Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C. AND ITS SUBSIDIARIES

31 December 2012

During the year ended 31 December 2012, the Group rescheduled it’s term loans through renegotiation with a local bank.

The rescheduling terms require the Group to repay the loan in sixteen quarterly instalments between 2012 and 2016 at a

similar interest rate. The average effective interest rate on the term loans is 5.63% (2011: 5.63%).

Certain assets with carrying value of KD 21,045,261 (31 December 2011: KD 13,097,779) were collateralized against the

term loans (Note 8 and 11).

Shares of a subsidiary company with a fair value of KD 24,480,000 (31 December 2011: KD 17,340,000) were collateralized

against the term loans.

Investment in associate with a carrying of KD 9,136,509 (31 December 2011: KD 9,136,509) were collateralized against

the term loans.

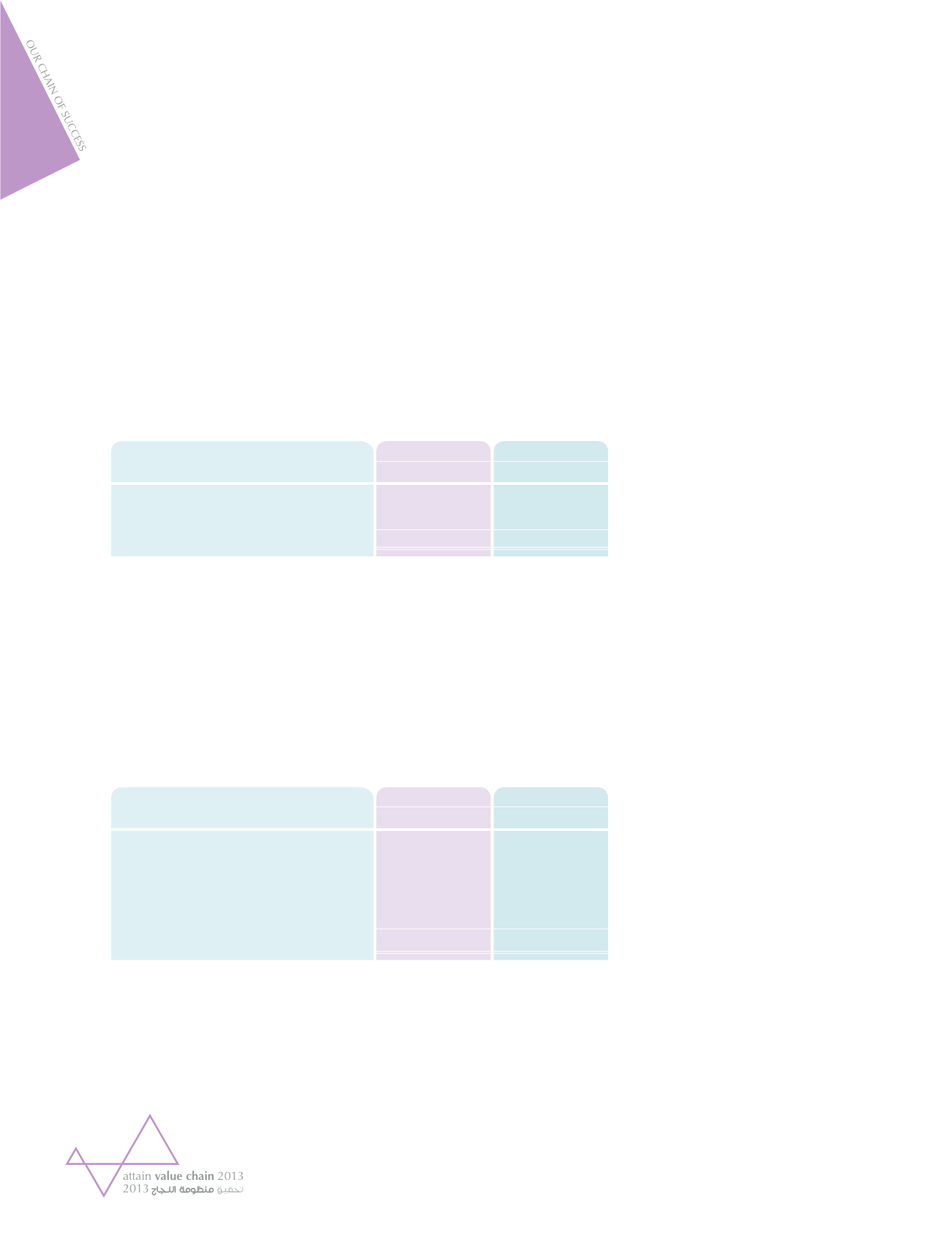

19. WAKALA AND MURABAHA PAYABLES

Average cost rate attributable to Wakala payable during the year ended31 December 2012 6.25% (2011: 6.25%) per

annum.

Average cost attributable to Murabaha payable during the year ended 31 December 2012 was 6.5% (2011: 6.5%) per

annum.

Certain shares in subsidiary with a fair value of KD 4,320,000 (2011: KD 3,060,000) are pledged against Wakala payable

maturing on 12 March 2013. Certain treasury shares are pledged against Murabaha payable maturing on 19 April 2013

(note 16).

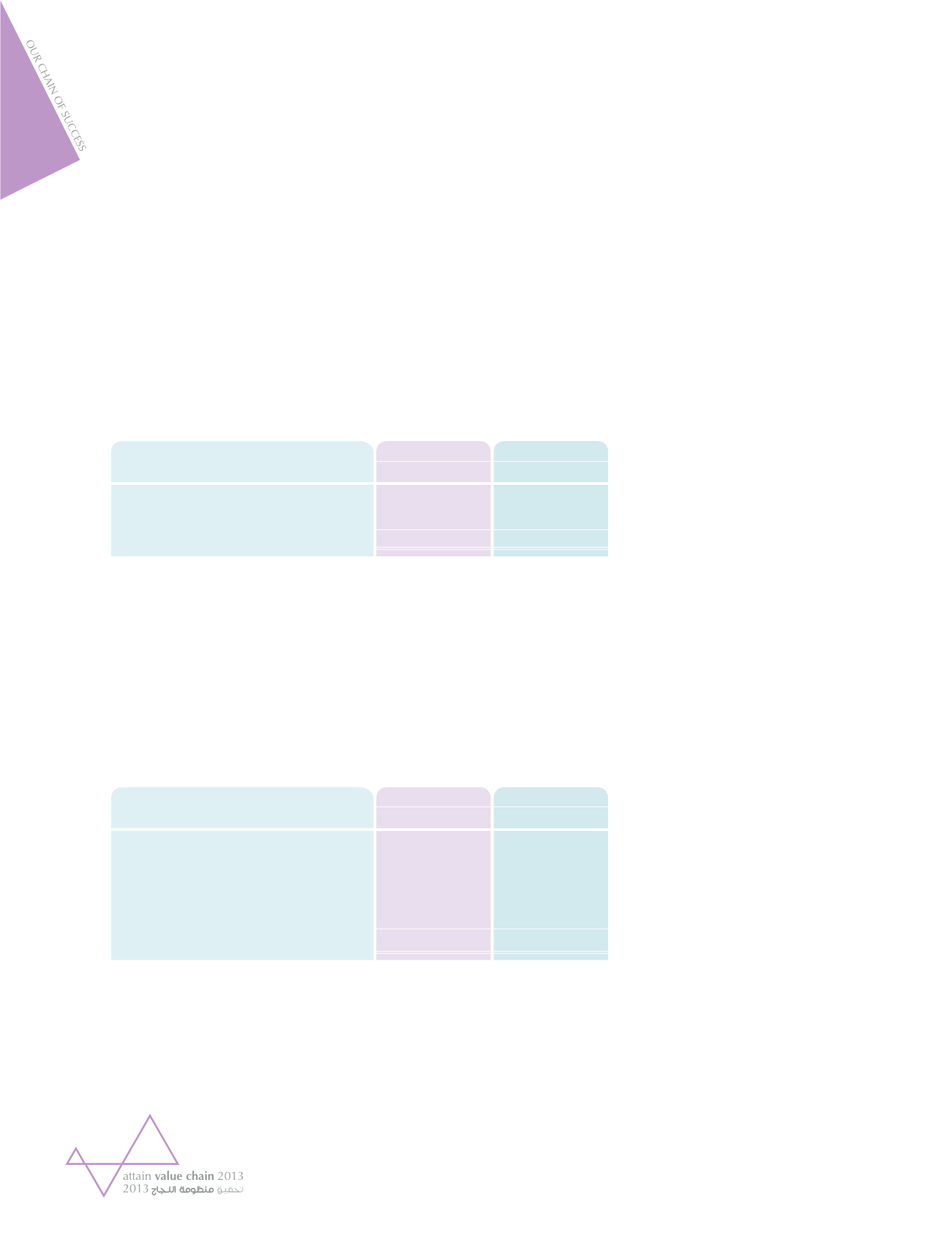

20. DEFFERED CONSIDERATION ON ACQUISITION OF PROPERTIES

2012

KD

5,000,000

3,500,000

8,500,000

Wakala payables

Murabaha payable

2011

KD

5,000,000

3,500,000

8,500,000

2012

KD

3,866,170

-

80,938

-

3,947,108

Balance at the beginning of the year

Consideration paid during the year

Foreign currency translation adjustments

Adjustments

Balance at the end of the year

2011

KD

30,070,031

(491,163)

(25,712,698)

3,866,170

48