Page 52 - FS-Q2-2023-EN

P. 52

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC) AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

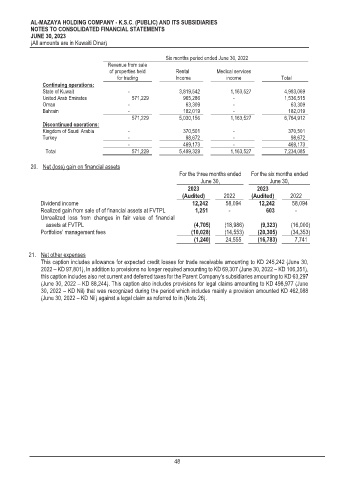

Six months period ended June 30, 2022

Revenue from sale

of properties held Rental Medical services

for trading Income income Total

Continuing operations:

State of Kuwait - 3,819,542 1,163,527 4,983,069

United Arab Emirates 571,229 965,286 - 1,536,515

Oman - 63,309 - 63,309

Bahrain - 182,019 - 182,019

571,229 5,030,156 1,163,527 6,764,912

Discontinued operations:

Kingdom of Saudi Arabia - 370,501 - 370,501

Turkey - 98,672 - 98,672

- 469,173 - 469,173

Total 571,229 5,499,329 1,163,527 7,234,085

20. Net (loss) gain on financial assets

For the three months ended For the six months ended

June 30, June 30,

2023 2023

(Audited) 2022 (Audited) 2022

Dividend income 12,242 58,094 12,242 58,094

Realized gain from sale of of financial assets at FVTPL 1,251 - 603 -

Unrealized loss from changes in fair value of financial

assets at FVTPL (4,705) (18,986) (9,323) (16,000)

Portfolios’ management fees (10,028) (14,553) (20,305) (34,353)

(1,240) 24,555 (16,783) 7,741

21. Net other expenses

This caption includes allowance for expected credit losses for trade receivable amounting to KD 245,242 (June 30,

2022 – KD 97,801), In addition to provisions no longer required amounting to KD 69,307 (June 30, 2022 – KD 106,351),

this caption includes also net current and deferred taxes for the Parent Company’s subsidiaries amounting to KD 63,297

(June 30, 2022 – KD 88,244). This caption also includes provisions for legal claims amounting to KD 498,977 (June

30, 2022 – KD Nil) that was recognized during the period which includes mainly a provision amounted KD 462,088

(June 30, 2022 – KD Nil) against a legal claim as referred to in (Note 26).

48