Page 59 - FS-Q2-2023-EN

P. 59

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC) AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

27. Financial risk management

In the normal course of business, the Group uses primary financial instruments such as cash and cash equivalents,

term deposits, financial assets at FVTPL, accounts receivable, financial assets at FVTOCI, accounts payable, lease

liabilities and Islamic bank facilities and as a result, is exposed to the risks indicated below. The Group currently does

not use derivative financial instruments to manage its exposure to these risks.

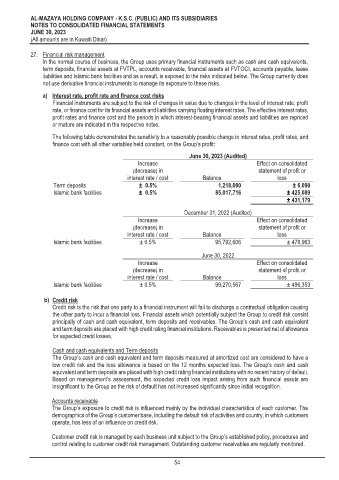

a) Interest rate, profit rate and finance cost risks

Financial instruments are subject to the risk of changes in value due to changes in the level of interest rate, profit

rate, or finance cost for its financial assets and liabilities carrying floating interest rates. The effective interest rates,

profit rates and finance cost and the periods in which interest-bearing financial assets and liabilities are repriced

or mature are indicated in the respective notes.

The following table demonstrates the sensitivity to a reasonably possible change in interest rates, profit rates, and

finance cost with all other variables held constant, on the Group’s profit:

June 30, 2023 (Audited)

Increase Effect on consolidated

(decrease) in statement of profit or

interest rate / cost Balance loss

Term deposits ± 0.5% 1,218,000 ± 6,090

Islamic bank facilities ± 0.5% 85,017,716 ± 425,089

± 431,179

December 31, 2022 (Audited)

Increase Effect on consolidated

(decrease) in statement of profit or

interest rate / cost Balance loss

Islamic bank facilities ± 0.5% 95,792,606 ± 478,963

June 30, 2022

Increase Effect on consolidated

(decrease) in statement of profit or

interest rate / cost Balance loss

Islamic bank facilities ± 0.5% 99,270,567 ± 496,353

b) Credit risk

Credit risk is the risk that one party to a financial instrument will fail to discharge a contractual obligation causing

the other party to incur a financial loss. Financial assets which potentially subject the Group to credit risk consist

principally of cash and cash equivalent, term deposits and receivables. The Group’s cash and cash equivalent

and term deposits are placed with high credit rating financial institutions. Receivables is presented net of allowance

for expected credit losses.

Cash and cash equivalents and Term deposits

The Group’s cash and cash equivalent and term deposits measured at amortized cost are considered to have a

low credit risk and the loss allowance is based on the 12 months expected loss. The Group's cash and cash

equivalent and term deposits are placed with high credit rating financial institutions with no recent history of default.

Based on management’s assessment, the expected credit loss impact arising from such financial assets are

insignificant to the Group as the risk of default has not increased significantly since initial recognition.

Accounts receivable

The Group’s exposure to credit risk is influenced mainly by the individual characteristics of each customer. The

demographics of the Group’s customer base, including the default risk of activities and country, in which customers

operate, has less of an influence on credit risk.

Customer credit risk is managed by each business unit subject to the Group’s established policy, procedures and

control relating to customer credit risk management. Outstanding customer receivables are regularly monitored.

54