Page 12 - Mazaya Holding_FS_E_Q3_2021

P. 12

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

SEPTEMBER 30, 2021

(All amounts are in Kuwaiti Dinars)

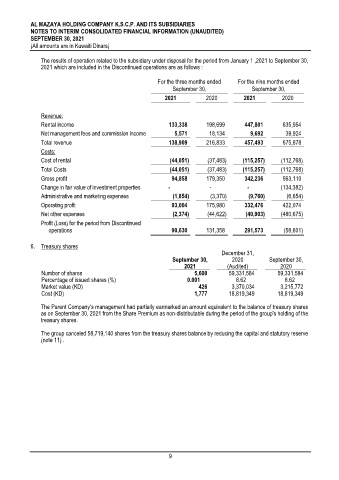

The results of operation related to the subsidiary under disposal for the period from January 1 ,2021 to September 30,

2021 which are included in the Discontinued operations are as follows :

For the three months ended For the nine months ended

September 30, September 30,

2021 2020 2021 2020

Revenue:

Rental income 133,338 198,699 447,801 635,954

Net management fees and commission income 5,571 18,134 9,692 39,924

Total revenue 138,909 216,833 457,493 675,878

Costs:

Cost of rental (44,051) (37,483) (115,257) (112,768)

Total Costs (44,051) (37,483) (115,257) (112,768)

Gross profit 94,858 179,350 342,236 563,110

Change in fair value of investment properties - - - (134,382)

Administrative and marketing expenses (1,854) (3,370) (9,760) (6,654)

Operating profit 93,004 175,980 332,476 422,074

Net other expenses (2,374) (44,622) (40,903) (480,675)

Profit (Loss) for the period from Discontinued

operations 90,630 131,358 291,573 (58,601)

6. Treasury shares

December 31,

September 30, 2020 September 30,

2021 (Audited) 2020

Number of shares 5,600 59,331,584 59,331,584

Percentage of issued shares (%) 0.001 8.62 8.62

Market value (KD) 426 3,370,034 3,215,772

Cost (KD) 1,777 18,819,349 18,819,349

The Parent Company’s management had partially earmarked an amount equivalent to the balance of treasury shares

as on September 30, 2021 from the Share Premium as non-distributable during the period of the group's holding of the

treasury shares.

The group canceled 58,719,140 shares from the treasury shares balance by reducing the capital and statutory reserve

(note 11) .

9