Page 42 - FS-Q2-2023-EN

P. 42

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

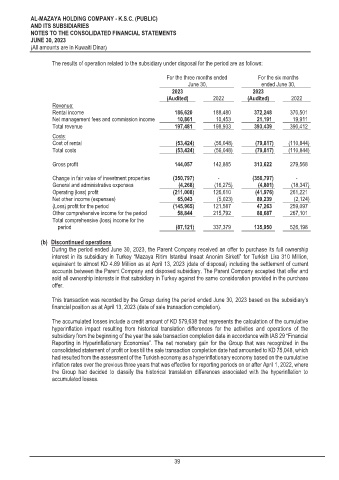

The results of operation related to the subsidiary under disposal for the period are as follows:

For the three months ended For the six months

June 30, ended June 30,

2023 2023

(Audited) 2022 (Audited) 2022

Revenue:

Rental income 186,620 188,480 372,248 370,501

Net management fees and commission income 10,861 10,453 21,191 19,911

Total revenue 197,481 198,933 393,439 390,412

Costs:

Cost of rental (53,424) (56,048) (79,817) (110,844)

Total costs (53,424) (56,048) (79,817) (110,844)

Gross profit 144,057 142,885 313,622 279,568

Change in fair value of investment properties (350,797) - (350,797) -

General and administrative expenses (4,268) (16,275) (4,801) (18,347)

Operating (loss) profit (211,008) 126,610 (41,976) 261,221

Net other income (expenses) 65,043 (5,023) 89,239 (2,124)

(Loss) profit for the period (145,965) 121,587 47,263 259,097

Other comprehensive income for the period 58,844 215,792 88,687 267,101

Total comprehensive (loss) income for the

period (87,121) 337,379 135,950 526,198

(b) Discontinued operations

During the period ended June 30, 2023, the Parent Company received an offer to purchase its full ownership

interest in its subsidiary in Turkey “Mazaya Ritim Istanbul Insaat Anonim Sirketi” for Turkish Lira 310 Million,

equivalent to almost KD 4.89 Million as at April 13, 2023 (date of disposal) including the settlement of current

accounts between the Parent Company and disposed subsidiary. The Parent Company accepted that offer and

sold all ownership interests in that subsidiary in Turkey against the same consideration provided in the purchase

offer.

This transaction was recorded by the Group during the period ended June 30, 2023 based on the subsidiary’s

financial position as at April 13, 2023 (date of sale transaction completion).

The accumulated losses include a credit amount of KD 579,638 that represents the calculation of the cumulative

hyperinflation impact resulting from historical translation differences for the activities and operations of the

subsidiary from the beginning of the year the sale transaction completion date in accordance with IAS 29 “Financial

Reporting in Hyperinflationary Economies”. The net monetary gain for the Group that was recognized in the

consolidated statement of profit or loss till the sale transaction completion date had amounted to KD 75,048, which

had resulted from the assessment of the Turkish economy as a hyperinflationary economy based on the cumulative

inflation rates over the previous three years that was effective for reporting periods on or after April 1, 2022, where

the Group had decided to classify the historical translation differences associated with the hyperinflation to

accumulated losses.

39