ANNUAL REPORT

2015

Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

31 December 2015

Certain assets with carrying value of Nil (31 December 2014: KD 11,977,922) were collateralized against the term loans (Note

8 and 11).

Shares of a listed subsidiary company with a fair value of Nil (31 December 2014: KD 7,750,000) and investment in associate with

a carrying value of Nil (31 December 2014: KD 9,181,630) were collateralized against the term loans.

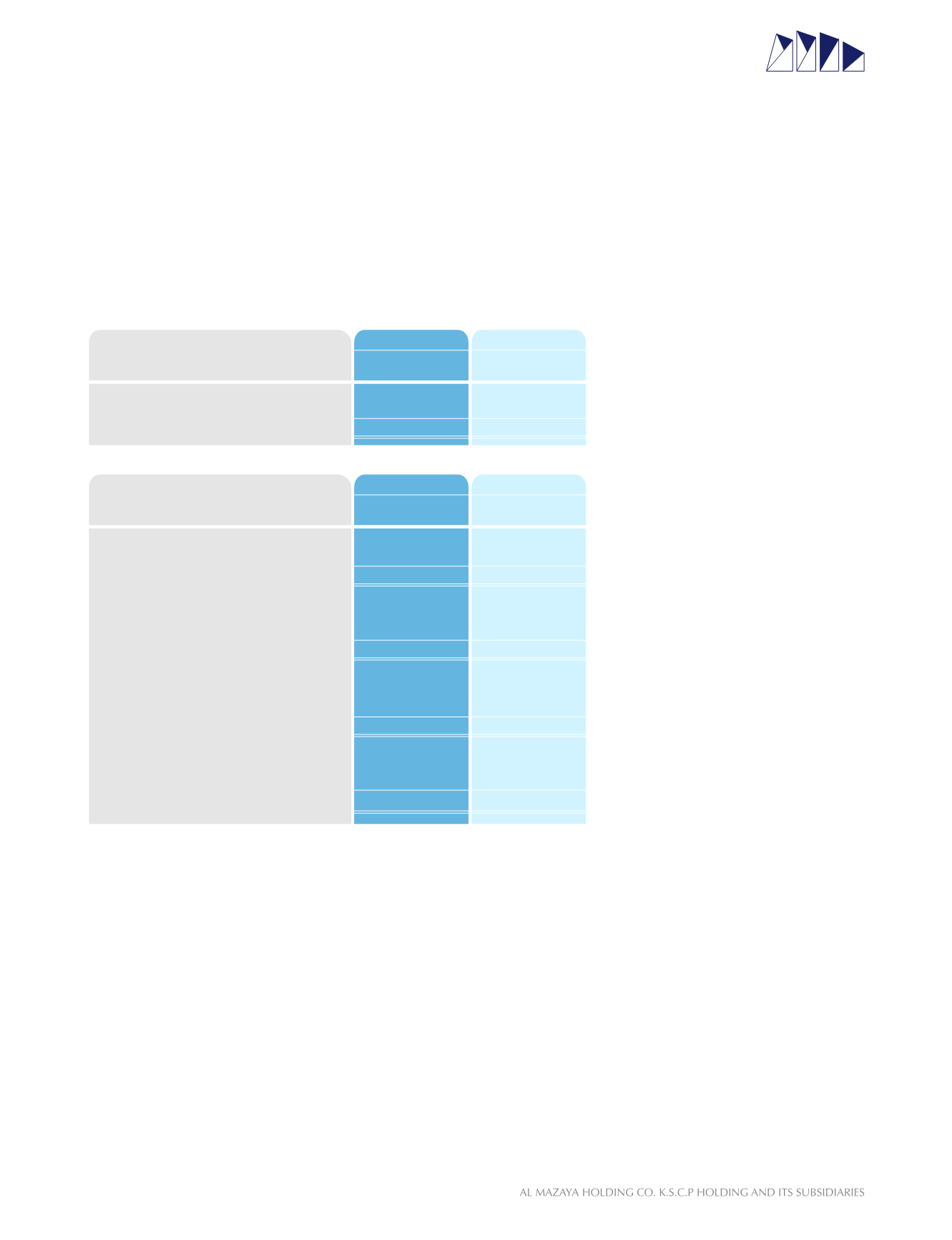

20. TAWARRUQ AND IJARA PAYABLE

The average cost rate attributable to tawarruq payable is 4.83% (2014: 4.5%). The cost rate attributable to ijara payable is 3.75%

(2014: 3.8%).

Certain assets with carrying value of KD 58,079,340 (2014: KD 19,625,000) are collateralised against Tawarruq payable (Note

8,10 and 11).

Certain shares in a subsidiary with a fair value of KD 32,564,728 (2014: KD 42,510,191) are pledged against tawarruq payable

maturing on 31 December 2018. Also, certain treasury shares are pledged as collateral against tawarruq payable (Note 18).

Certain investment properties with carrying value of KD 32,443,880 (2014: KD 31,193,139) are collateralised against ijara payable

(Note 8).

2015

KD

2015

KD

60,771,791

19,594,655

80,366,446

70,999,066

(10,227,275)

60,771,791

53,426,809

7,344,982

60,771,791

24,159,762

(4,565,107)

19,594,655

18,560,093

1,034,562

19,594,655

Tawarruq payable

Ijara payable

Tawarruq payable

Gross amount

Less: deferred profit payable

Non- current

Current

Ijara payable

Gross amount

Less: deferred profit payable

Non-current

Current

2014

KD

2014

KD

32,288,514

19,970,000

52,258,514

79

37,345,053

(5,056,539)

32,288,514

28,883,513

3,405,001

32,288,514

25,365,350

(5,395,350)

19,970,000

19,370,900

599,100

19,970,000