Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C. AND ITS SUBSIDIARIES

31 December 2012

(i) Included in additions are properties held for trading received from Al Madar, Al Wahda and Villa as a result of asset

distribution agreement (note 9 (i), (ii) and (iv)).

(ii) During the year the Parent Company entered into an agreement to distribute the certain assets of it’s joint venture Villa

– 492 Project (the Villa) with one of its partner NNRG. Based on the agreement certain of the properties held for trading

were transferred to NNGR (Note 9 (ii) and (iv)).

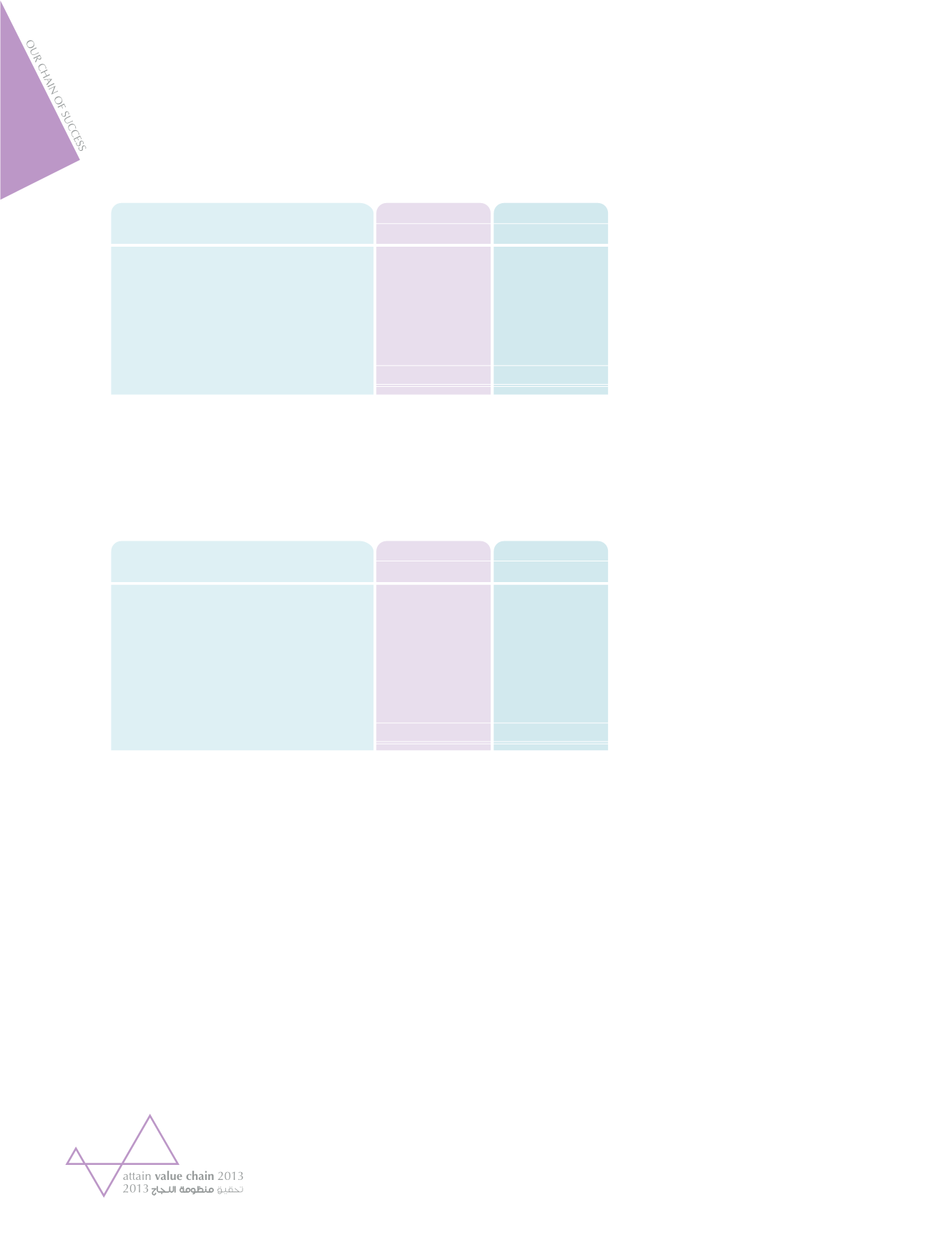

12. PROPERTIES HELD FOR TRADING

2012

KD

107,372,223

16,219,784

(23,592,161)

(345,710)

(7,951,891)

773,133

1,312,868

93,788,246

Balance at the beginning of the year

Additions (refer note (i) below)

Disposals

Transferred to investment properties (note 8)

Net transfers (refer note (ii) below)

Foreign currency translation adjustments

Impairment reversal (charge) for the year

Balance at the end of the year

2011

KD

115,314,965

71,039,745

(59,361,095)

(801,770)

-

(59,417)

(18,760,205)

107,372,223

Impairment loss of KD 2,767,082 (31 December 2011: KD 455,904) has been made against certain quoted and unquoted

securities on which there has been a significant or prolonged decline in value (note 23).

Available for sale investments with a fair value of KD 6,761,573 (31 December 2011: KD 3,389,445) are pledged against

certain term loans disclosed in note 18.

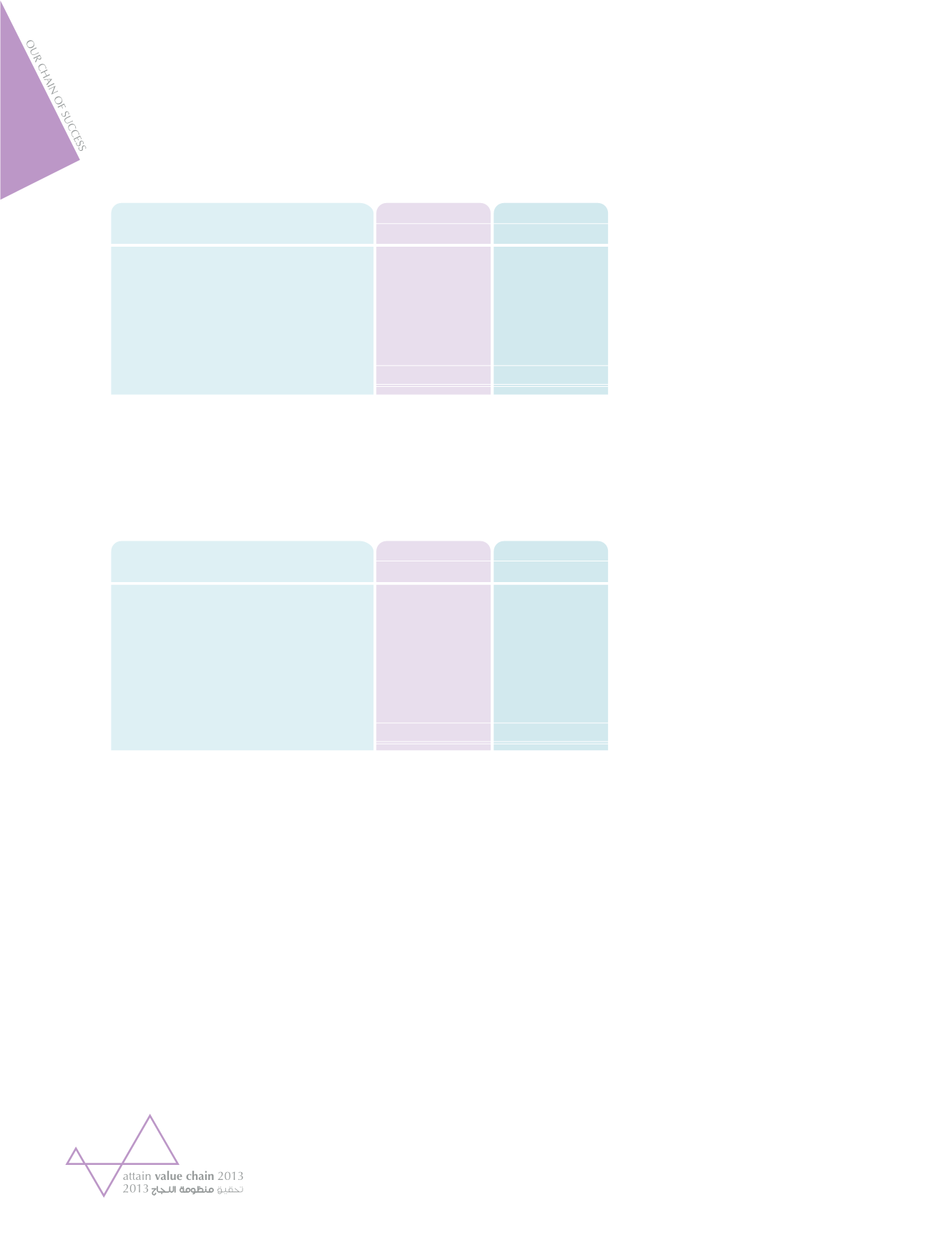

2012

KD

2,732,376

2,555,187

7,606,660

12,894,223

Quoted:

Equity securities

Unquoted:

Equity securities

Funds and managed portfolios

2011

KD

1,933,622

4,626,679

9,774,316

16,334,617

11. FINANCIAL ASSETS AVAILABLE FOR SALE

44