Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C. AND ITS SUBSIDIARIES

31 December 2012

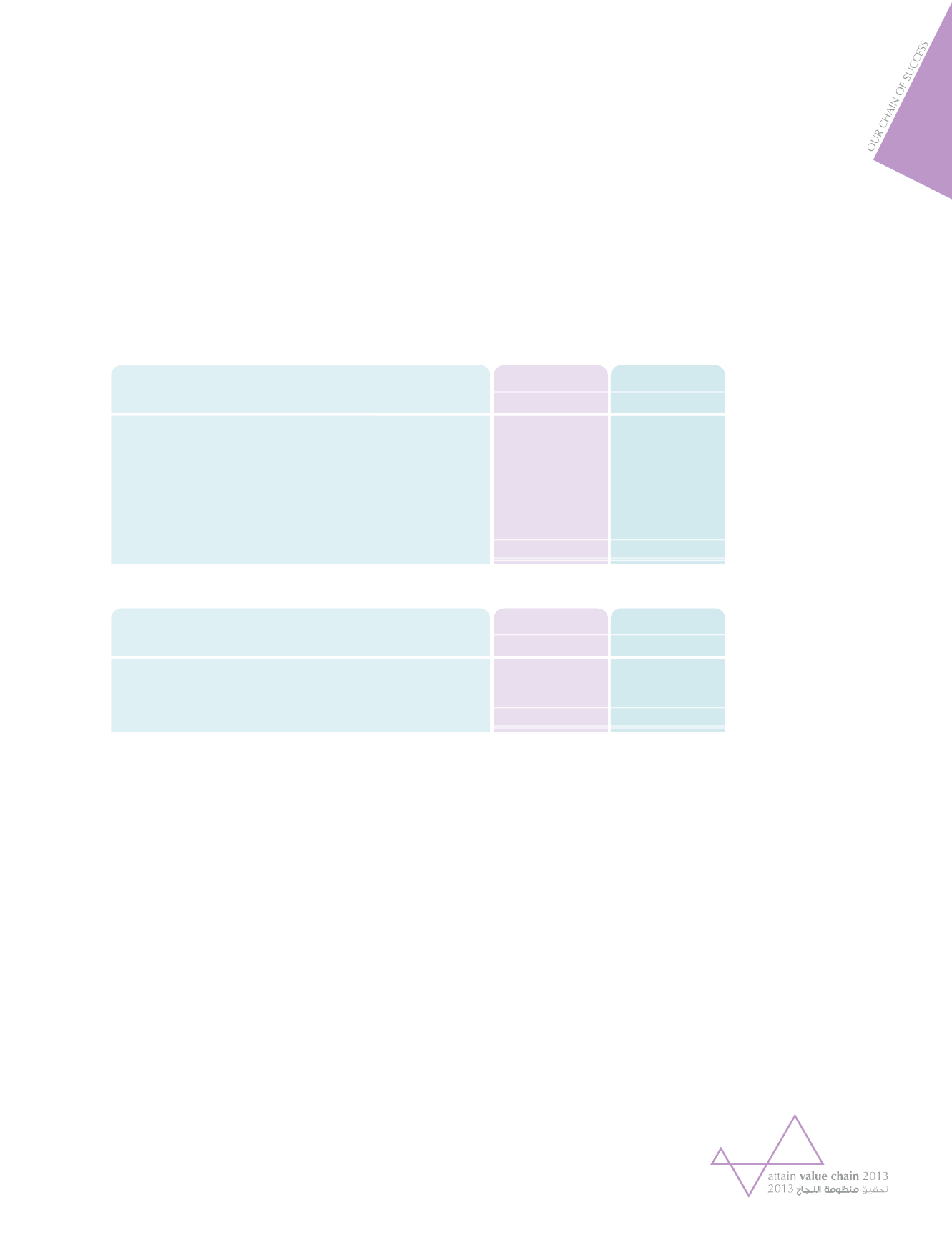

Investment properties mainly comprise of the following;

6,901,421

67,572,725

74,474,146

8,319,013

65,537,659

73,856,672

Land

Developed property held for earning rental income

2012

KD

2011

KD

Certain investment properties with a carrying value of KD 14,283,688 (31 December 2011: KD 9,708,334) are collateralised

against term loans amounting to KD 38,000,000 (31 December 2011: KD 42,500,000) (note 18).

(i) Valuations of investment properties were conducted as at 31 December 2012 by two independent appraisers with

a recognised and relevant professional qualification and recent experience of the location and category of investment

properties being valued. The change in fair value was calculated based on the lower of the two values. Fair value of the

investment properties is arrived at by reference to industry acknowledged methods of valuations that depend on market

data including recent sales value of comparable properties.

39

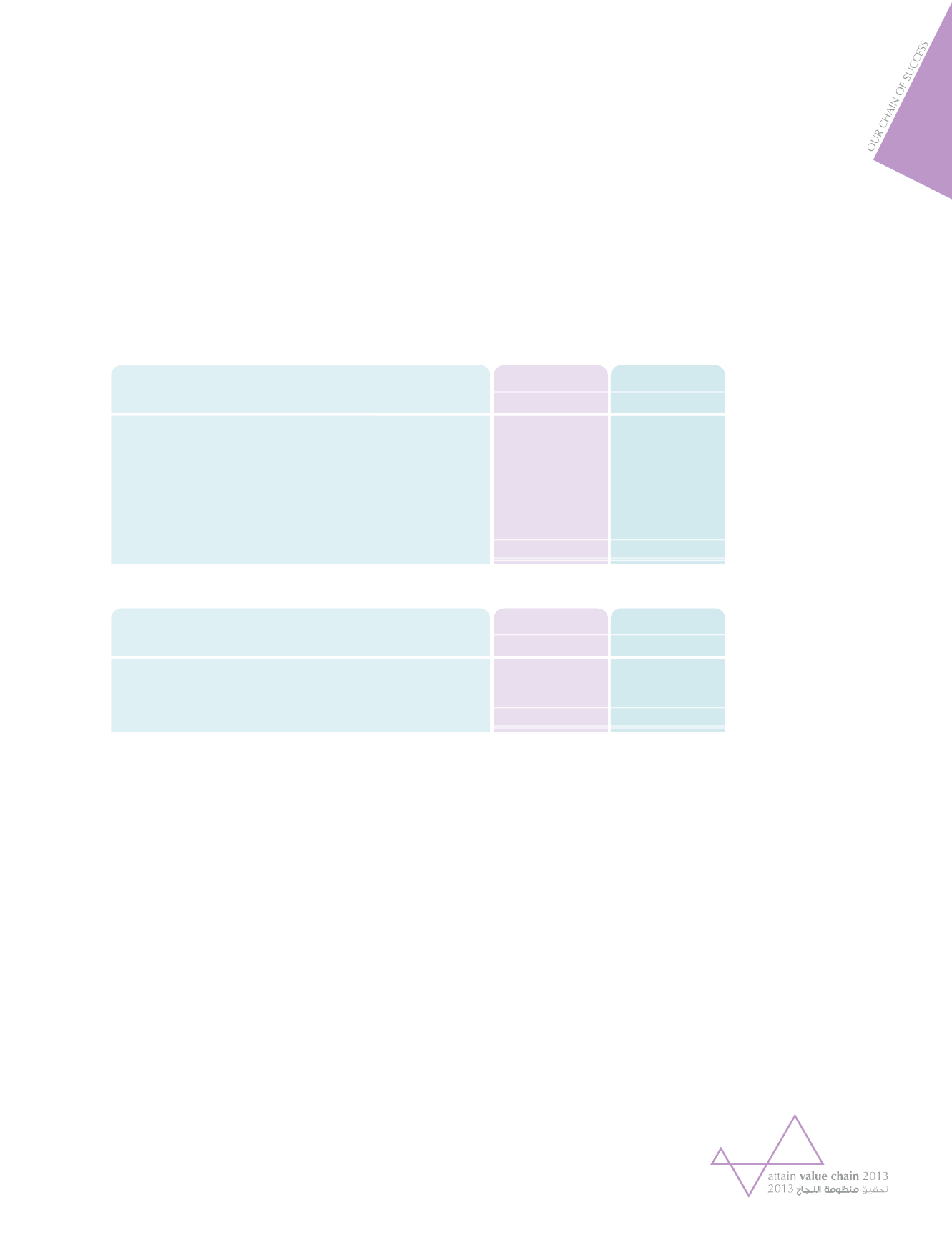

73,856,672

2,198,232

345,710

)1,965,753(

-

39,285

74,474,146

116,921,489

5,899,754

801,770

)11,239,341(

)38,438,463(

)88,537(

73,856,672

Balance at the beginning of the year

Additions

Transferred from properties held for trading (Note 12)

Net changes in fair value (refer note (i) below)

Adjustments (refer note (ii) below)

Foreign currency translation adjustments

Balance at the end of the year

2012

KD

2011

KD

7. GOODWILL

Goodwill represents excess of consideration paid for acquisition of First Dubai Real Estate Development Company K.S.C.

(Closed) (FDDRE) share over and above the fair value of the identifiable assets and liabilities. During the year management

has tested the carrying value of goodwill for impairment based on cash flows from the underlying real estate projects of

FDDRE. The management has used cash flow projection for 1 to 2 years, applying 15% discount rate and recorded an

impairment loss of KD 825,000. For projecting cash flows, management has used assumptions of market rate per sq. ft.

derived from the valuation performed for properties held for trading in the books of FDDRE.

8. INVESTMENT PROPERTIES