Page 34 - FS-Q2-2023-EN

P. 34

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

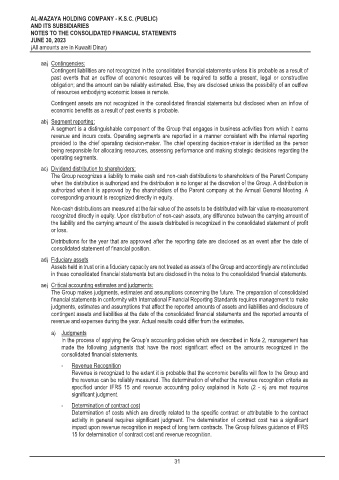

aa) Contingencies:

Contingent liabilities are not recognized in the consolidated financial statements unless it is probable as a result of

past events that an outflow of economic resources will be required to settle a present, legal or constructive

obligation; and the amount can be reliably estimated. Else, they are disclosed unless the possibility of an outflow

of resources embodying economic losses is remote.

Contingent assets are not recognized in the consolidated financial statements but disclosed when an inflow of

economic benefits as a result of past events is probable.

ab) Segment reporting:

A segment is a distinguishable component of the Group that engages in business activities from which it earns

revenue and incurs costs. Operating segments are reported in a manner consistent with the internal reporting

provided to the chief operating decision-maker. The chief operating decision-maker is identified as the person

being responsible for allocating resources, assessing performance and making strategic decisions regarding the

operating segments.

ac) Dividend distribution to shareholders:

The Group recognizes a liability to make cash and non-cash distributions to shareholders of the Parent Company

when the distribution is authorized and the distribution is no longer at the discretion of the Group. A distribution is

authorized when it is approved by the shareholders of the Parent company at the Annual General Meeting. A

corresponding amount is recognized directly in equity.

Non-cash distributions are measured at the fair value of the assets to be distributed with fair value re-measurement

recognized directly in equity. Upon distribution of non-cash assets, any difference between the carrying amount of

the liability and the carrying amount of the assets distributed is recognized in the consolidated statement of profit

or loss.

Distributions for the year that are approved after the reporting date are disclosed as an event after the date of

consolidated statement of financial position.

ad) Fiduciary assets

Assets held in trust or in a fiduciary capacity are not treated as assets of the Group and accordingly are not included

in these consolidated financial statements but are disclosed in the notes to the consolidated financial statements.

ae) Critical accounting estimates and judgments:

The Group makes judgments, estimates and assumptions concerning the future. The preparation of consolidated

financial statements in conformity with International Financial Reporting Standards requires management to make

judgments, estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of

revenue and expenses during the year. Actual results could differ from the estimates.

a) Judgments

In the process of applying the Group’s accounting policies which are described in Note 2, management has

made the following judgments that have the most significant effect on the amounts recognized in the

consolidated financial statements.

- Revenue Recognition

Revenue is recognized to the extent it is probable that the economic benefits will flow to the Group and

the revenue can be reliably measured. The determination of whether the revenue recognition criteria as

specified under IFRS 15 and revenue accounting policy explained in Note (2 - s) are met requires

significant judgment.

- Determination of contract cost

Determination of costs which are directly related to the specific contract or attributable to the contract

activity in general requires significant judgment. The determination of contract cost has a significant

impact upon revenue recognition in respect of long term contracts. The Group follows guidance of IFRS

15 for determination of contract cost and revenue recognition.

31