Page 12 - FS-EN-Q2-30-06-2022

P. 12

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

JUNE 30, 2022

(All amounts are in Kuwaiti Dinars)

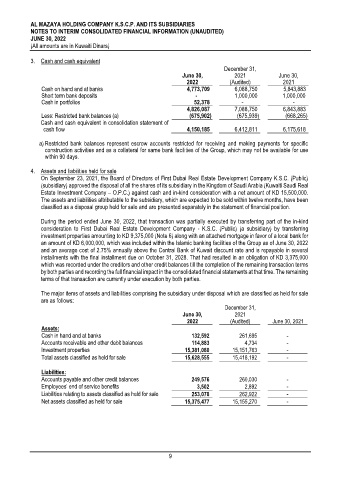

3. Cash and cash equivalent

December 31,

June 30, 2021 June 30,

2022 (Audited) 2021

Cash on hand and at banks 4,773,709 6,088,750 5,843,883

Short term bank deposits - 1,000,000 1,000,000

Cash in portfolios 52,378 - -

4,826,087 7,088,750 6,843,883

Less: Restricted bank balances (a) (675,902) (675,939) (668,265)

Cash and cash equivalent in consolidation statement of

cash flow 4,150,185 6,412,811 6,175,618

a) Restricted bank balances represent escrow accounts restricted for receiving and making payments for specific

construction activities and as a collateral for same bank facilities of the Group, which may not be available for use

within 90 days.

4. Assets and liabilities held for sale

On September 23, 2021, the Board of Directors of First Dubai Real Estate Development Company K.S.C. (Public)

(subsidiary) approved the disposal of all the shares of its subsidiary in the Kingdom of Saudi Arabia (Kuwaiti Saudi Real

Estate Investment Company – O.P.C.) against cash and in-kind consideration with a net amount of KD 15,500,000.

The assets and liabilities attributable to the subsidiary, which are expected to be sold within twelve months, have been

classified as a disposal group held for sale and are presented separately in the statement of financial position.

During the period ended June 30, 2022, that transaction was partially executed by transferring part of the in-kind

consideration to First Dubai Real Estate Development Company - K.S.C. (Public) (a subsidiary) by transferring

investment properties amounting to KD 9,375,000 (Note 6) along with an attached mortgage in favor of a local bank for

an amount of KD 6,000,000, which was included within the Islamic banking facilities of the Group as of June 30, 2022

and an average cost of 2.75% annually above the Central Bank of Kuwait discount rate and is repayable in several

installments with the final installment due on October 31, 2028. That had resulted in an obligation of KD 3,375,000

which was recorded under the creditors and other credit balances till the completion of the remaining transaction terms

by both parties and recording the full financial impact in the consolidated financial statements at that time. The remaining

terms of that transaction are currently under execution by both parties.

The major items of assets and liabilities comprising the subsidiary under disposal which are classified as held for sale

are as follows:

December 31,

June 30, 2021

2022 (Audited) June 30, 2021

Assets:

Cash in hand and at banks 132,592 261,695 -

Accounts receivable and other debit balances 114,883 4,734 -

Investment properties 15,381,080 15,151,763 -

Total assets classified as held for sale 15,628,555 15,418,192 -

Liabilities:

Accounts payable and other credit balances 249,576 260,030 -

Employees’ end of service benefits 3,502 2,892 -

Liabilities relating to assets classified as held for sale 253,078 262,922 -

Net assets classified as held for sale 15,375,477 15,155,270 -

9