Page 10 - Q3 2024 EN

P. 10

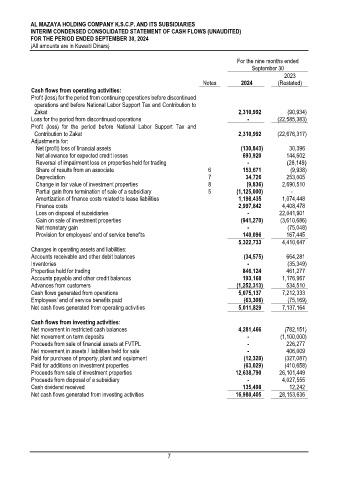

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

FOR THE PERIOD ENDED SEPTEMBER 30, 2024

(All amounts are in Kuwaiti Dinars)

For the nine months ended

September 30

2023

Notes 2024 (Restated)

Cash flows from operating activities:

Profit (loss) for the period from continuing operations before discontinued

operations and before National Labor Support Tax and Contribution to

Zakat 2,310,992 (90,934)

Loss for the period from discontinued operations - (22,585,383)

Profit (loss) for the period before National Labor Support Tax and

Contribution to Zakat 2,310,992 (22,676,317)

Adjustments for:

Net (profit) loss of financial assets (130,843) 30,396

Net allowance for expected credit losses 693,920 144,602

Reversal of impairment loss on properties held for trading - ) 28,149 (

Share of results from an associate 6 153,671 (9,938)

Depreciation 7 34,726 253,005

Change in fair value of investment properties 8 (9,836) 2,690,510

Partial gain from termination of sale of a subsidiary 5 (1,125,000) -

Amortization of finance costs related to lease liabilities 1,198,435 1,074,448

Finance costs 2,997,842 4,408,478

Loss on disposal of subsidiaries - 22,041,901

Gain on sale of investment properties (941,270) (3,610,686)

Net monetary gain - (75,048)

Provision for employees’ end of service benefits 140,096 167,445

5,322,733 4,410,647

Changes in operating assets and liabilities:

Accounts receivable and other debit balances (34,575) 664,281

Inventories - (35,349)

Properties held for trading 846,124 461,277

Accounts payable and other credit balances 193,168 1,176,967

Advances from customers (1,252,313) 534,510

Cash flows generated from operations 5,075,137 7,212,333

Employees’ end of service benefits paid (63,308) (75,169)

Net cash flows generated from operating activities 5,011,829 7,137,164

Cash flows from investing activities:

Net movement in restricted cash balances 4,281,466 (782,151)

Net movement on term deposits - (1,100,000)

Proceeds from sale of financial assets at FVTPL - 226,277

Net movement in assets / liabilities held for sale - 406,009

Paid for purchase of property, plant and equipment (12,320) (327,087)

Paid for additions on investment properties (63,029) (410,658)

Proceeds from sale of investment properties 12,638,790 26,101,449

Proceeds from disposal of a subsidiary - 4,027,555

Cash dividend received 135,498 12,242

Net cash flows generated from investing activities 16,980,405 28,153,636

7