Page 54 - FS-Q2-2023-EN

P. 54

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC) AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

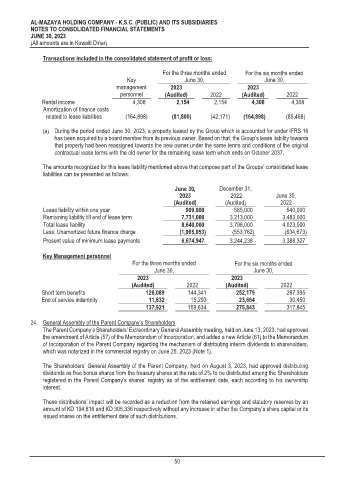

Transactions included in the consolidated statement of profit or loss:

For the three months ended For the six months ended

Key June 30, June 30,

management 2023 2023

personnel (Audited) 2022 (Audited) 2022

Rental income 4,308 2,154 2,154 4,308 4,308

Amortization of finance costs

related to lease liabilities (164,898) (81,800) (42,171) (164,898) (85,468)

(a) During the period ended June 30, 2023, a property leased by the Group which is accounted for under IFRS 16

has been acquired by a board member from its previous owner. Based on that, the Group’s lease liability towards

that property had been reassigned towards the new owner under the same terms and conditions of the original

contractual lease terms with the old owner for the remaining lease term which ends on October 2037.

The amounts recognized for this lease liability mentioned above that compose part of the Groups’ consolidated lease

liabilities can be presented as follows:

June 30, December 31,

2023 2022 June 30,

(Audited) (Audited) 2022

Lease liability within one year 909,000 585,000 540,000

Remaining liability till end of lease term 7,731,000 3,213,000 3,483,000

Total lease liability 8,640,000 3,798,000 4,023,000

Less: Unamortized future finance charge (1,965,053) (553,762) (634,673)

Present value of minimum lease payments 6,674,947 3,244,238 3,388,327

Key Management personnel

For the three months ended For the six months ended

June 30, June 30,

2023 2023

(Audited) 2022 (Audited) 2022

Short term benefits 126,089 144,341 252,179 287,395

End of service indemnity 11,832 15,293 23,664 30,450

137,921 159,634 275,843 317,845

24. General Assembly of the Parent Company’s Shareholders

The Parent Company’s Shareholders’ Extraordinary General Assembly meeting, held on June 13, 2023, had approved

the amendment of Article (57) of the Memorandum of Incorporation, and added a new Article (61) to the Memorandum

of Incorporation of the Parent Company regarding the mechanism of distributing interim dividends to shareholders,

which was notarized in the commercial registry on June 25, 2023 (Note 1).

The Shareholders’ General Assembly of the Parent Company, held on August 3, 2023, had approved distributing

dividends as free bonus shares from the treasury shares at the rate of 2% to be distributed among the Shareholders

registered in the Parent Company’s shares’ registry as of the entitlement date, each according to his ownership

interest.

These distributions’ impact will be recorded as a reduction from the retained earnings and statutory reserves by an

amount of KD 194,816 and KD 305,336 respectively without any increase in either the Company’s share capital or its

issued shares on the entitlement date of such distributions.

50