Page 13 - Mazaya Holding_FS_E_Q3_2021

P. 13

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

SEPTEMBER 30, 2021

(All amounts are in Kuwaiti Dinars)

7. Net other (expenses) income

The comparative financial period for the nine months ended September 30, 2020, includes amounts related to a lawsuit

filed by two subsidiaries of the group in the United Arab Emirates against some investors for the development of real

estate projects in the Emirate of Dubai in the United Arab Emirates. The Group had recognized a provision during that

period amounting to AED 14,793,394 (equivalent to KD 1,231,430) in order to complete the recognition of full provision

for all the balances reported in its records pertaining to that claim for conservatism purposes and not in surrender to

the Group’s rights in those balances reported in its records. During the period ending on September 30, 2021, the Court

of Cassation ruled its verdict confirming the ruling of the Court of Appeal which previously confirmed the ruling of the

Court of First Instance in favor of the two subsidiaries of the group entitling them to a total amounting to AED 19,780,852

(equivalent to KD 1,625,687) in addition to the legal interest at the rate of 9% from the date of the judicial claim until the

full payment. Implementation procedures for this ruling are currently in process by the two subsidiaries. The group did

not reverse any provision previously recorded against this case for conservatism purposes till the implemation of that

verdict and receiving the ruled amounts in favor of the Group.

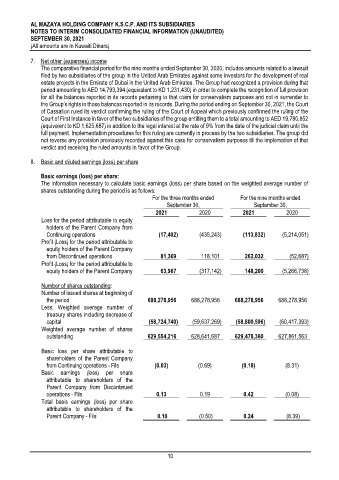

8. Basic and diluted earnings (loss) per share

Basic earnings (loss) per share:

The information necessary to calculate basic earnings (loss) per share based on the weighted average number of

shares outstanding during the period is as follows:

For the three months ended For the nine months ended

September 30, September 30,

2021 2020 2021 2020

Loss for the period attributable to equity

holders of the Parent Company from

Continuing operations (17,402) (435,243) (113,832) (5,214,051)

Profit (Loss) for the period attributable to

equity holders of the Parent Company

from Discontinued operations 81,369 118,101 262,032 (52,687)

Profit (Loss) for the period attributable to

equity holders of the Parent Company 63,967 (317,142) 148,200 (5,266,738)

Number of shares outstanding:

Number of issued shares at beginning of

the period 688,278,956 688,278,956 688,278,956 688,278,956

Less: Weighted average number of

treasury shares including decrease of

capital (58,724,740) (59,637,269) (58,800,596) (60,417,393)

Weighted average number of shares

outstanding 629,554,216 628,641,687 629,478,360 627,861,563

Basic loss per share attributable to

shareholders of the Parent Company

from Continuing operations - Fils (0.03) (0.69) (0.18) (8.31)

Basic earnings (loss) per share

attributable to shareholders of the

Parent Company from Discontinued

operations - Fils 0.13 0.19 0.42 (0.08)

Total basis earnings (loss) per share

attributable to shareholders of the

Parent Company - Fils 0.10 (0.50) 0.24 (8.39)

10