Page 10 - Q1 2024 EN

P. 10

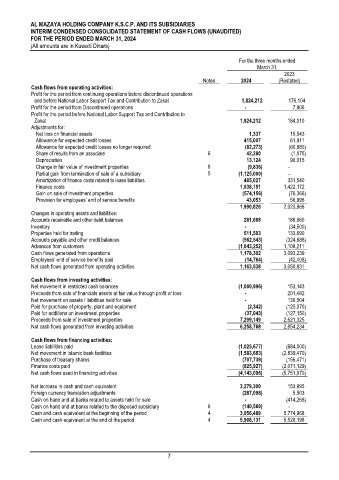

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

FOR THE PERIOD ENDED MARCH 31, 2024

(All amounts are in Kuwaiti Dinars)

For the three months ended

March 31,

2023

Notes 2024 (Restated)

Cash flows from operating activities:

Profit for the period from continuing operations before discontinued operations

and before National Labor Support Tax and Contribution to Zakat 1,824,212 176,104

Profit for the period from Discontinued operations - 7,906

Profit for the period before National Labor Support Tax and Contribution to

Zakat 1,824,212 184,010

Adjustments for:

Net loss on financial assets 1,337 15,543

Allowance for expected credit losses 415,007 61,911

Allowance for expected credit losses no longer required (82,273) (60,880)

Share of results from an associate 6 42,280 (1,075)

Depreciation 13,124 90,015

Change in fair value of investment properties 8 (9,836) -

Partial gain from termination of sale of a subsidiary 5 (1,125,000) -

Amortization of finance costs related to lease liabilities 405,027 331,540

Finance costs 1,038,151 1,422,172

Gain on sale of investment properties (574,156) (76,366)

Provision for employees’ end of service benefits 43,053 56,996

1,990,826 2,023,866

Changes in operating assets and liabilities:

Accounts receivable and other debit balances 281,668 186,660

Inventory - (34,500)

Properties held for trading 511,503 133,690

Accounts payable and other credit balances (562,543) (324,688)

Advances from customers (1,043,252) 1,108,211

Cash flows generated from operations 1,178,302 3,093,239

Employees’ end of service benefits paid (14,764) (42,408)

Net cash flows generated from operating activities 1,163,538 3,050,831

Cash flows from investing activities:

Net movement in restricted cash balances (1,000,996) 153,143

Proceeds from sale of financials assets at fair value through profit or loss - 201,482

Net movement on assets / liabilities held for sale - 130,504

Paid for purchase of property, plant and equipment (2,342) (125,070)

Paid for additions on investment properties (37,043) (127,150)

Proceeds from sale of investment properties 7,299,149 2,621,325

Net cash flows generated from investing activities 6,258,768 2,854,234

Cash flows from financing activities:

Lease liabilities paid (1,025,677) (684,000)

Net movement in Islamic bank facilities (1,583,663) (2,839,470)

Purchase of treasury shares (707,739) (156,471)

Finance costs paid (825,927) (2,071,129)

Net cash flows used in financing activities (4,143,006) (5,751,070)

Net increase in cash and cash equivalent 3,279,300 153,995

Foreign currency translation adjustments (287,098) 5,503

Cash on hand and at banks related to assets held for sale - (414,268)

Cash on hand and at banks related to the disposed subsidiary 6 (140,560) -

Cash and cash equivalent at the beginning of the period 4 3,056,489 5,774,968

Cash and cash equivalent at the end of the period 4 5,908,131 5,520,198

7