Page 15 - FS-EN-Q2-30-06-2022

P. 15

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

JUNE 30, 2022

(All amounts are in Kuwaiti Dinars)

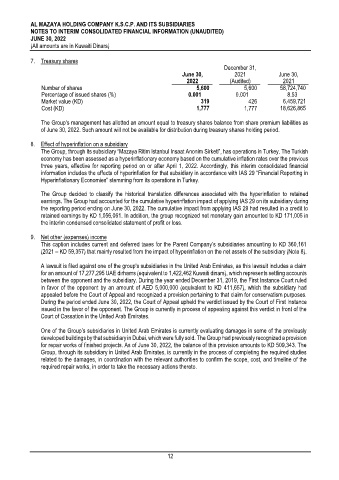

7. Treasury shares

December 31,

June 30, 2021 June 30,

2022 (Audited) 2021

Number of shares 5,600 5,600 58,724,740

Percentage of issued shares (%) 0.001 0.001 8.53

Market value (KD) 319 426 6,459,721

Cost (KD) 1,777 1,777 18,626,865

The Group’s management has allotted an amount equal to treasury shares balance from share premium liabilities as

of June 30, 2022. Such amount will not be available for distribution during treasury shares holding period.

8. Effect of hyperinflation on a subsidiary

The Group, through its subsidiary “Mazaya Ritim Istanbul Insaat Anonim Sirketi”, has operations in Turkey. The Turkish

economy has been assessed as a hyperinflationary economy based on the cumulative inflation rates over the previous

three years, effective for reporting period on or after April 1, 2022. Accordingly, this interim consolidated financial

information includes the effects of hyperinflation for that subsidiary in accordance with IAS 29 “Financial Reporting in

Hyperinflationary Economies” stemming from its operations in Turkey.

The Group decided to classify the historical translation differences associated with the hyperinflation to retained

earnings. The Group had accounted for the cumulative hyperinflation impact of applying IAS 29 on its subsidiary during

the reporting period ending on June 30, 2022. The cumulative impact from applying IAS 29 had resulted in a credit to

retained earnings by KD 1,056,061. In addition, the group recognized net monetary gain amounted to KD 171,005 in

the interim condensed consolidated statement of profit or loss.

9. Net other (expenses) income

This caption includes current and deferred taxes for the Parent Company’s subsidiaries amounting to KD 360,161

(2021 – KD 59,357) that mainly resulted from the impact of hyperinflation on the net assets of the subsidiary (Note 8).

A lawsuit is filed against one of the group's subsidiaries in the United Arab Emirates, as this lawsuit includes a claim

for an amount of 17,277,295 UAE dirhams (equivalent to 1,422,462 Kuwaiti dinars), which represents settling accounts

between the opponent and the subsidiary. During the year ended December 31, 2019, the First Instance Court ruled

in favor of the opponent by an amount of AED 5,000,000 (equivalent to KD 411,657), which the subsidiary had

appealed before the Court of Appeal and recognized a provision pertaining to that claim for conservatism purposes.

During the period ended June 30, 2022, the Court of Appeal upheld the verdict issued by the Court of First Instance

issued in the favor of the opponent. The Group is currently in process of appealing against this verdict in front of the

Court of Cassation in the United Arab Emirates.

One of the Group’s subsidiaries in United Arab Emirates is currently evaluating damages in some of the previously

developed buildings by that subsidiary in Dubai, which were fully sold. The Group had previously recognized a provision

for repair works of finished projects. As of June 30, 2022, the balance of this provision amounts to KD 509,343. The

Group, through its subsidiary in United Arab Emirates, is currently in the process of completing the required studies

related to the damages, in coordination with the relevant authorities to confirm the scope, cost, and timeline of the

required repair works, in order to take the necessary actions thereto.

12