Page 18 - Mazaya Holding_FS_E_Q3_2021

P. 18

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

SEPTEMBER 30, 2021

(All amounts are in Kuwaiti Dinars)

11. Annual General Assembly

The Annual Shareholders’ General Assembly Meeting held on February 22, 2021 had approved the consolidated financial

statements of the Group for the year ended December 31, 2020, and approved the following items:

• Not to distribute cash dividend or bonus share and not to pay Board of Directors remuneration for the year ended

December 31, 2020.

• To offset the entire accumulated loss balance amounted to KD 3,733,833 representing 5.42% from share capital as at

December 31, 2020 against reducing the balance of the share premium from KD 21,655,393 to KD 17,921,560.

The Annual General Meeting of the Shareholders held on February 20, 2020, had approved the consolidated financial

statements of the Group for the year ended December 31, 2019, and not to distribute cash dividend or bonus share

and not to pay Board of Directors remuneration for the year ended December 31, 2019.

During the period ended September 30, 2021, the Extraordinary Shareholdedrs’ General Assembly of the Parent

Company, held on April 25, 2021, had approved the cancellation of 58,719,140 shares representing the direct treasury

shares that amounts to KD 18,625,088, by reducing the capital of the Parent Company from KD 68,827,896 to KD

62,955,982, which is equivalent to the nominal value of direct treasury shares that amounts to KD 5,871,914 in addition

to the reduction of the statutory reserve by KD 12,753,174. This transction was notarized in the Parnet Company’s

commercial registry on June 8, 2021.

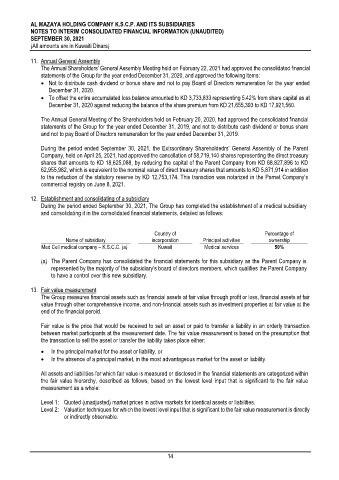

12. Establishment and consolidating of a subsidiary

During the period ended September 30, 2021, The Group has completed the establishment of a medical subsidiary

and consolidating it in the consolidated financial statements, detailed as follows:

Country of Percentage of

Name of subsidiary incorporation Principal activities ownership

Med Cell medical company – K.S.C.C. (a) Kuwait Medical services 50%

(a) The Parent Company has consolidated the financial statements for this subsidiary as the Parent Company is

represented by the majority of the subsidiary’s board of directors members, which qualifies the Parent Company

to have a control over this new subsidiary.

13. Fair value measurement

The Group measures financial assets such as financial assets at fair value through profit or loss, financial assets at fair

value through other comprehensive income, and non-financial assets such as investment properties at fair value at the

end of the financial peroid.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date. The fair value measurement is based on the presumption that

the transaction to sell the asset or transfer the liability takes place either:

• In the principal market for the asset or liability, or

• In the absence of a principal market, in the most advantageous market for the asset or liability

All assets and liabilities for which fair value is measured or disclosed in the financial statements are categorized within

the fair value hierarchy, described as follows, based on the lowest level input that is significant to the fair value

measurement as a whole:

Level 1: Quoted (unadjusted) market prices in active markets for identical assets or liabilities.

Level 2: Valuation techniques for which the lowest level input that is significant to the fair value measurement is directly

or indirectly observable.

14