Rayhan Real Estate Limited

Advantage General Trading Co. W.L.L.

Kuwaiti Saudi Real Estate Investment Co. L.L.C

Mazaya Lebanon Company - S.A.L. (Holding)

Mazaya Lamartien - S.A.L.

2015

2014

Country of

incorporation

Entity

Kuwait

Kuwait

Kuwait

Kuwait

Kuwait

Kuwait

U.A.E

U.A.E

U.A.E

U.A.E

KSA

Lebanon

Lebanon

The consolidated financial statements include the financial statements of the Parent Company and the following subsidiaries,

where the Parent Company has direct investment:

Business combinations and goodwill

A business combination is the bringing together of separate entities or businesses into one reporting entity as a result one entity, the

acquirer, obtaining control of one or more other businesses. The acquisition method of accounting is used to account for business

combinations. The cost of an acquisition is measured as the aggregate of the consideration transferred, measured at acquisition

date fair value and the amount of any non-controlling interests in the acquiree. Under this method, the Group recognises,

separately from goodwill, identifiable assets acquired, liabilities assumed and any non-controlling interests in the acquiree at the

acquisition date. For each business combination, the Group elects to measure the non-controlling interests in the acquiree either

at fair value or at the proportionate share of the acquiree’s identifiable net assets. Acquisition costs incurred are expensed and

included in other expenses.

When the Group acquires a business, it assesses the financial assets and liabilities assumed for appropriate classification and

designation in accordance with the contractual terms, economic circumstances and pertinent conditions as at the acquisition

date. This includes the separation of embedded derivatives in host contracts by the acquiree.

If the business combination is achieved in stages, the acquisition date fair value of the acquirer’s previously held equity interest in

the acquiree is remeasured to fair value at the acquisition date through profit or loss.

Any contingent consideration to be transferred by the acquirer will be recognised at fair value at the acquisition date. Subsequent

changes to the fair value of the contingent consideration which is deemed to be an asset or liability will be recognised in

accordance with IAS 39 either in consolidated statement of income or as a change to other comprehensive income. If the

contingent consideration is classified as equity, it will not be remeasured. Subsequent settlement is accounted for within equity.

In instances where the contingent consideration does not fall within the scope of IAS 39, it is measured in accordance with the

appropriate IFRS.

58