Page 42 - Q4-2024-EN

P. 42

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

(All amounts are in Kuwaiti Dinars)

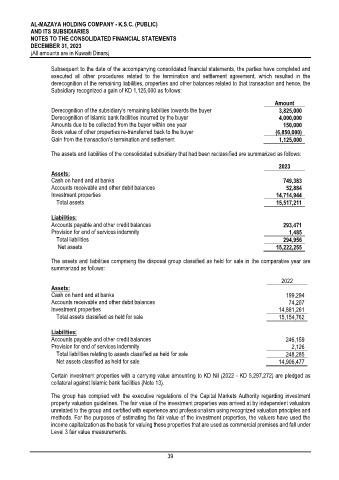

Subsequent to the date of the accompanying consolidated financial statements, the parties have completed and

executed all other procedures related to the termination and settlement agreement, which resulted in the

derecognition of the remaining liabilities, properties and other balances related to that transaction and hence, the

Subsidiary recognized a gain of KD 1,125,000 as follows:

Amount

Derecognition of the subsidiary’s remaining liabilties towards the buyer 3,825,000

Derecognition of Islamic bank facilities incurred by the buyer 4,000,000

Amounts due to be collected from the buyer within one year 150,000

Book value of other properties re-transferred back to the buyer (6,850,000)

Gain from the transaction’s termination and settlement 1,125,000

The assets and liabilities of the consolidated subsidiary that had been reclassified are summarized as follows:

2023

Assets:

Cash on hand and at banks 749,383

Accounts receivable and other debit balances 52,884

Investment properties 14,714,944

Total assets 15,517,211

Liabilities:

Accounts payable and other credit balances 293,471

Provision for end of services indemnity 1,485

Total liabilities 294,956

Net assets 15,222,255

The assets and liabilities comprising the disposal group classified as held for sale in the comparative year are

summarized as follows:

2022

Assets:

Cash on hand and at banks 199,294

Accounts receivable and other debit balances 74,207

Investment properties 14,881,261

Total assets classified as held for sale 15,154,762

Liabilities:

Accounts payable and other credit balances 246,159

Provision for end of services indemnity 2,126

Total liabilities relating to assets classified as held for sale 248,285

Net assets classified as held for sale 14,906,477

Certain investment properties with a carrying value amounting to KD Nil (2022 - KD 5,297,272) are pledged as

collateral against Islamic bank facilities (Note 13).

The group has complied with the executive regulations of the Capital Markets Authority regarding investment

property valuation guidelines. The fair value of the investment properties was arrived at by independent valuators

unrelated to the group and certified with experience and professionalism using recognized valuation principles and

methods. For the purposes of estimating the fair value of the investment properties, the valuers have used the

income capitalization as the basis for valuing these properties that are used as commercial premises and fall under

Level 3 fair value measurements.

39