Page 39 - FS-Q2-2023-EN

P. 39

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

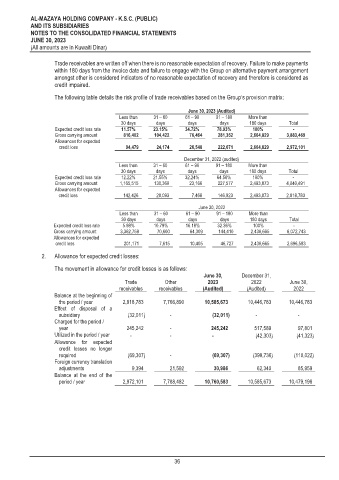

Trade receivables are written off when there is no reasonable expectation of recovery. Failure to make payments

within 180 days from the invoice date and failure to engage with the Group on alternative payment arrangement

amongst other is considered indicators of no reasonable expectation of recovery and therefore is considered as

credit impaired.

The following table details the risk profile of trade receivables based on the Group’s provision matrix:

June 30, 2023 (Audited)

Less than 31 – 60 61 – 90 91 – 180 More than

30 days days days days 180 days Total

Expected credit loss rate 11.57% 23.15% 34.72% 78.93% 100% -

Gross carrying amount 816,402 104,422 76,464 281,352 2,604,829 3,883,469

Allowances for expected

credit loss 94,479 24,174 26,548 222,071 2,604,829 2,972,101

December 31, 2022 (audited)

Less than 31 – 60 61 – 90 91 – 180 More than

30 days days days days 180 days Total

Expected credit loss rate 12.22% 21.55% 32.24% 64.56% 100% -

Gross carrying amount 1,165,515 130,360 23,166 227,577 2,493,873 4,040,491

Allowances for expected

credit loss 142,426 28,093 7,468 146,923 2,493,873 2,818,783

June 30, 2022

Less than 31 – 60 61 – 90 91 – 180 More than

30 days days days days 180 days Total

Expected credit loss rate 5.98% 10.79% 16.18% 32.36% 100% -

Gross carrying amount 3,362,759 70,600 64,309 144,410 2,430,665 6,072,743

Allowances for expected

credit loss 201,171 7,615 10,405 46,727 2,430,665 2,696,583

2. Allowance for expected credit losses:

The movement in allowance for credit losses is as follows:

June 30, December 31,

Trade Other 2023 2022 June 30,

receivables receivables (Audited) (Audited) 2022

Balance at the beginning of

the period / year 2,818,783 7,766,890 10,585,673 ¤ 10,446,783 10,446,783

Effect of disposal of a

subsidiary (32,011) - (32,011) - -

Charged for the period /

year 245,242 - 245,242 517,589 97,801

Utilized in the period / year - - - (42,303) (41,323)

Allowance for expected

credit losses no longer

required (69,307) - (69,307) (398,736) (110,022)

Foreign currency translation

¤

adjustments 9,394 21,592 30,986 62,340 85,959

Balance at the end of the

period / year 2,972,101 7,788,482 ¤ 10,760,583 10,585,673 10,479,198

36