ANNUAL REPORT

2015

Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

31 December 2015

Valuation of properties held for trading were conducted by two independent appraisers with recognised and relevant professional

qualifications and experience of the location and category of properties being valued. The reversal of impairment provision

was calculated based on the lower of the two valuations. Net realisable value of the properties held for trading is arrived at by

reference to industry acknowledged methods of valuations that depend on market data including recent sales value of comparable

properties, annual rental income and capitalization rate.

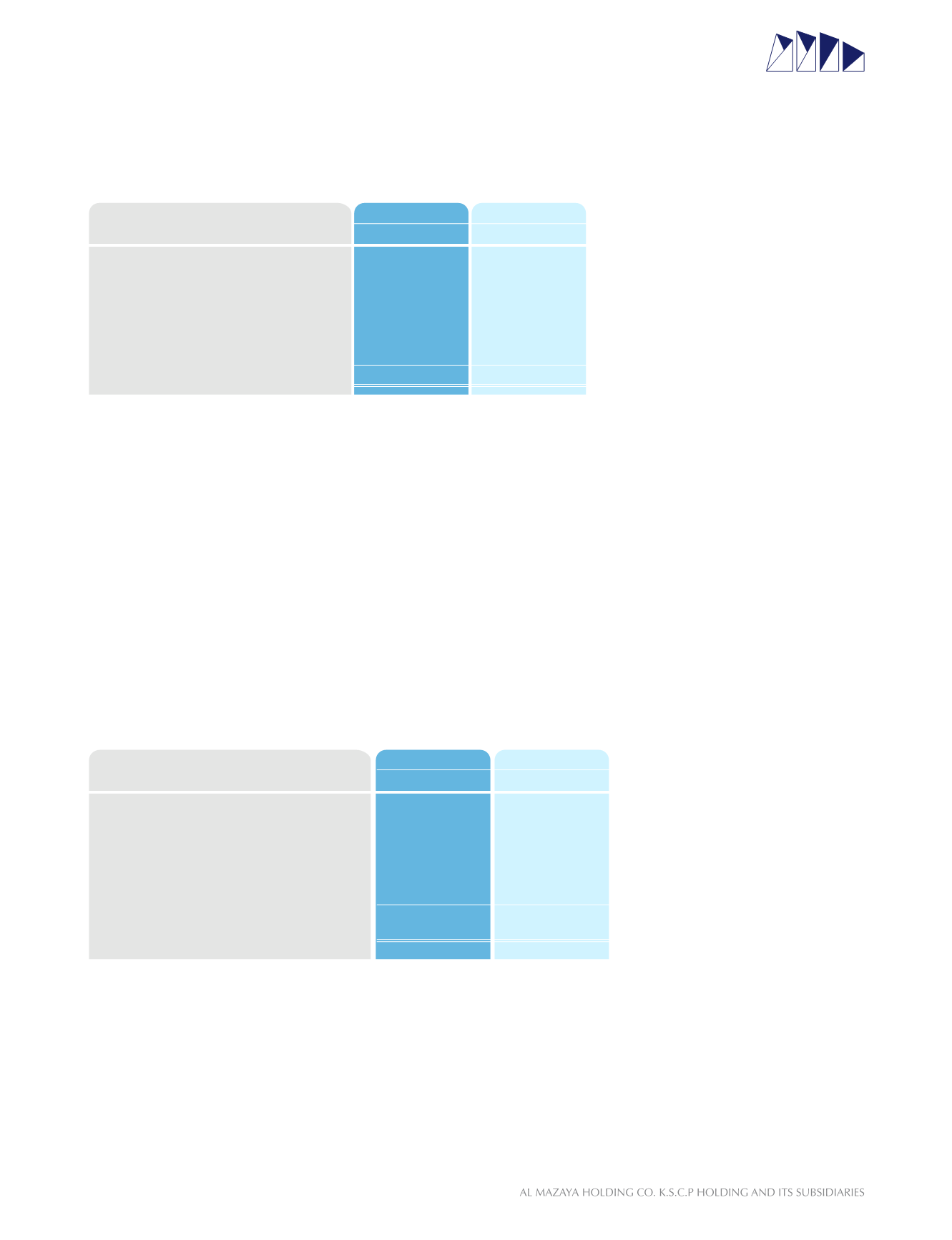

13. PROPERTIES HELD FOR TRADING

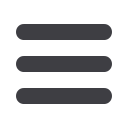

12. ADVANCES FOR PURCHASE OF PROPERTIES

2015

KD

98,751,223

11,347,712

(42,375,649)

1,411,010

2,518,837

71,653,133

Balance at the beginning of the year

Additions

Disposals

Written back of impairment loss during the year

Foreign currency translation adjustments

Balance at the end of the year

2014

KD

86,385,937

16,373,446

(9,168,087)

2,003,838

3,156,089

98,751,223

Financial assets available for sale with a fair value of Nil (2014: KD 6,781,345) are pledged against certain term loans disclosed

in Note 19. Financial assets available for sale investments with a fair value of KD 6,377,658 (2014: Nil) are collateralised against

certain tawarruq payable (Note 20).

Unquoted equity shares are carried at cost, less impairment, if any, due to the non-availability of reliable measures of their fair

values. Management has performed a review of its unquoted equity investments to assess whether impairment has occurred in the

value of these investments and recorded an impairment loss of KD 38,349 (2014: KD 61,904) in the consolidated statement of

income. Based on the latest available financial information, management is of the view that no further impairment loss is required

as at 31 December 2015 in respect of these investments. Impairment loss of KD 16,598 (2014: Nil) is recorded in consolidated

statement of income on funds and managed portfolios.

Advances for purchase of properties includes an amount of TRY 115,000,000 equivalent to KD 11,933,090 (2014: KD 14,656,980)

paid by one of the Group’s subsidiaries as an advance to a joint venture of the Parent Company (Note 24) to purchase properties

in Turkey.

2015

KD

2,022,930

1,952,600

7,146,012

11,121,542

Quoted:

Equity securities

Unquoted:

Equity securities

Funds and managed portfolios

2014

KD

2,727,631

1,931,434

7,413,632

12,072,697

11. FINANCIAL ASSETS AVAILABLE FOR SALE

75