Project Management &

Consultancy

AL MAZAYA

Holding manages a construction

project and operates as an extension to your company,

and represents the company interests while leveraging

the best possible performance out of all the entities

employed on the project.

AL MAZAYA

Holding

direct the day-to day work of all entities involved on

the project, while you retain all the major decision

making authority. Experience, influencing skills, and

leadership style are paramount in determining the

effectiveness of a Project from assessing the viability of

the development, controlling the design and construction

phases to providing the required facility and operation

management through leadership and exceptional real

estate construction experience & assist avoiding both

financial obstacles, and development problems.

Portfolio & Fund Management

AL MAZAYA

Holding provides professional

management services to clients and other real estate

companies that encompass a variety of consultation on

various real estate management aspects including: overall

management services, strategic planning and budgeting,

business operations, including business development,

marketing/sales, administration, and financial & project

feasibilities, policies & procedures, operational manuals,

setup of information technology systems, organizational

and functional structure, staffing, and training.

Real Estate Brokerage

AL MAZAYA

Holding’s Brokerage is based on the

desire to personalize and increase the level of service

toward its clients.This service will provide

ALMAZAYA

Holding’s clients the ability to view its projects online

using the latest forms of technology, and allow the ability

to follow up this with personalized VIP site visits.

Real Estate Development &

Investments

There is a variety of different approaches for development

in which

AL MAZAYA

Holding can be involved in. The

range from master developments to individual projects

in different sectors, including residential, commercial,

industrial, educational and health. These endeavors can

be directly owned, owned through a partnership with

investors, Joint Venture, and BOT’s (Build, Operate and

Transfer).

15

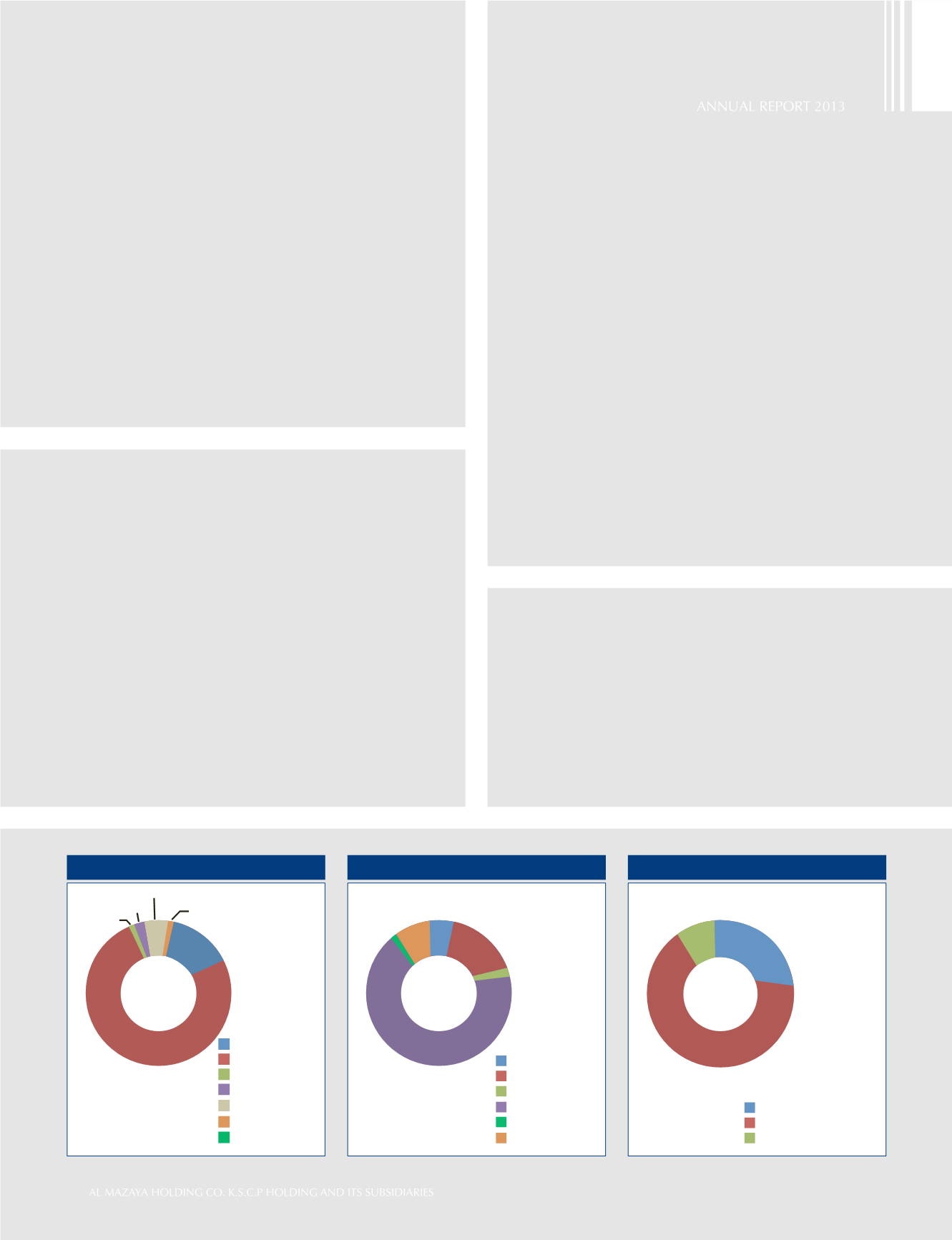

Allocation By Geography - 2013

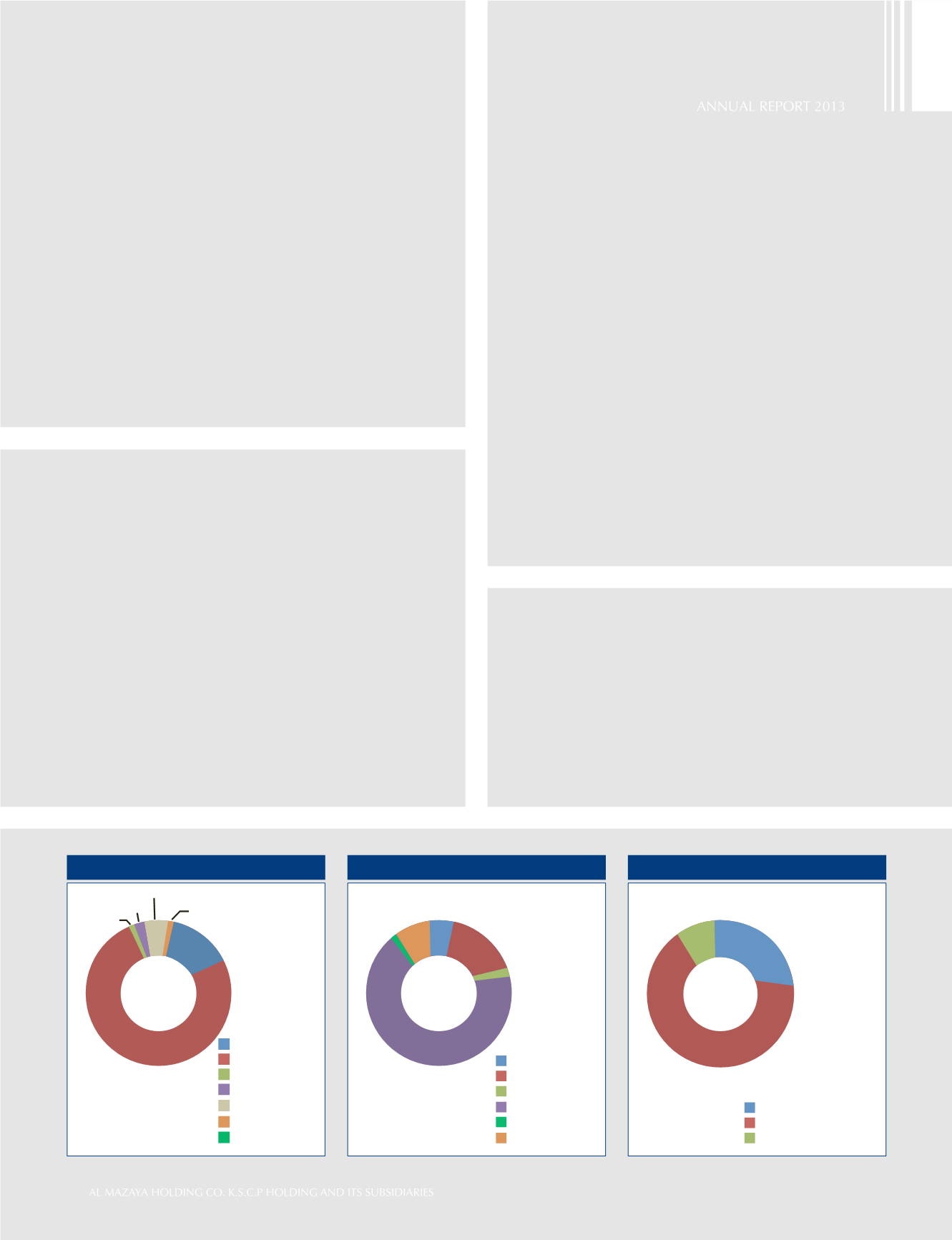

Allocation By Sector - 2013

Sources of Income Allocation - 2013

%72

21%

1%

0%

3%

2%

1%

Medical

Offices

Retail

Residential

Logistics

Residential -

Land

= 5 %

= 23 %

= 2 %

= 62 %

= 1 %

= 8 %

Rent

Sales of Properties

Management Fees

= 36 %

= 56 %

= 8 %

%62

23%

4%

2%

1%

8%

%56

8% 36%

Kuwait

UAE

Bahrain

Oman

Saudi Arabia

Lebanon

Turkey

= 21 %

= 72 %

= 1 %

= 2 %

= 3 %

= 1 %

= 0 %