Page 33 - FS-Q2-2023-EN

P. 33

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

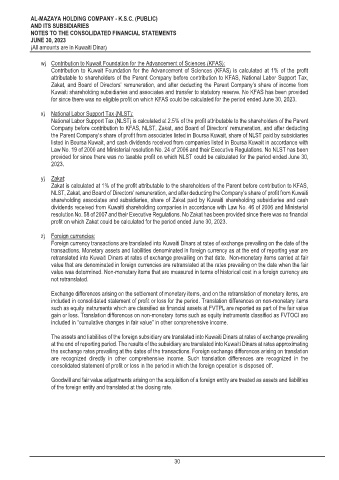

w) Contribution to Kuwait Foundation for the Advancement of Sciences (KFAS):

Contribution to Kuwait Foundation for the Advancement of Sciences (KFAS) is calculated at 1% of the profit

attributable to shareholders of the Parent Company before contribution to KFAS, National Labor Support Tax,

Zakat, and Board of Directors’ remuneration, and after deducting the Parent Company’s share of income from

Kuwaiti shareholding subsidiaries and associates and transfer to statutory reserve. No KFAS has been provided

for since there was no eligible profit on which KFAS could be calculated for the period ended June 30, 2023.

x) National Labor Support Tax (NLST):

National Labor Support Tax (NLST) is calculated at 2.5% of the profit attributable to the shareholders of the Parent

Company before contribution to KFAS, NLST, Zakat, and Board of Directors’ remuneration, and after deducting

the Parent Company’s share of profit from associates listed in Boursa Kuwait, share of NLST paid by subsidiaries

listed in Boursa Kuwait, and cash dividends received from companies listed in Boursa Kuwait in accordance with

Law No. 19 of 2000 and Ministerial resolution No. 24 of 2006 and their Executive Regulations. No NLST has been

provided for since there was no taxable profit on which NLST could be calculated for the period ended June 30,

2023.

y) Zakat:

Zakat is calculated at 1% of the profit attributable to the shareholders of the Parent before contribution to KFAS,

NLST, Zakat, and Board of Directors’ remuneration, and after deducting the Company’s share of profit from Kuwaiti

shareholding associates and subsidiaries, share of Zakat paid by Kuwaiti shareholding subsidiaries and cash

dividends received from Kuwaiti shareholding companies in accordance with Law No. 46 of 2006 and Ministerial

resolution No. 58 of 2007 and their Executive Regulations. No Zakat has been provided since there was no financial

profit on which Zakat could be calculated for the period ended June 30, 2023.

z) Foreign currencies:

Foreign currency transactions are translated into Kuwaiti Dinars at rates of exchange prevailing on the date of the

transactions. Monetary assets and liabilities denominated in foreign currency as at the end of reporting year are

retranslated into Kuwaiti Dinars at rates of exchange prevailing on that date. Non-monetary items carried at fair

value that are denominated in foreign currencies are retranslated at the rates prevailing on the date when the fair

value was determined. Non-monetary items that are measured in terms of historical cost in a foreign currency are

not retranslated.

Exchange differences arising on the settlement of monetary items, and on the retranslation of monetary items, are

included in consolidated statement of profit or loss for the period. Translation differences on non-monetary items

such as equity instruments which are classified as financial assets at FVTPL are reported as part of the fair value

gain or loss. Translation differences on non-monetary items such as equity instruments classified as FVTOCI are

included in “cumulative changes in fair value” in other comprehensive income.

The assets and liabilities of the foreign subsidiary are translated into Kuwaiti Dinars at rates of exchange prevailing

at the end of reporting period. The results of the subsidiary are translated into Kuwaiti Dinars at rates approximating

the exchange rates prevailing at the dates of the transactions. Foreign exchange differences arising on translation

are recognized directly in other comprehensive income. Such translation differences are recognized in the

consolidated statement of profit or loss in the period in which the foreign operation is disposed off.

Goodwill and fair value adjustments arising on the acquisition of a foreign entity are treated as assets and liabilities

of the foreign entity and translated at the closing rate.

30