Page 50 - FS-Q2-2023-EN

P. 50

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC) AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

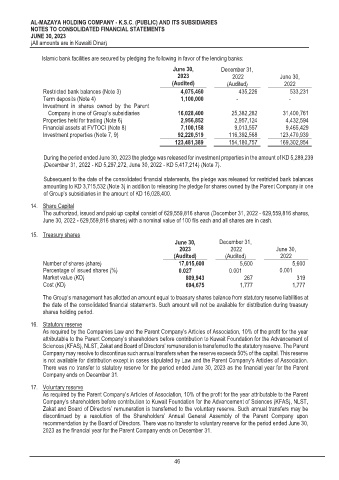

Islamic bank facilities are secured by pledging the following in favor of the lending banks:

June 30, December 31,

2023 2022 June 30,

(Audited) (Audited) 2022

Restricted bank balances (Note 3) 4,075,460 435,226 533,231

Term deposits (Note 4) 1,100,000 - -

Investment in shares owned by the Parent

Company in one of Group’s subsidiaries 16,028,400 25,382,282 31,400,761

Properties held for trading (Note 6) 2,956,852 2,957,124 4,432,594

Financial assets at FVTOCI (Note 8) 7,100,158 9,013,557 9,465,429

Investment properties (Note 7, 9) 92,220,519 116,392,568 123,470,939

123,481,389 154,180,757 169,302,954

During the period ended June 30, 2023 the pledge was released for investment properties in the amount of KD 5,289,239

(December 31, 2022 - KD 5,297,272, June 30, 2022 - KD 5,417,214) (Note 7).

Subsequent to the date of the consolidated financial statements, the pledge was released for restricted bank balances

amounting to KD 3,715,532 (Note 3) in addition to releasing the pledge for shares owned by the Parent Company in one

of Group’s subsidiaries in the amount of KD 16,028,400.

14. Share Capital

The authorized, issued and paid up capital consist of 629,559,816 shares (December 31, 2022 - 629,559,816 shares,

June 30, 2022 - 629,559,816 shares) with a nominal value of 100 fils each and all shares are in cash.

15. Treasury shares

June 30, December 31,

2023 2022 June 30,

(Audited) (Audited) 2022

Number of shares (share) 17,015,600 5,600 5,600

Percentage of issued shares (%) 0.027 0.001 0.001

Market value (KD) 809,943 267 319

Cost (KD) 694,675 1,777 1,777

The Group’s management has allotted an amount equal to treasury shares balance from statutory reserve liabilities at

the date of the consolidated financial statements. Such amount will not be available for distribution during treasury

shares holding period.

16. Statutory reserve

As required by the Companies Law and the Parent Company's Articles of Association, 10% of the profit for the year

attributable to the Parent Company’s shareholders before contribution to Kuwait Foundation for the Advancement of

Sciences (KFAS), NLST, Zakat and Board of Directors’ remuneration is transferred to the statutory reserve. The Parent

Company may resolve to discontinue such annual transfers when the reserve exceeds 50% of the capital. This reserve

is not available for distribution except in cases stipulated by Law and the Parent Company's Articles of Association.

There was no transfer to statutory reserve for the period ended June 30, 2023 as the financial year for the Parent

Company ends on December 31.

17. Voluntary reserve

As required by the Parent Company’s Articles of Association, 10% of the profit for the year attributable to the Parent

Company’s shareholders before contribution to Kuwait Foundation for the Advancement of Sciences (KFAS), NLST,

Zakat and Board of Directors’ remuneration is transferred to the voluntary reserve. Such annual transfers may be

discontinued by a resolution of the Shareholders’ Annual General Assembly of the Parent Company upon

recommendation by the Board of Directors. There was no transfer to voluntary reserve for the period ended June 30,

2023 as the financial year for the Parent Company ends on December 31.

46