Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

31 December 2013

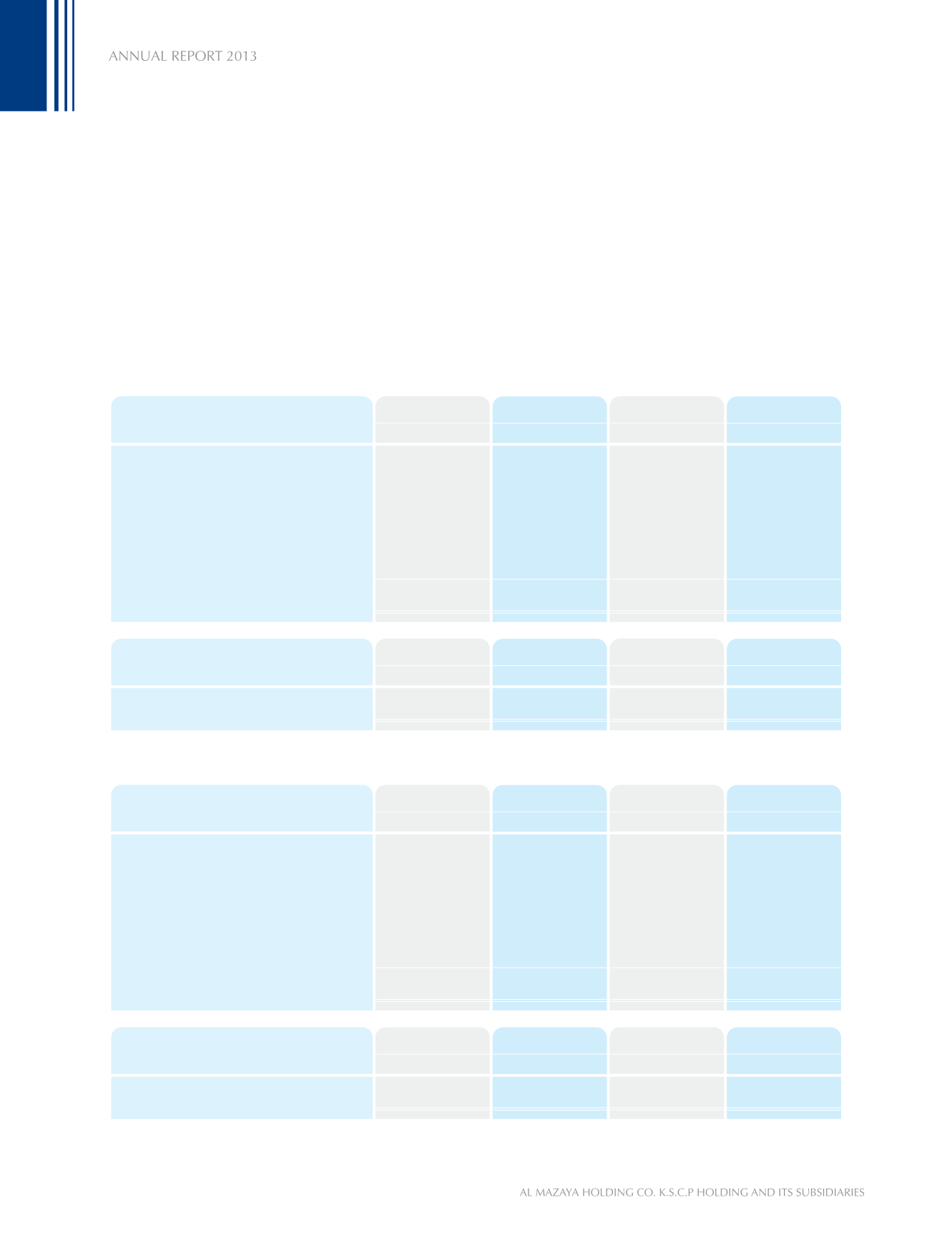

30.2 Liquidity risk

Liquidity risk is the risk that the Group will be unable to meet its liabilities when they fall due. To limit this risk, management

has arranged diversified funding sources, manages assets with liquidity in mind, and monitors liquidity on a daily basis.

The Group’s objective is to maintain a balance between continuity of funding and flexibility through the use of bank

deposits and loans.

The table below summarises the maturity profile of the Group’s financial liabilities based on contractual undiscounted

repayment obligations. The liquidity profile of financial liabilities reflects the projected cash flows which includes future

interest payments over the life of these financial liabilities.

31 December 2013

3,408,300

2,688,438

7,566,055

3,021,238

16,684,031

4,219,837

7,547,813

2,554,012

-

14,321,662

26,380,112

26,377,189

12,523,867

3,021,238

68,302,406

18,751,975

16,140,938

2,403,800

-

37,296,713

Tawarruq payable

Term loans

Accounts payable and other credit balances

Bank overdraft

Total undiscounted liabilities

Within 1 year

KD

1 - 2 years

KD

2 - 5 years

KD

Total

KD

3,555,492

4,444,365

17,777,462

9,777,605

Capital commitments

Within 1 year

KD

1 - 2 years

KD

2 - 5 years

KD

Total

KD

Commitments

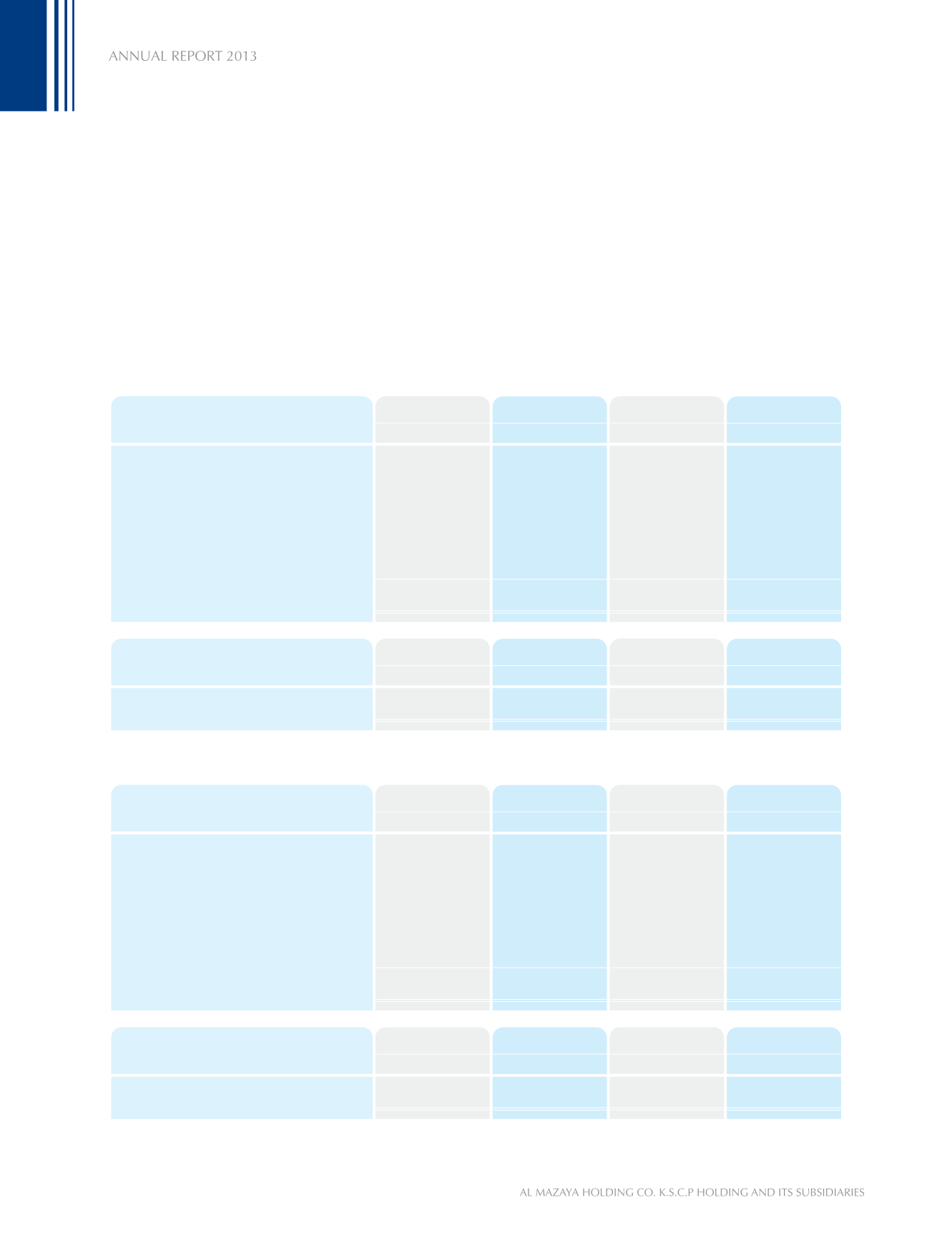

31 December 2012

9,040,000

9,225,000

1,022,483

-

3,120,435

22,407,918

-

9,300,000

3,180,783

3,947,108

-

16,427,891

9,040,000

44,625,000

17,443,352

3,947,108

3,120,435

78,175,895

-

26,100,000

13,240,086

-

-

39,340,086

Wakala and murabaha payables

Term loans

Accounts payable and other credit balances

Deferred consideration on acquisition of

properties

Bank overdraft

Total undiscounted liabilities

Within 1 year

KD

1 - 2 years

KD

2 - 5 years

KD

Total

KD

2,933,113

3,666,391

14,665,565

8,066,061

Capital commitments

Within 1 year

KD

1 - 2 years

KD

2 - 5 years

KD

Total

KD

Commitments

56

76