Page 6 - Q3 2024 EN

P. 6

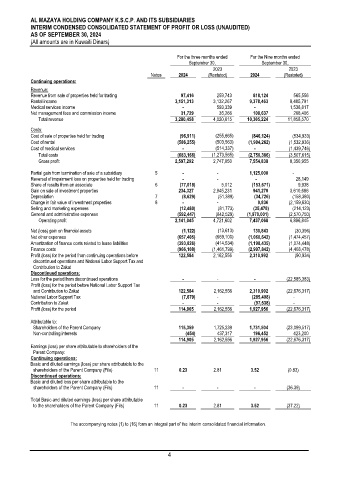

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS (UNAUDITED)

AS OF SEPTEMBER 30, 2024

(All amounts are in Kuwaiti Dinars)

For the three months ended For the Nine months ended

September 30, September 30,

2023 2023

Notes 2024 (Restated) 2024 (Restated)

Continuing operations:

Revenue:

Revenue from sale of properties held for trading 97,416 259,743 818,124 565,556

Rental income 3,151,313 3,132,267 9,378,463 9,485,791

Medical services income - 593,339 - 1,538,817

Net management fees and commission income 31,729 35,266 108,637 268,406

Total revenue 3,280,458 4,020,615 10,305,224 11,858,570

Costs:

Cost of sale of properties held for trading (96,911) ) 255,665 ( (846,124) (534,933)

Cost of rental (586,255) ) 503,563 ( (1,904,262) (1,532,936)

Cost of medical services - ) 514,337 ( - (1,439,746)

Total costs (683,166) ) 1,273,565 ( (2,750,386) (3,507,615)

Gross profit 2,597,292 2,747,050 7,554,838 8,350,955

Partial gain from termination of sale of a subsidiary 5 - - 1,125,000 -

Reversal of impairment loss on properties held for trading - - - 28,149

Share of results from an associate 6 (77,018) 5,012 (153,671) 9,938

Gain on sale of investment properties 234,327 2,945,231 941,270 3,610,686

Depreciation 7 (8,629) (51,389) (34,726) (158,380)

Change in fair value of investment properties 8 - - 9,836 (2,159,630)

Selling and marketing expenses (12,480) (81,773) (35,478) (214,123)

General and administrative expenses (592,447) (842,529) (1,970,001) (2,570,750)

Operating profit 2,141,045 4,721,602 7,437,068 6,896,845

Net (loss) gain on financial assets (1,122) ) 13,613 ( 130,843 (30,396)

Net other expenses (657,405) ) 669,100 ( (1,060,642) (1,474,457)

Amortization of finance costs related to lease liabilities (393,826) ) 414,534 ( (1,198,435) (1,074,448)

Finance costs (966,108) (1,461,799) (2,997,842) (4,408,478)

Profit (loss) for the period from continuing operations before 122,584 2,162,556 2,310,992 (90,934)

discontinued operations and National Labor Support Tax and

Contribution to Zakat

Discontinued operations:

Loss for the period from discontinued operations - - - (22,585,383)

Profit (loss) for the period before National Labor Support Tax

and Contribution to Zakat 122,584 2,162,556 2,310,992 (22,676,317)

National Labor Support Tax (7,679) - (285,498) -

Contribution to Zakat - - (97,538) -

Profit (loss) for the period 114,905 2,162,556 1,927,956 (22,676,317)

Attributable to:

Shareholders of the Parent Company 115,359 1,725,239 1,731,504 (23,099,517)

Non-controlling interests (454) 437,317 196,452 423,200

114,905 2,162,556 1,927,956 (22,676,317)

Earnings (loss) per share attributable to shareholders of the

Parent Company:

Continuing operations:

Basic and diluted earnings (loss) per share attributable to the

shareholders of the Parent Company (Fils) 11 0.23 2.81 3.52 (0.83)

Discontinued operations:

Basic and diluted loss per share attributable to the

shareholders of the Parent Company (Fils) 11 - - - (36.39)

Total Basic and diluted earnings (loss) per share attributable

to the shareholders of the Parent Company (Fils) 11 0.23 2.81 3.52 (37.22)

The accompanying notes (1) to (16) form an integral part of the interim consolidated financial information.

4