Page 13 - Q1 2024 EN

P. 13

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

MARCH 31, 2024

(All amounts are in Kuwaiti Dinars)

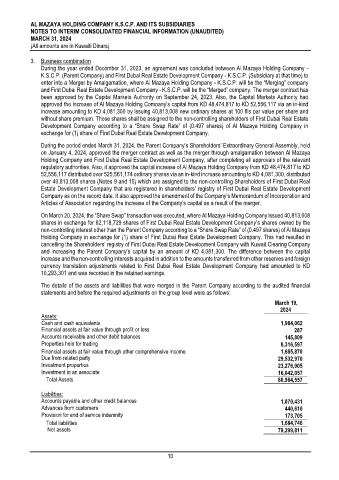

3. Business combination

During the year ended December 31, 2023, an agreement was concluded between Al Mazaya Holding Company -

K.S.C.P. (Parent Company) and First Dubai Real Estate Development Company - K.S.C.P. (Subsidiary at that time) to

enter into a Merger by Amalgamation, where Al Mazaya Holding Company - K.S.C.P. will be the “Merging” company

and First Dubai Real Estate Development Company - K.S.C.P. will be the “Merged” company. The merger contract has

been approved by the Capital Markets Authority on September 24, 2023. Also, the Capital Markets Authority had

approved the increase of Al Mazaya Holding Company’s capital from KD 48,474,817 to KD 52,556,117 via an in-kind

increase amounting to KD 4,081,300 by issuing 40,813,008 new ordinary shares at 100 fils par value per share and

without share premium. Those shares shall be assigned to the non-controlling shareholders of First Dubai Real Estate

Development Company according to a “Share Swap Rate” of (0.497 shares) of Al Mazaya Holding Company in

exchange for (1) share of First Dubai Real Estate Development Company.

During the period ended March 31, 2024, the Parent Company’s Shareholders’ Extraordinary General Assembly, held

on January 4, 2024, approved the merger contract as well as the merger through amalgamation between Al Mazaya

Holding Company and First Dubai Real Estate Development Company, after completing all approvals of the relevant

regulatory authorities. Also, it approved the capital increase of Al Mazaya Holding Company from KD 48,474,817 to KD

52,556,117 distributed over 525,561,174 ordinary shares via an in-kind increase amounting to KD 4,081,300, distributed

over 40,813,008 shares (Notes 9 and 15) which are assigned to the non-controlling Shareholders of First Dubai Real

Estate Development Company that are registered in shareholders’ registry of First Dubai Real Estate Development

Company as on the record date. It also approved the amendment of the Company’s Memorandum of Incorporation and

Articles of Association regarding the increase of the Company’s capital as a result of the merger.

On March 20, 2024, the “Share Swap” transaction was executed, where Al Mazaya Holding Company issued 40,813,008

shares in exchange for 82,118,729 shares of First Dubai Real Estate Development Company’s shares owned by the

non-controlling interest other than the Parent Company according to a “Share Swap Rate” of (0.497 shares) of Al Mazaya

Holding Company in exchange for (1) share of First Dubai Real Estate Development Company. This had resulted in

cancelling the Shareholders’ registry of First Dubai Real Estate Development Company with Kuwait Clearing Company

and increasing the Parent Company’s capital by an amount of KD 4,081,300. The difference between the capital

increase and the non-controlling interests acquired in addition to the amounts transferred from other reserves and foreign

currency translation adjustments related to First Dubai Real Estate Development Company had amounted to KD

10,293,301 and was recorded in the retained earnings.

The details of the assets and liabilities that were merged in the Parent Company according to the audited financial

statements and before the required adjustments on the group level were as follows:

March 19,

2024

Assets:

Cash and cash equivalents 1,984,062

Financial assets at fair value through profit or loss 287

Accounts receivable and other debit balances 145,809

Properties held for trading 8,316,597

Financial assets at fair value through other comprehensive income 1,685,870

Due from related party 29,532,970

Investment properties 23,276,905

Investment in an associate 16,042,057

Total Assets 80,984,557

Liabilities:

Accounts payable and other credit balances 1,070,431

Advances from customers 440,610

Provision for end of service indemnity 173,705

Total liabilities 1,684,746

Net assets 79,299,811

10