Page 39 - Q4-2024-EN

P. 39

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

- Leases

Key sources of estimation uncertainty in the application of IFRS 16 include, among others, the following:

• Estimation of the lease term.

• Determination of the appropriate rate to discount the lease payments.

• Assessment of whether a right-of-use asset is impaired.

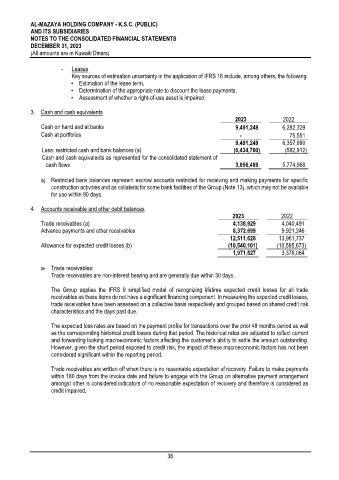

3. Cash and cash equivalents

2023 2022

Cash on hand and at banks 9,491,249 6,282,329

Cash at portfolios - 75,551

9,491,249 6,357,880

Less: restricted cash and bank balances (a) (6,434,760) (582,912)

Cash and cash equivalents as represented for the consolidated statement of

cash flows 3,056,489 5,774,968

a) Restricted bank balances represent escrow accounts restricted for receiving and making payments for specific

construction activities and as collateral for some bank facilities of the Group (Note 13), which may not be available

for use within 90 days.

4. Accounts receivable and other debit balances

2023 2022

Trade receivables (a) 4,138,929 4,040,491

Advance payments and other receivables 8,372,699 9,921,246

12,511,628 13,961,737

Allowance for expected credit losses (b) (10,540,101) (10,585,673)

1,971,527 3,376,064

a- Trade receivables:

Trade receivables are non-interest bearing and are generally due within 30 days.

The Group applies the IFRS 9 simplified model of recognizing lifetime expected credit losses for all trade

receivables as these items do not have a significant financing component. In measuring the expected credit losses,

trade receivables have been assessed on a collective basis respectively and grouped based on shared credit risk

characteristics and the days past due.

The expected loss rates are based on the payment profile for transactions over the prior 48 months period as well

as the corresponding historical credit losses during that period. The historical rates are adjusted to reflect current

and forwarding looking macroeconomic factors affecting the customer’s ability to settle the amount outstanding.

However, given the short period exposed to credit risk, the impact of these macroeconomic factors has not been

considered significant within the reporting period.

Trade receivables are written off when there is no reasonable expectation of recovery. Failure to make payments

within 180 days from the invoice date and failure to engage with the Group on alternative payment arrangement

amongst other is considered indicators of no reasonable expectation of recovery and therefore is considered as

credit impaired.

36