Page 27 - Q4-2024-EN

P. 27

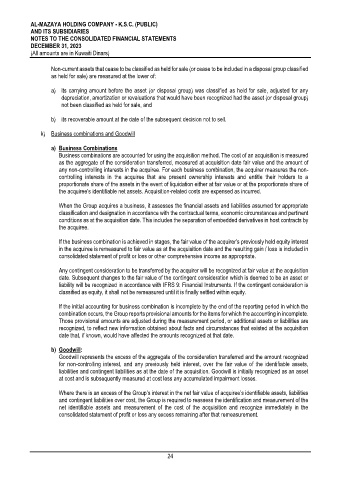

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

Non-current assets that cease to be classified as held for sale (or cease to be included in a disposal group classified

as held for sale) are measured at the lower of:

a) its carrying amount before the asset (or disposal group) was classified as held for sale, adjusted for any

depreciation, amortization or revaluations that would have been recognized had the asset (or disposal group)

not been classified as held for sale, and

b) its recoverable amount at the date of the subsequent decision not to sell.

k) Business combinations and Goodwill

a) Business Combinations

Business combinations are accounted for using the acquisition method. The cost of an acquisition is measured

as the aggregate of the consideration transferred, measured at acquisition date fair value and the amount of

any non-controlling interests in the acquiree. For each business combination, the acquirer measures the non-

controlling interests in the acquiree that are present ownership interests and entitle their holders to a

proportionate share of the assets in the event of liquidation either at fair value or at the proportionate share of

the acquiree’s identifiable net assets. Acquisition-related costs are expensed as incurred.

When the Group acquires a business, it assesses the financial assets and liabilities assumed for appropriate

classification and designation in accordance with the contractual terms, economic circumstances and pertinent

conditions as at the acquisition date. This includes the separation of embedded derivatives in host contracts by

the acquiree.

If the business combination is achieved in stages, the fair value of the acquirer’s previously held equity interest

in the acquiree is remeasured to fair value as at the acquisition date and the resulting gain / loss is included in

consolidated statement of profit or loss or other comprehensive income as appropriate.

Any contingent consideration to be transferred by the acquirer will be recognized at fair value at the acquisition

date. Subsequent changes to the fair value of the contingent consideration which is deemed to be an asset or

liability will be recognized in accordance with IFRS 9: Financial Instruments. If the contingent consideration is

classified as equity, it shall not be remeasured until it is finally settled within equity.

If the initial accounting for business combination is incomplete by the end of the reporting period in which the

combination occurs, the Group reports provisional amounts for the items for which the accounting in incomplete.

Those provisional amounts are adjusted during the measurement period, or additional assets or liabilities are

recognized, to reflect new information obtained about facts and circumstances that existed at the acquisition

date that, if known, would have affected the amounts recognized at that date.

b) Goodwill:

Goodwill represents the excess of the aggregate of the consideration transferred and the amount recognized

for non-controlling interest, and any previously held interest, over the fair value of the identifiable assets,

liabilities and contingent liabilities as at the date of the acquisition. Goodwill is initially recognized as an asset

at cost and is subsequently measured at cost less any accumulated impairment losses.

Where there is an excess of the Group’s interest in the net fair value of acquiree’s identifiable assets, liabilities

and contingent liabilities over cost, the Group is required to reassess the identification and measurement of the

net identifiable assets and measurement of the cost of the acquisition and recognize immediately in the

consolidated statement of profit or loss any excess remaining after that remeasurement.

24