Page 14 - FS-EN-Q2-30-06-2022

P. 14

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

JUNE 30, 2022

(All amounts are in Kuwaiti Dinars)

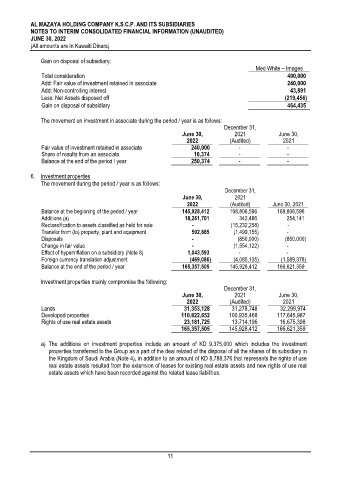

Gain on disposal of subsidiary:

Med White – Images

Total consideration 400,000

Add: Fair value of investment retained in associate 240,000

Add: Non-controlling interest 43,891

Less: Net Assets disposed off (219,456)

Gain on disposal of subsidiary 464,435

The movement on investment in associate during the period / year is as follows:

December 31,

June 30, 2021 June 30,

2022 (Audited) 2021

Fair value of investment retained in associate 240,000 - -

Share of results from an associate 10,374 - -

Balance at the end of the period / year 250,374 - -

6. Investment properties

The movement during the period / year is as follows:

December 31,

June 30, 2021

2022 (Audited) June 30, 2021

Balance at the beginning of the period / year 145,928,412 168,806,596 168,806,596

Additions (a) 18,261,701 342,486 254,141

Reclassification to assets classified as held for sale - (15,232,258) -

Transfer from (to) property, plant and equipment 592,885 (1,499,155) -

Disposals - (850,000) (850,000)

Change in fair value - (1,554,122) -

Effect of hyperinflation on a subsidiary (Note 8) 1,043,593 - -

Foreign currency translation adjustment (469,086) (4,085,135) (1,589,378)

Balance at the end of the period / year 165,357,505 145,928,412 166,621,359

Investment properties mainly compromise the following:

December 31,

June 30, 2021 June 30,

2022 (Audited) 2021

Lands 31,353,128 31,278,748 32,299,974

Developed properties 110,822,652 100,935,468 117,645,987

Rights of use real estate assets 23,181,725 13,714,196 16,675,398

165,357,505 145,928,412 166,621,359

a) The additions on investment properties include an amount of KD 9,375,000 which includes the investment

properties transferred to the Group as a part of the deal related of the disposal of all the shares of its subsidiary in

the Kingdom of Saudi Arabia (Note 4), in addition to an amount of KD 8,788,376 that represents the rights of use

real estate assets resulted from the extension of leases for existing real estate assets and new rights of use real

estate assets which have been recorded against the related lease liabilities.

11