N

otes To The Consolidated Financial Statements

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

As At 31 December 2016

ANNUAL REPORT

2016

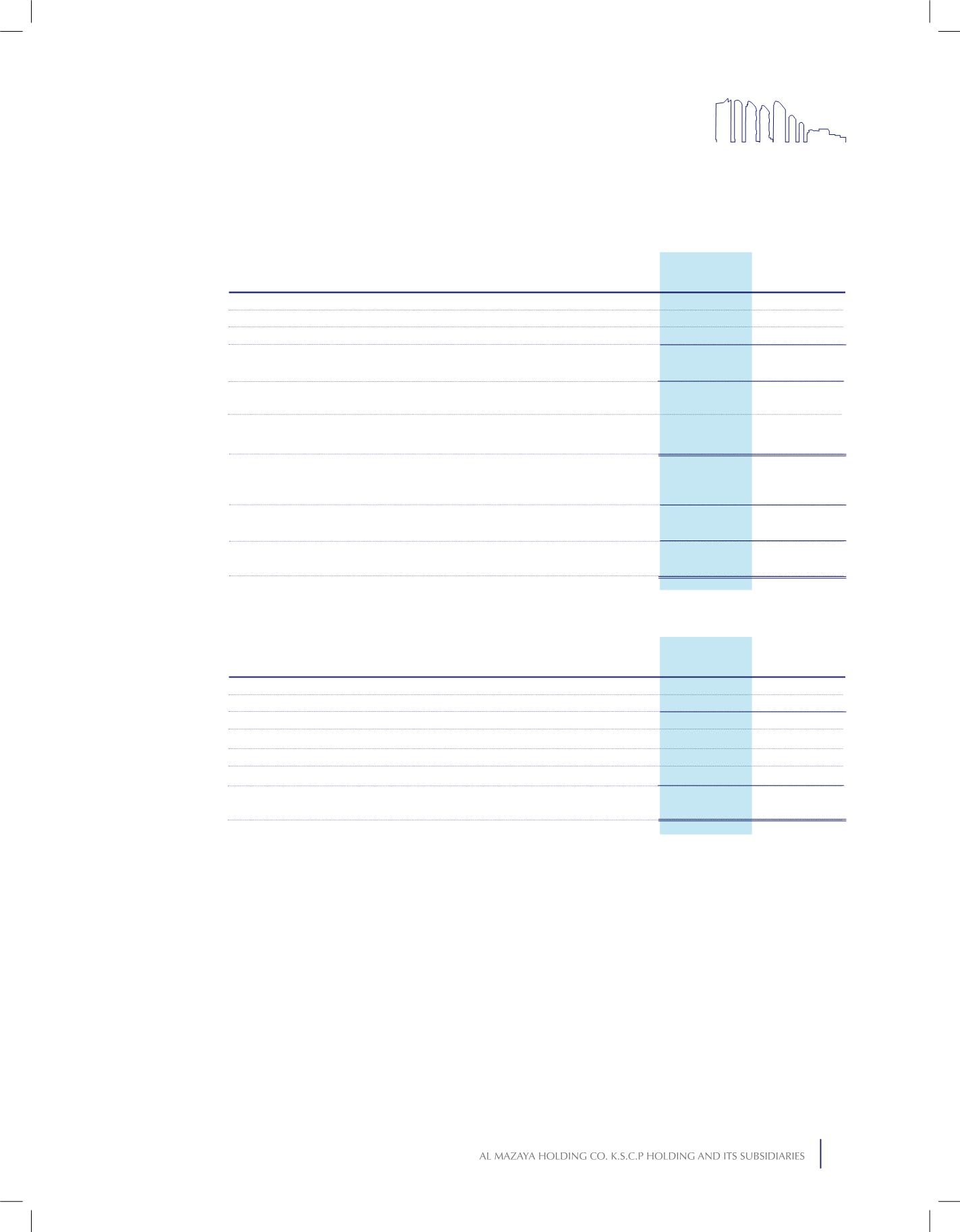

12. FINANCIAL ASSETS AVAILABLE-FOR-SALE

Financial assets available-for-sale investments with a fair value of KD 6,081,296 (2015: KD 6,377,658) are

collateralised against certain tawarruq payable (Note 19).

Certain unquoted equity shares amounting to KD 1,863,879 (2015: 1,952,600) are carried at cost, less impairment,

if any, due to the non-availability of reliable measures of their fair values. Management has performed a review of

its unquoted equity investments to assess whether impairment has occurred in the value of these investments and

recorded an impairment loss of KD 76,000 (2015: KD 38,349) in the consolidated statement of income. Based on

the latest available financial information, management is of the view that no further impairment loss is required

as at 31 December 2016 in respect of these investments. Impairment loss of KD 148,672 (2015: KD 16,598) is

recorded in consolidated statement of income on funds and managed portfolios.

Movement in the carrying amount of investment in an associate is as follows:

Assets

Liabilities

Equity

Proportion of the Group’s ownership

Carrying value of the investment

Share of associates’ results for the year:

Revenues

Profit for the year

Group›s share of profit for the year

Quoted:

Equity securities

Unquoted:

Equity securities

Funds and managed portfolios

69,813,134

)16,490,198(

53,322,936

17.54%

9,352,843

75,045

12,925

2,267

60,013

2,236,178

6,830,769

9,126,960

54,719,143

)1,737,319(

52,981,824

17.54%

9,293,012

1,475,604

861,790

151,158

2,022,930

1,952,600

7,146,012

11,121,542

2016

KD

2016

KD

2015

KD

2015

KD

109