Page 14 - Q1 2024 EN

P. 14

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

MARCH 31, 2024

(All amounts are in Kuwaiti Dinars)

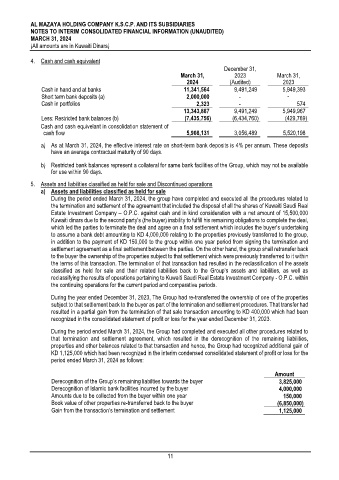

4. Cash and cash equivalent

December 31,

March 31, 2023 March 31,

2024 (Audited) 2023

Cash in hand and at banks 11,341,564 9,491,249 5,949,393

Short term bank deposits (a) 2,000,000 - -

Cash in portfolios 2,323 - 574

13,343,887 9,491,249 5,949,967

Less: Restricted bank balances (b) (7,435,756) (6,434,760) (429,769)

Cash and cash equivelant in consolidation statement of

cash flow 5,908,131 3,056,489 5,520,198

a) As at March 31, 2024, the effective interest rate on short-term bank deposits is 4% per annum. These deposits

have an average contractual maturity of 90 days.

b) Restricted bank balances represent a collateral for same bank facilities of the Group, which may not be available

for use within 90 days.

5. Assets and liabilities classified as held for sale and Discontinued operations

a) Assets and liabilities classified as held for sale

During the period ended March 31, 2024, the group have completed and executed all the procedures related to

the termination and settlement of the agreement that included the disposal of all the shares of Kuwaiti Saudi Real

Estate Investment Company – O.P.C. against cash and in kind consideration with a net amount of 15,500,000

Kuwaiti dinars due to the second party’s (the buyer) inability to fulfill his remaining obligations to complete the deal,

which led the parties to terminate the deal and agree on a final settlement which includes the buyer’s undertaking

to assume a bank debt amounting to KD 4,000,000 relating to the properties previously transferred to the group,

in addition to the payment of KD 150,000 to the group within one year period from signing the termination and

settlement agreement as a final settlement between the parties. On the other hand, the group shall retransfer back

to the buyer the ownership of the properties subject to that settlement which were previously transferred to it within

the terms of this transaction. The termination of that transaction had resulted in the reclassification of the assets

classified as held for sale and their related liabilities back to the Group’s assets and liabilities, as well as

reclassifying the results of operations pertaining to Kuwaiti Saudi Real Estate Investment Company - O.P.C. within

the continuing operations for the current period and comparative periods.

During the year ended December 31, 2023, The Group had re-transferred the ownership of one of the properties

subject to that settlement back to the buyer as part of the termination and settlement procedures. That transfer had

resulted in a partial gain from the termination of that sale transaction amounting to KD 400,000 which had been

recognized in the consolidated statement of profit or loss for the year ended December 31, 2023.

During the period ended March 31, 2024, the Group had completed and executed all other procedures related to

that termination and settlement agreement, which resulted in the derecognition of the remaining liabilities,

properties and other balances related to that transaction and hence, the Group had recognized additional gain of

KD 1,125,000 which had been recognized in the interim condensed consolidated statement of profit or loss for the

period ended March 31, 2024 as follows:

Amount

Derecognition of the Group’s remaining liabilties towards the buyer 3,825,000

Derecognition of Islamic bank facilities incurred by the buyer 4,000,000

Amounts due to be collected from the buyer within one year 150,000

Book value of other properties re-transferred back to the buyer (6,850,000)

Gain from the transaction’s termination and settlement 1,125,000

11