Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

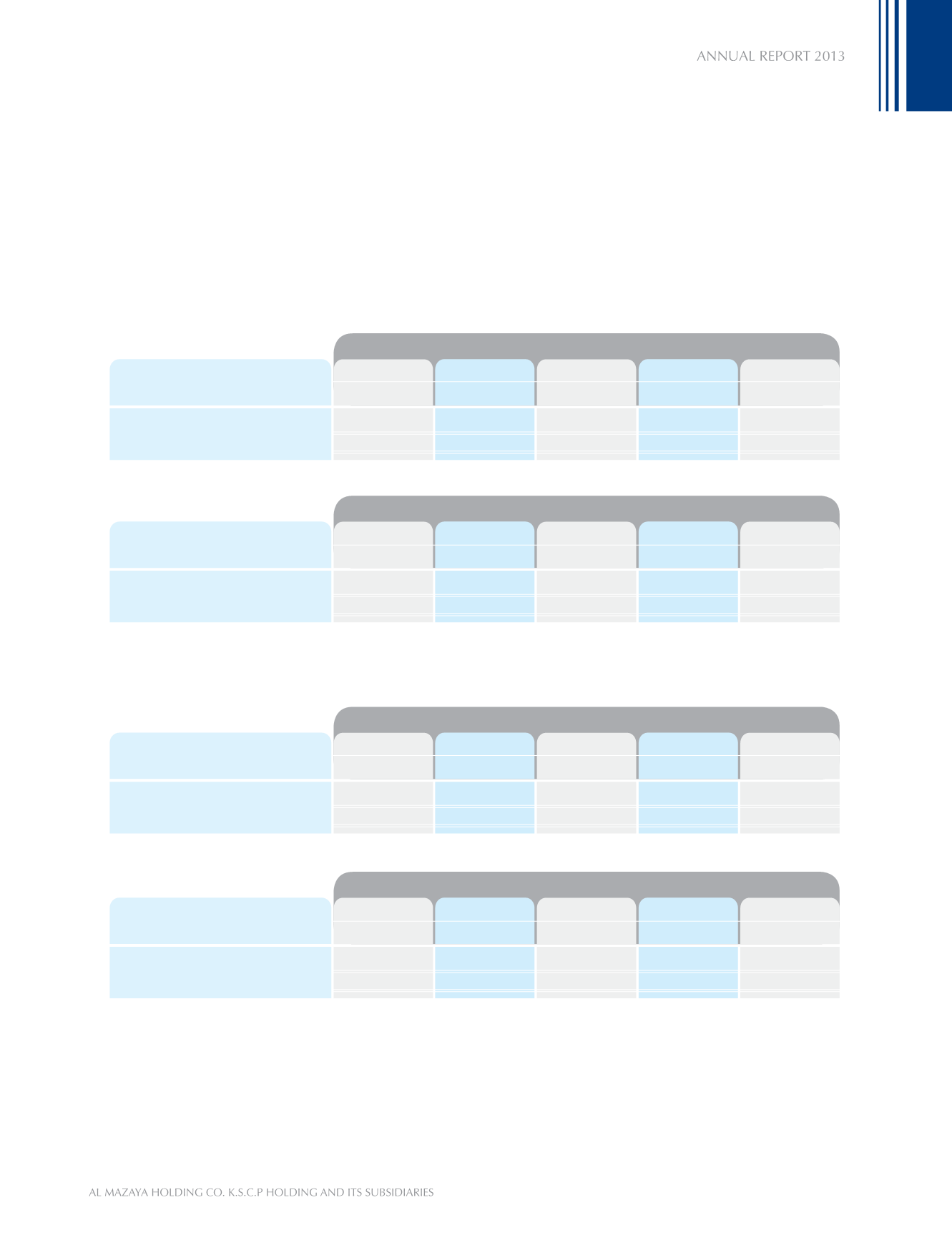

31 December 2013

2012

714,083

)1,100,774(

Kuwait

KD

UAE

KD

Segment revenue

Segment (loss) profit *

KSA

KD

Others

KD

Total

KD

31,561,667

7,563,952

925,974

)3,712,206(

300,253

)2,416,099(

33,501,977

334,873

2013

403,513

454,710

Kuwait

KD

UAE

KD

Segment revenue

Segment (loss) profit *

KSA

KD

Others

KD

Total

KD

23,393,968

6,520,991

1,820,700

)592,007(

357,759

415,534

25,975,940

6,799,228

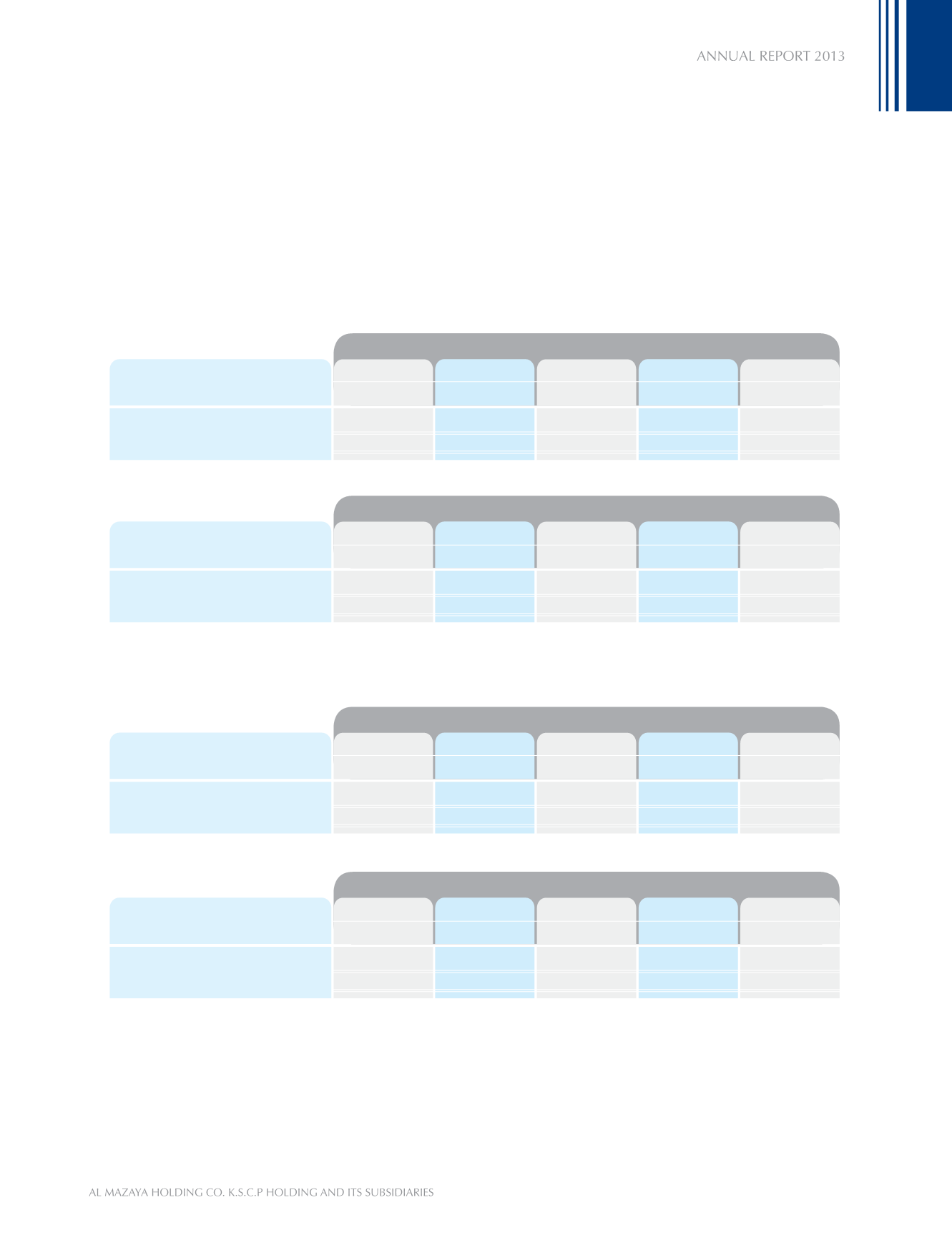

2012

11,828,905

2,519

Kuwait

KD

UAE

KD

Total segment assets

Total segment liabilities

KSA

KD

Others

KD

Total

KD

150,883,528

69,055,178

53,419,854

64,155,449

4,920,687

-

221,052,974

133,213,146

2013

11,449,255

15,622

Kuwait

KD

UAE

KD

Total segment assets

Total segment liabilities

KSA

KD

Others

KD

Total

KD

142,856,067

77,693,429

68,668,247

53,239,752

5,142,572

-

228,116,141

130,948,803

27. SEGMENT INFORMATION

i) Primary segment information:

For management purposes, the Group is divided into three main geographical segments that are: State of Kuwait, United

Arab Emirates (UAE), Kingdom of Saudi Arabia (KSA) and others, where the Group performs its main activities in the real

estate segment. There is no income generating transactions between the Group’s segments.

* Segment results are computed after allocating common cost to the geographical segments based on asset base of the

segment.

71