Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

31 December 2013

55

2012

KD

972,494

-

-

972,494

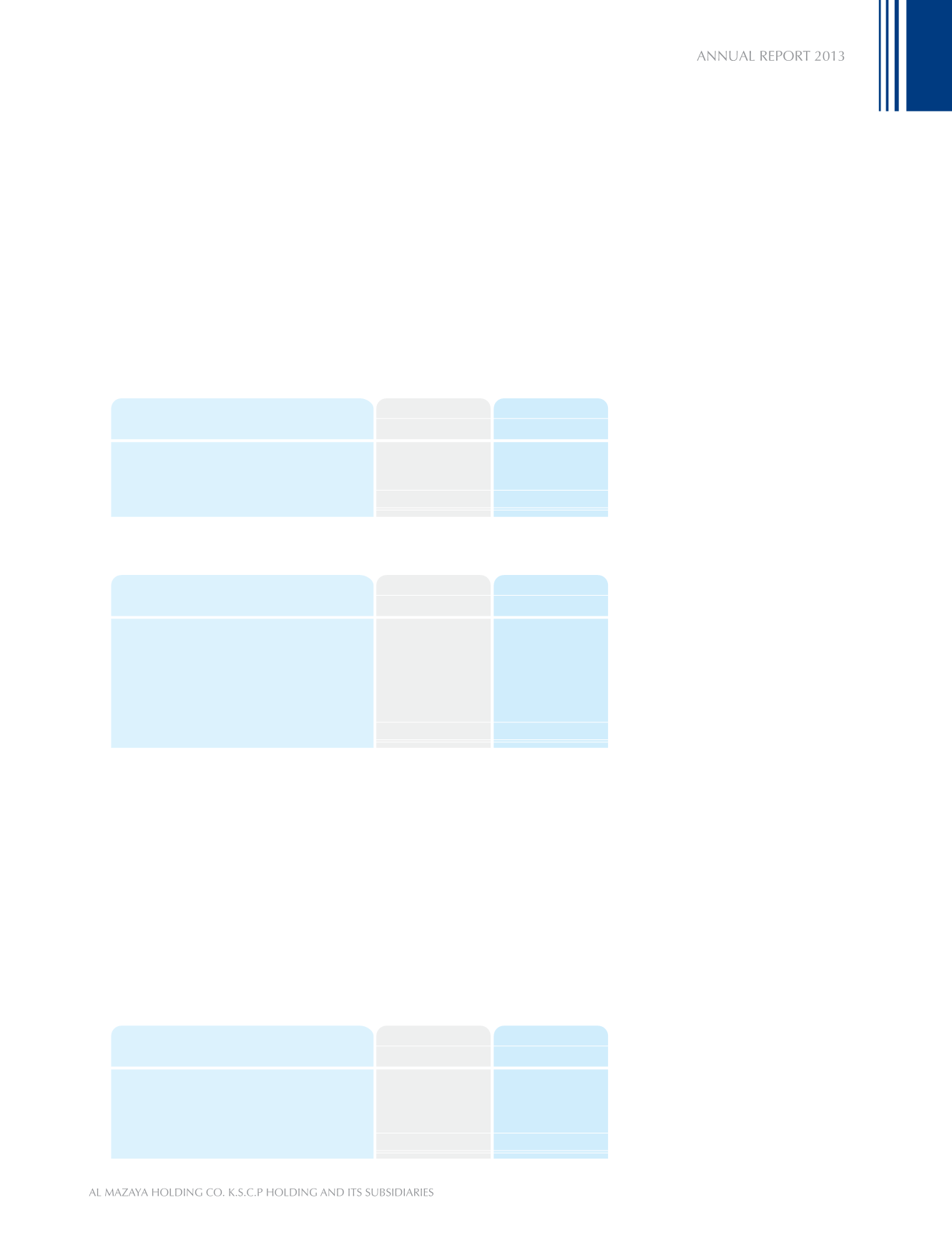

Balance at the beginning of the year

Charge for the year

Written off

Balance at the end of the year

2011

KD

10,449,677

236,167

(9,713,350)

972,494

The Group trades only with recognised, creditworthy third parties. In addition, receivable balances are monitored on an

ongoing basis. For transactions that do not occur in the country of the relevant operating unit, the Group does not offer

credit terms without the approval of the Group management.

With respect to credit risk arising from the other financial assets of the Group, which comprise bank balances, short term

deposits and account receivables, the Group’s exposure to credit risk arising from default of the counterparty, with a

maximum exposure equal to the carrying amount these instruments.

Due to the nature of the Group’s business, the Group does not take possession of collaterals.

The financial assets of the Group are distributed over the following geographical regions:

30.1.1 Gross maximum exposure to credit risk

The table below shows the gross maximum exposure to credit risk across the Group’s financial assets.

The Group’s exposure is predominately to real estate and construction sectors.

There is no concentration of credit risk with respect to real estate receivables, as the Group has a large number of tenants.

30.1.2 Credit quality of financial assets that are neither past due nor impaired

The Group neither uses internal credit grading system nor external credit grades. The Group manages credit quality by

ensuring that credit is granted only to known creditworthy parties.

30.1.3 Past due and impaired

The Group does not have any past due but not impaired financial assets as at 31 December 2013 and 31 December 2012.

Gross amount due amounting to KD 2,129,737 (2012: KD 2,129,737) were impaired with a provision of KD 972,494

(2012: KD 972,494). The movement in provision allowance during the year is as follows:

Allowance for doubtful debts for receivables

2013

KD

6,280,165

16,163,114

7,224

22,450,503

Geographical regions:

Kuwait

Dubai

Other

2012

KD

5,460,094

12,822,242

7,030

18,289,366

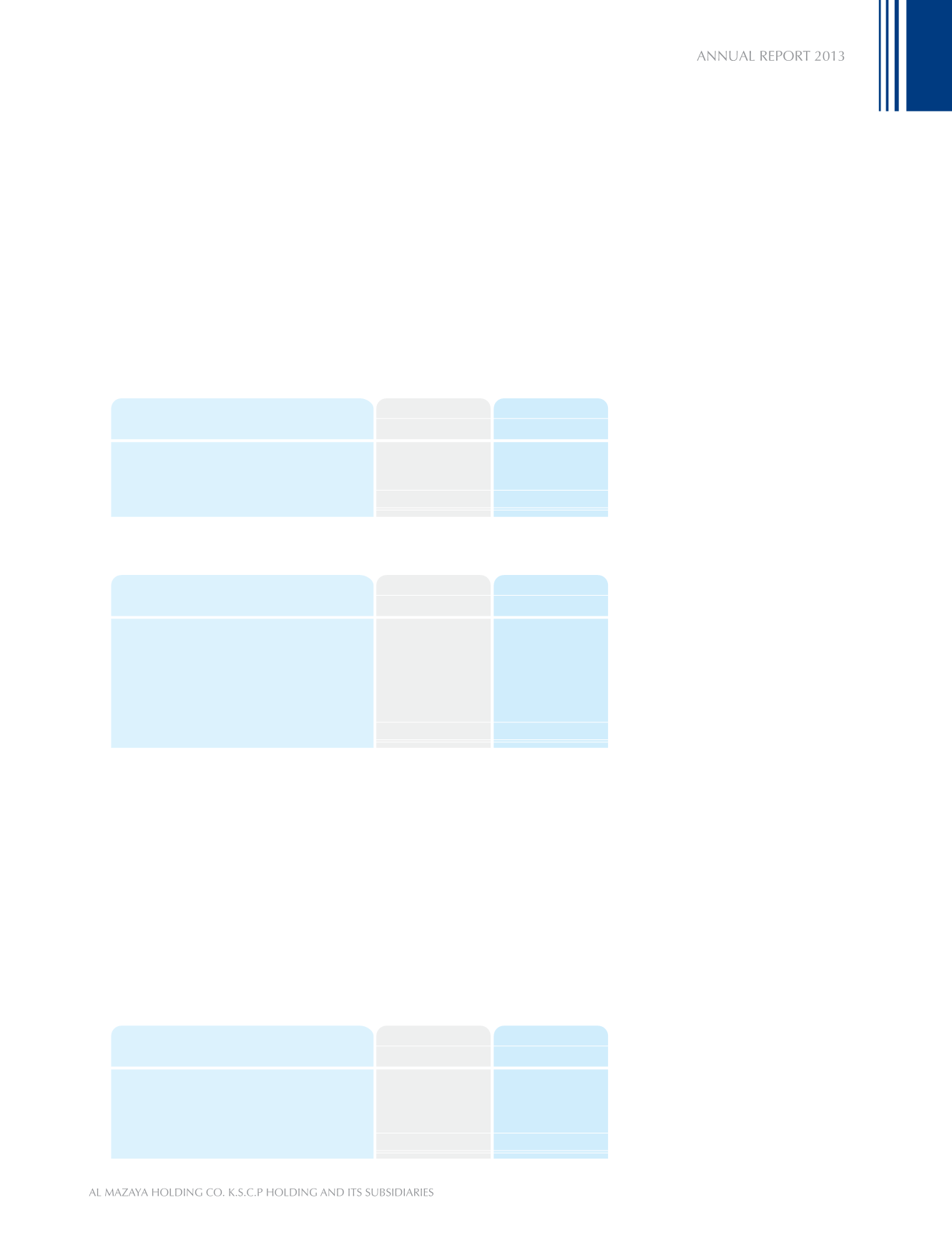

2013

KD

17,440,462

5,010,041

22,450,503

Bank balances and short term deposits

Accounts receivable

2012

KD

13,386,421

4,902,945

18,289,366

75