Page 9 - Mazaya Holding_FS_E_Q2_2021

P. 9

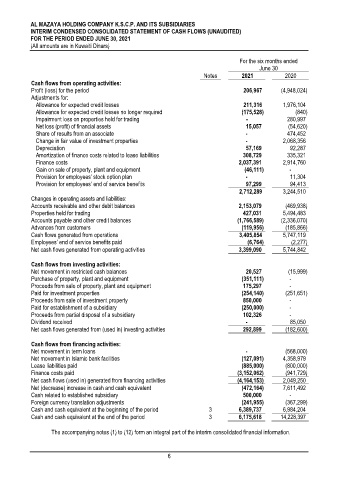

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

FOR THE PERIOD ENDED JUNE 30, 2021

(All amounts are in Kuwaiti Dinars)

For the six months ended

June 30

Notes 2021 2020

Cash flows from operating activities:

Profit (loss) for the period 206,967 (4,948,024)

Adjustments for:

Allowance for expected credit losses 211,316 1,976,104

Allowance for expected credit losses no longer required (175,528) (840)

Impairment loss on properties held for trading - 280,997

Net loss (profit) of financial assets 15,057 (54,620)

Share of results from an associate - 474,452

Change in fair value of investment properties - 2,068,356

Depreciation 57,169 92,287

Amortization of finance costs related to lease liabilities 308,729 335,321

Finance costs 2,037,391 2,914,760

Gain on sale of property, plant and equipment (46,111) -

Provision for employees’ stock option plan - 11,304

Provision for employees’ end of service benefits 97,299 94,413

2,712,289 3,244,510

Changes in operating assets and liabilities:

Accounts receivable and other debit balances 2,153,079 (469,938)

Properties held for trading 427,031 5,494,483

Accounts payable and other credit balances (1,766,589) (2,336,070)

Advances from customers (119,956) (185,866)

Cash flows generated from operations 3,405,854 5,747,119

Employees’ end of service benefits paid (6,764) (2,277)

Net cash flows generated from operating activities 3,399,090 5,744,842

Cash flows from investing activities:

Net movement in restricted cash balances 20,527 (15,999)

Purchase of property, plant and equipment (351,111) -

Proceeds from sale of property, plant and equipment 175,297 -

Paid for investment properties (254,140) (251,651)

Proceeds from sale of investment property 850,000 -

Paid for establishment of a subsidiary (250,000) -

Proceeds from partial disposal of a subsidiary 102,326 -

Dividend received - 85,050

Net cash flows generated from (used in) investing activities 292,899 (182,600)

Cash flows from financing activities:

Net movement in term loans - (568,000)

Net movement in Islamic bank facilities (127,091) 4,358,979

Lease liabilities paid (885,000) (800,000)

Finance costs paid (3,152,062) (941,729)

Net cash flows (used in) generated from financing activities (4,164,153) 2,049,250

Net (decrease) increase in cash and cash equivalent (472,164) 7,611,492

Cash related to established subsidiary 500,000 -

Foreign currency translation adjustments (241,955) (367,299)

Cash and cash equivalent at the beginning of the period 3 6,389,737 6,984,204

Cash and cash equivalent at the end of the period 3 6,175,618 14,228,397

The accompanying notes (1) to (12) form an integral part of the interim consolidated financial information.

6