Page 11 - Mazaya Holding_FS_E_Q3_2021

P. 11

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

SEPTEMBER 30, 2021

(All amounts are in Kuwaiti Dinars)

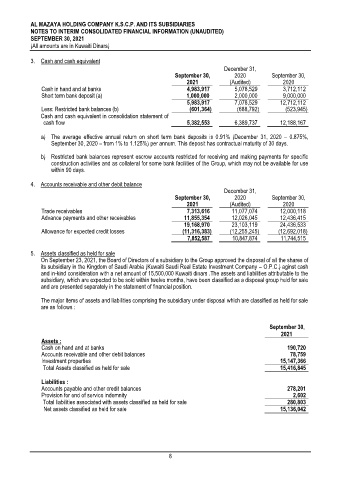

3. Cash and cash equivalent

December 31,

September 30, 2020 September 30,

2021 (Audited) 2020

Cash in hand and at banks 4,983,917 5,078,529 3,712,112

Short term bank deposit (a) 1,000,000 2,000,000 9,000,000

5,983,917 7,078,529 12,712,112

Less: Restricted bank balances (b) (601,364) (688,792) (523,945)

Cash and cash equivalent in consolidation statement of

cash flow 5,382,553 6,389,737 12,188,167

a) The average effective annual return on short term bank deposits is 0.91% (December 31, 2020 – 0.875%,

September 30, 2020 – from 1% to 1.125%) per annum. This deposit has contractual maturity of 30 days.

b) Restricted bank balances represent escrow accounts restricted for receiving and making payments for specific

construction activities and as collateral for some bank facilities of the Group, which may not be available for use

within 90 days.

4. Accounts receivable and other debit balance

December 31,

September 30, 2020 September 30,

2021 (Audited) 2020

Trade receivables 7,313,616 11,077,074 12,000,118

Advance payments and other receivables 11,855,354 12,026,045 12,436,415

19,168,970 23,103,119 24,436,533

Allowance for expected credit losses (11,316,383) (12,255,245) (12,692,018)

7,852,587 10,847,874 11,744,515

5. Assets classified as held for sale

On September 23, 2021, the Board of Directors of a subsidiary to the Group approved the disposal of all the shares of

its subsidiary in the Kingdom of Saudi Arabia (Kuwaiti Saudi Real Estate Investment Company – O.P.C.) aginst cash

and in-kind consideration with a net amount of 15,500,000 Kuwaiti dinars .The assets and liabilities attributable to the

subsidiary, which are expected to be sold within twelve months, have been classified as a disposal group held for sale

and are presented separately in the statement of financial position.

The major items of assets and liabilities comprising the subsidiary under disposal which are classified as held for sale

are as follows :

September 30,

2021

Assets :

Cash on hand and at banks 190,720

Accounts receivable and other debit balances 78,759

Investment properties 15,147,366

Total Assets classified as held for sale 15,416,845

Liabilities :

Accounts payable and other credit balances 278,201

Provision for end of service indemnity 2,602

Total liabilities associated with assets classified as held for sale 280,803

Net assets classified as held for sale 15,136,042

8