Page 5 - Mazaya Holding_FS_E_Q2_2021

P. 5

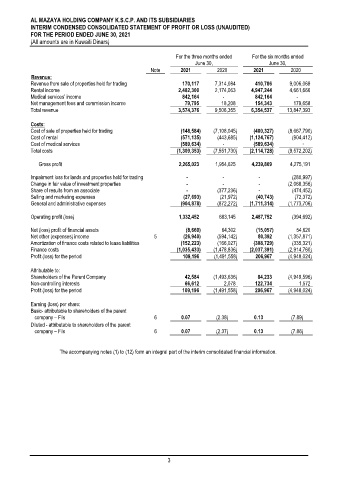

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS (UNAUDITED)

FOR THE PERIOD ENDED JUNE 30, 2021

(All amounts are in Kuwaiti Dinars)

For the three months ended For the six months ended

June 30, June 30,

Note 2021 2020 2021 2020

Revenue:

Revenue from sale of properties held for trading 170,117 7,314,084 410,786 9,006,069

Rental income 2,482,300 2,174,063 4,947,244 4,661,666

Medical services’ income 842,164 - 842,164 -

Net management fees and commission income 79,795 18,208 154,343 179,658

Total revenue 3,574,376 9,506,355 6,354,537 13,847,393

Costs:

Cost of sale of properties held for trading (148,584) (7,108,045) (400,327) (8,667,790)

Cost of rental (571,135) (443,685) (1,124,767) (904,412)

Cost of medical services (589,634) - (589,634) -

Total costs (1,309,353) (7,551,730) (2,114,728) (9,572,202)

Gross profit 2,265,023 1,954,625 4,239,809 4,275,191

Impairment loss for lands and properties held for trading - - - (280,997)

Change in fair value of investment properties - - - (2,068,356)

Share of results from an associate - (377,236) - (474,452)

Selling and marketing expenses (27,693) (21,972) (40,743) (72,372)

General and administrative expenses (904,878) (872,272) (1,711,314) (1,773,706)

Operating profit (loss) 1,332,452 683,145 2,487,752 (394,692)

Net (loss) profit of financial assets (8,660) 64,302 (15,057) 54,620

Net other (expenses) income 5 (26,940) (594,142) 80,392 (1,357,871)

Amortization of finance costs related to lease liabilities (152,223) (166,027) (308,729) (335,321)

Finance costs (1,035,433) (1,478,836) (2,037,391) (2,914,760)

Profit (loss) for the period 109,196 (1,491,558) 206,967 (4,948,024)

Attributable to:

Shareholders of the Parent Company 42,584 (1,493,636) 84,233 (4,949,596)

Non-controlling interests 66,612 2,078 122,734 1,572

Profit (loss) for the period 109,196 (1,491,558) 206,967 (4,948,024)

Earning (loss) per share:

Basic- attributable to shareholders of the parent

company – Fils 6 0.07 (2.38) 0.13 (7.89)

Diluted - attributable to shareholders of the parent

company – Fils 6 0.07 (2.37) 0.13 (7.86)

The accompanying notes (1) to (12) form an integral part of the interim consolidated financial information.

3