Page 28 - Q4-2024-EN

P. 28

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

For the purpose of impairment testing, goodwill is allocated to each of the Group’s cash-generating units

expected to benefit from the synergies of the combination. Cash-generating units to which goodwill has been

allocated are tested for impairment annually, or more frequently when there is an indication that the unit may

be impaired. If the recoverable amount of the cash-generating unit is less than the carrying amount of the unit,

the impairment loss is allocated first to reduce the carrying amount of any goodwill allocated to the unit and

then to the other assets of the unit pro-rata on the basis of the carrying amount of each asset in the unit. An

impairment loss recognized for goodwill is not reversed in a subsequent period.

Where goodwill forms part of a cash-generating unit and part of the operation within that unit is disposed of, the

goodwill associated with the operation disposed of is included in the carrying amount of the operation when

determining the gain or loss on disposal of the operation. Goodwill disposed of in this circumstance is measured

based on the relative values of the operation disposed of and the portion of the cash-generating unit retained.

l) Property, Plant and equipment:

The initial cost of Property, Plant and equipment comprises its purchase price and any directly attributable costs

of bringing the asset to its working condition and location for its intended use. Expenditures incurred after the

Property, Plant and equipment have been put into operation, such as repairs and maintenance and overhaul costs,

are normally charged to consolidated statement of profit or loss in the period in which the costs are incurred. In

situations where it can be clearly demonstrated that the expenditures have resulted in an increase in the future

economic benefits expected to be obtained from the use of an item of Property, Plant and equipment beyond its

originally assessed standard of performance, the expenditures are capitalized as an additional cost of Property,

Plant and equipment.

Property, Plant and equipment are stated at cost less accumulated depreciation and impairment losses. When

assets are sold or retired, their cost and accumulated depreciation are eliminated from the accounts and any gain

or loss resulting from their disposal is included in consolidated statement of profit or loss for the period. The carrying

values of Property, Plant and equipment are reviewed for impairment when events or changes in circumstances

indicate the carrying value may not be recoverable. If any such indication exists and where the carrying values

exceed the estimated recoverable amount, the assets are written down to their recoverable amount, being the

higher of their fair value less costs to sell and their value in use.

Land is not depreciated. Depreciation is computed on a straight-line basis over the estimated useful lives of other

Property, Plant and equipment as follows:

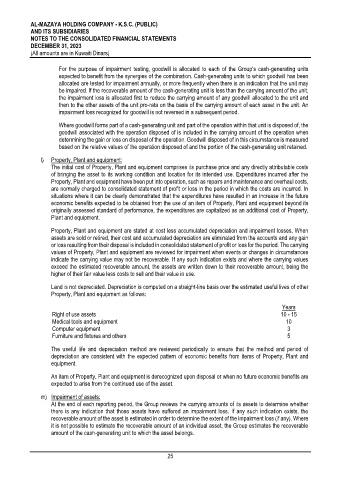

Years

Right of use assets 10 - 15

Medical tools and equipment 10

Computer equipment 3

Furniture and fixtures and others 5

The useful life and depreciation method are reviewed periodically to ensure that the method and period of

depreciation are consistent with the expected pattern of economic benefits from items of Property, Plant and

equipment.

An item of Property, Plant and equipment is derecognized upon disposal or when no future economic benefits are

expected to arise from the continued use of the asset.

m) Impairment of assets:

At the end of each reporting period, the Group reviews the carrying amounts of its assets to determine whether

there is any indication that those assets have suffered an impairment loss. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine the extent of the impairment loss (if any). Where

it is not possible to estimate the recoverable amount of an individual asset, the Group estimates the recoverable

amount of the cash-generating unit to which the asset belongs.

25