Page 8 - FS-EN-Q2-30-06-2022

P. 8

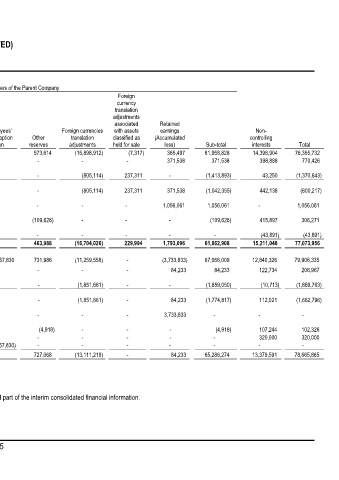

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

FOR THE PERIOD ENDED JUNE 30, 2022

(All amounts are in Kuwaiti Dinars)

Attributable to shareholders of the Parent Company

Foreign

currency

translation

adjustments

associated Retained

Employees’ Foreign currencies with assets earnings Non-

Share Share Treasury Statutory Fair value share option Other translation classified as (Accumulated controlling

Capital premium Shares reserve reserve plan reserves adjustments held for sale loss) Sub-total interests Total

Balance as at January 1, 2022 62,955,982 17,921,560 (1,777) 1,632,430 (5,582,249) - 573,614 (15,898,912) (7,317) 365,497 61,958,828 14,396,904 76,355,732

Profit for the period - - - - - - - - - 371,538 371,538 398,888 770,426

Other comprehensive (loss) income for

the period - - - - (846,090) - - (805,114) 237,311 - (1,413,893) 43,250 (1,370,643)

Total comprehensive (loss) income for

the period - - - - (846,090) - - (805,114) 237,311 371,538 (1,042,355) 442,138 (600,217)

Effect of hyperinflation on a subsidiary

(Note 8) - - - - - - - - - 1,056,061 1,056,061 - 1,056,061

Effect of partial disposal of a

subsidiary - - - - - - (109,626) - - - (109,626) 415,897 306,271

Effect of disposal of a subsidiary

(Note 5) - - - - - - - - - - - (43,891) (43,891)

Balance as at June 30, 2022 62,955,982 17,921,560 (1,777) 1,632,430 (6,428,339) - 463,988 (16,704,026) 229,994 1,793,096 61,862,908 15,211,048 77,073,956

Balance as at January 1, 2021 68,827,896 21,655,393 (18,819,349) 14,469,647 (4,874,003) 67,830 731,986 (11,259,558) - (3,733,833) 67,066,009 12,840,326 79,906,335

Profit for the period - - - - - - - - - 84,233 84,233 122,734 206,967

Other comprehensive loss for the

period - - - - (7,389) - - (1,851,661) - - (1,859,050) (10,713) (1,869,763)

Total comprehensive (loss) income for

the period - - - - (7,389) - - (1,851,661) - 84,233 (1,774,817) 112,021 (1,662,796)

Setting off accumulated losses

(Note 13) - (3,733,833) - - - - - - - 3,733,833 - - -

Effect of partial disposal of a

subsidiary - - - - - - (4,918) - - - (4,918) 107,244 102,326

Effect of consolidating a subsidiary - - - - - - - - - - - 320,000 320,000

Employees’ share options exercised - - 192,484 (124,654) - (67,830) - - - - - - -

Balance as at June 30, 2021 68,827,896 17,921,560 (18,626,865) 14,344,993 (4,881,392) - 727,068 (13,111,219) - 84,233 65,286,274 13,379,591 78,665,865

The accompanying notes (1) to (15) form an integral part of the interim consolidated financial information.

5